A few days ago a friend asked me to recommend what PHEV he could buy second-hand for around £10,000 (12,700 USD) in the UK. I was left scratching my head trying to think firstly what in the way of PHEVs were even sold in the market, and secondly which had been on sale long enough to be available for that kind of price second-hand.

Had the question been asked in China, I would have been able to reel off a whole list of cars and for the price many of them would be new rather than second-hand. The question helped show a divergence in the path to electrification and how Europe is increasingly stalled in adoption while China powers ahead.

PHEVs often come in for a lot of stick from EV evangelists but that is not entirely fair. One way of looking at the situation is that the cells for one battery for a fully electric car can produce around 3 or 4 batteries for PHEVs. As most journeys will just use electric power you now have more motorists on the road using electricity than if you just had one BEV.

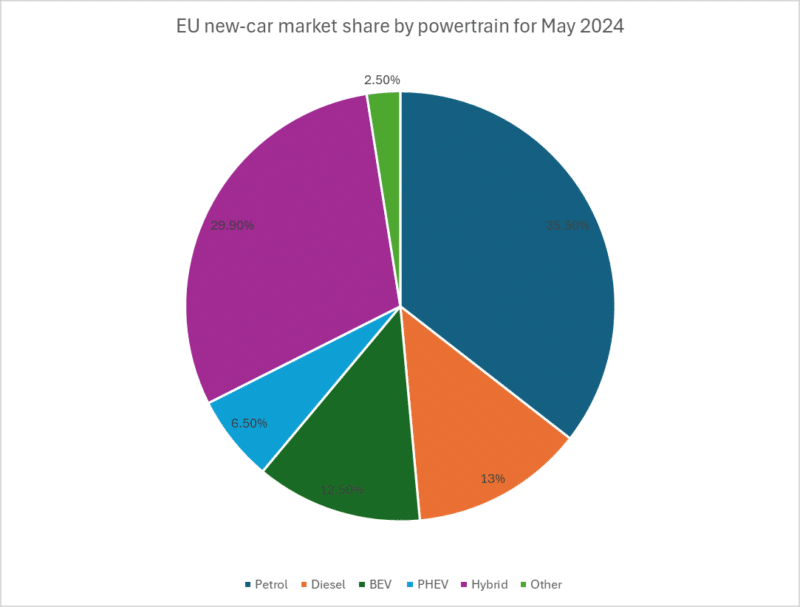

So how does the situation between the EU and China compare? In May the penetration rate of PHEVs in China was 18.0% whereas in the EU it was just 6.5% Furthermore the general trend in the EU has been down while in China it has been up.

Earlier this year we reported on EV driving during the Chinese New Year break and spoke about the charging problems. At the time we mentioned a rather long post on Popular Science China’s WeChat account extolling the virtues of PHEVs. In it, the author mentioned that over the course of 2023 the penetration rate had gone from 6% to 11.2%. As the author correctly predicted this trend seems to be ongoing with current figures showing a 21.4% figure for June so far. It should be pointed out that PHEV for the context of this article includes EREVs, which despite the name are actually a series PHEV,

