China’s battery industry is increasingly turning to sodium-ion technology as lithium prices rise and major manufacturers expand production and investment. The shift signals growing interest in alternative battery chemistries for cost-sensitive and cold-climate applications, according to Autohome.

Sodium-ion batteries are chemically similar to lithium-ion batteries but use more abundant raw materials. Sodium is widely distributed in Earth’s crust, with a concentration roughly 400 times that of lithium, which is concentrated mainly in South America and Australia. This makes sodium-ion batteries potentially less exposed to resource volatility and supply-chain constraints.

Rising lithium prices have intensified interest in alternatives. In early 2026, lithium carbonate prices surpassed 150,000 yuan per ton and reached levels above 170,000 yuan per ton (approximately 20,900–23,700 USD per ton). Higher material costs have intensified production pressures on entry-level electric vehicles, which predominantly rely on lithium iron phosphate (LFP) batteries.

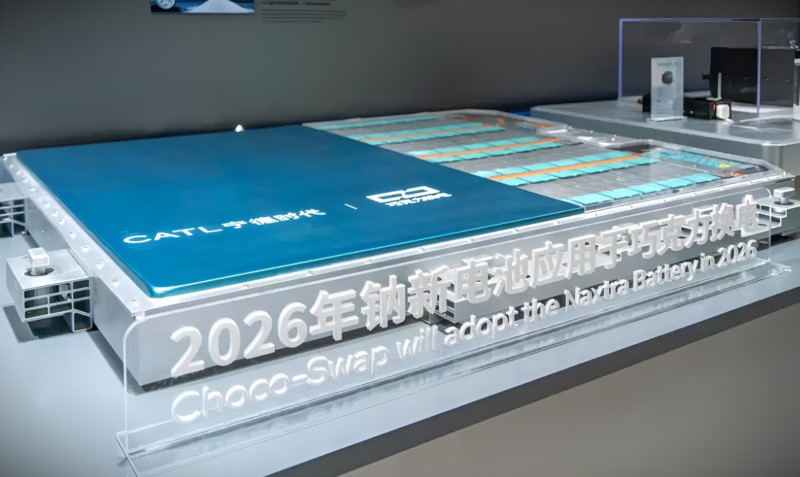

CATL recently launched a sodium-ion battery for light commercial vehicles and indicated passenger-car deployment is planned in the second quarter of 2026, with the first model reportedly the Aion Y Plus. However, sodium-ion technology is being adopted more broadly, with several Chinese battery manufacturers investing in production capacity. BYD has commissioned a 30 GWh sodium-ion battery line, while EVE Energy has launched a 1 billion-yuan (about 144 million USD) sodium-ion project, and Ronbay Technology has converted part of its lithium battery production to sodium-ion materials. In 2025, global sodium-ion shipments reached around 9 GWh, up 150 percent from the previous year.

Sodium-ion batteries offer certain performance advantages in specific scenarios. They maintain higher capacity retention at low temperatures, with some prototypes retaining more than 90 percent of capacity at -20 °C, compared with roughly 80 percent for standard lithium batteries. Cost estimates suggest sodium-ion materials could be 30–40 percent cheaper than lithium equivalents, although overall production costs remain affected by scale and early-stage supply-chain development.

Challenges remain for sodium-ion technology. Energy density currently ranges from 100 to 170 Wh/kg, which is below that of mature LFP batteries (180–200 Wh/kg) and significantly below that of ternary lithium batteries (250–300 Wh/kg), thereby limiting their use in high-range EVs. Supply-chain coordination and scale production remain in development.

Analysts expect sodium-ion batteries to be adopted initially in specific segments such as entry-level electric vehicles, cold-climate applications, and stationary energy storage, complementing rather than replacing lithium-based batteries. Industry observers suggest that 2026 could mark a period of accelerated commercialization for sodium-ion technology in China.