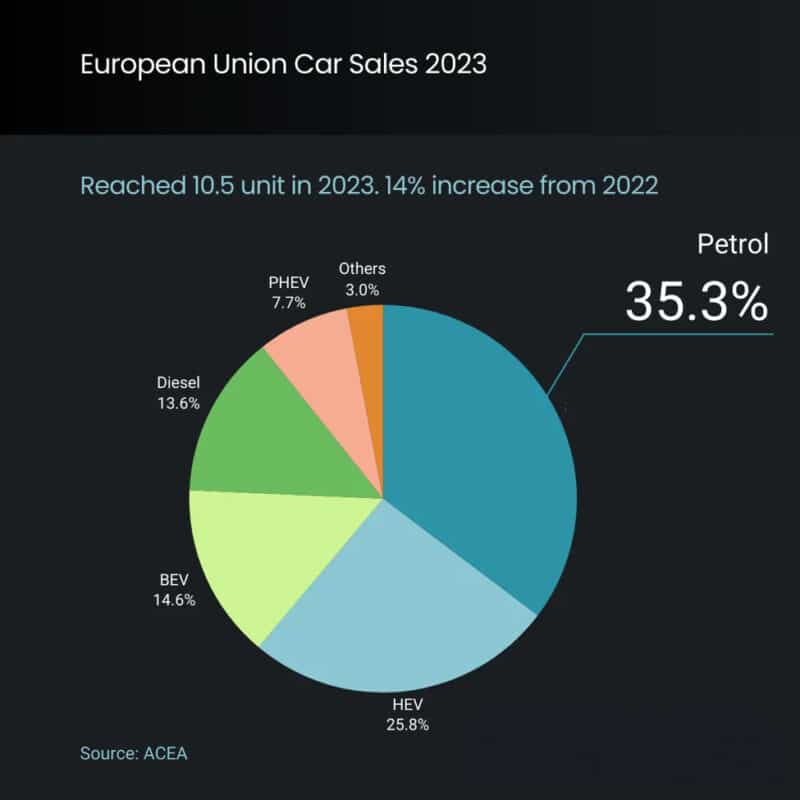

Last year in Europe the share for PHEVs was just 7.7% which was down from 9.4% in 2022. The May figure of 6.5% indicates the trend is ongoing. Put another way PHEVs accounted for 46% of the European plug-in market, which China refers to as NEVs, back in 2021 but by 2023 this had fallen to 33%.

However, there seems to be a bigger problem in that the sales of electrified cars in general are stalling within the EU. Up until December last year the sales of BEVs had seen continual growth since April 2020. December was the first decline and May was the third such monthly decline. Market share was 12.5% in May which was 1.3 percentage points down on May 2023 and represents a 12% fall.

Where Europe surprises is the continued outperformance of hybrids (HEVs). In 2023 these made up 25.8% of the market and accounted for the second largest share after petrol ICE cars. The May figures show that although the share for petrol cars is similar to the level across 2023, HEVs now account for 29.9%. Autovista24 reports that hybrids are the only powertrain to record improved deliveries.

In China sales of hybrids are relatively small given the near wholesale shift to NEVs. According to Reuters sales last year dropped by 15% and they make up only 9% of cars sold in China with some form of electrified powertrain and so made up around 3% of the overall car market.

The China Passenger Car Association reported on June 24 that from January to May the sales of new energy vehicles (mainly BEVs and PHEVs) had increased by 34.4% compared to the same period last year. Although BEV sales have gone up by 17.4% the real shining start has been PHEVs with a 70.1% increase.

Fast Technology quotes analysts as saying that they have advantages over pure electric models in terms of initial purchase costs and alleviate consumer worries about charging issues.

The recent headlines made by the launch of BYD’s DM 5.0 technology is a good example. Both the launch cars – the Qin L and Seal 06 DM-i – start for less than 100,000 yuan (13,750 USD) and yet have claimed ranges of 2,100 km which has even been achieved in real-world tests. Depending on version they also have either an 80 or 120 km all-electric range which is easily enough for most people’s daily commute.

Such performance is impossible from any ICE or HEV car. If Europe is serious about cutting emissions and also achieving the ban on new cars with combustion engines by 2035 then a switch from HEV to PHEV in the near term would make a lot of sense. While PHEVs are also banned under the EU’s rules from 2035 they would allow an immediate reduction in emissions and give consumers an option that costs less than buying a new BEV today but not significantly more than buying an HEV or ICE.

In China, prices of electrified cars, especially PHEVs, have come down so much that they’re now a real alternative to traditional cars and producers are having to discount ICEs heavily to be able to compete with the likes of BYD and Geely.

Such cars also might be China’s hidden card when it comes to the EU. So far PHEVs are not covered by the EU tariffs against Chinese EVs and so these could be the ace in China’s sleeve for the next few years.

Sources: Fast Technology, Reuters, Autovista24, Statzon