Price wars and inventory surges: the story behind China’s “zero-mileage used cars”

The seemingly contradictory terms “used” and “new car” have merged to form a new phrase, “zero-mileage used cars,” which is currently at the forefront of industry discussions. This phenomenon refers to new vehicles that are registered and licensed but immediately sold as used cars without being driven by a consumer, often with mileage in the low hundreds or even zero, and at significantly lower prices than new vehicles.

Wei Jianjun, Chairman of Great Wall Motor, recently expressed concern about this trend: “In recent years, some products have dropped from 220,000-230,000 yuan to 120,000-130,000 yuan. What kind of industrial product can slash 100,000 yuan (13,800 USD)while guaranteeing quality? How do you expect our Chinese brands to develop overseas?” He highlighted that these vehicles are registered as sold but then re-enter the used car market. An anonymous industry expert commented that this marketing model is unlikely to disappear anytime soon.

Behind the “zero-mileage used car” trend

The core of this practice lies in the intense competition within the Chinese automotive market. Dealers engage in this practice for two reasons: proactively gaining manufacturer rebates or semi-proactively meeting sales targets. Manufacturers often offer incentives to dealers to register new cars, even if they are immediately resold as used. This helps manufacturers meet sales quotas and manage inventory, especially for slow-moving models.

An insider revealed that some car manufacturers are pushing this strategy to address liquidity issues and employee salaries. For instance, a joint venture brand, “J car,” recently “packaged” and sold 3,000 new cars in inventory for two years. Two-thirds of these vehicles were sold domestically, while the remaining third went to Central Asian and Middle Eastern markets. This strategy allows manufacturers to bypass European (Euro) standards for new cars, as used cars are not subject to the same regulations.

Impact on consumers and the market

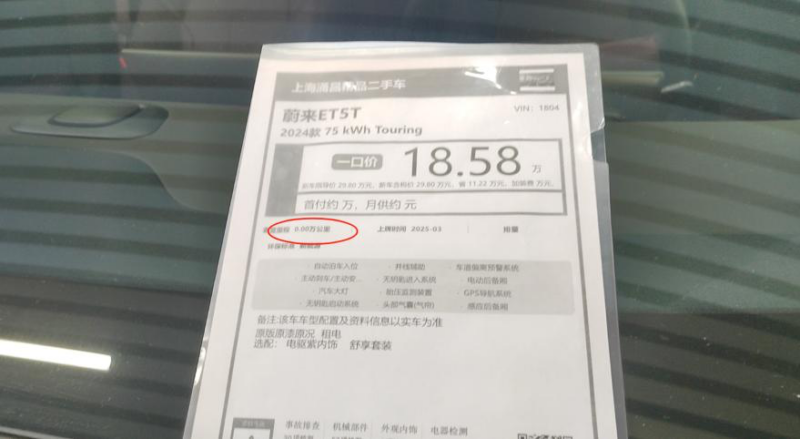

While “zero-mileage used cars” offer significant discounts, consumer rights are often compromised. For example, a new Nio ET5T 2024 model, priced at 298,000 yuan (41,000 USD) including tax, was observed being sold as a “zero-mileage used car” for 185,800 yuan (25,600 USD), a discount of over 110,000 yuan (15,000 USD). However, the original owner’s warranty of 6 years or 150,000 kilometers for the entire vehicle and 10 years/unlimited mileage for the battery system is reduced to 3 years or 120,000 kilometers for the vehicle and 8 years or 120,000 kilometers for the battery system for the second owner, representing at least a 20% reduction in overall benefits.

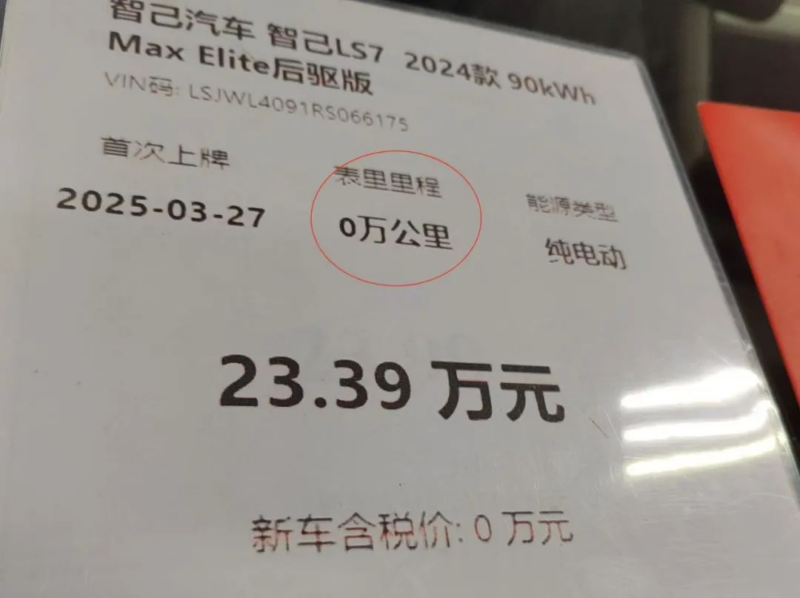

At the Shanghai Used Car Trading Centre, nearly one-tenth of the vehicles displayed are “quasi-new cars.” These vehicles come from various sources, including 4S dealerships (manufacturer’s inventory cars), test drive vehicles, and even cars from online influencers. The price reductions vary, with some models like the Xiaomi SU7 seeing a nearly 20,000 yuan (2,750 USD) discount. In comparison, others like the IM models have discounts of around 100,000 yuan (13,800 USD), ranging from 10% to 30% off the price of a brand-new car.

This practice can mislead consumers into believing that car manufacturers have higher sales than they do, potentially harming their purchasing decisions. Industry professionals are concerned that this trend could destabilise vehicle pricing, leading to a faster depreciation of consumer assets.

Industry challenges and regulatory response

The Chinese automotive market is experiencing intense competition, with over 200 models seeing price reductions in 2024 and more than 60 in the first four months of 2025. In May, price cuts intensified, with some models seeing reductions of over 50,000 yuan (6,900 USD). Cui Dongshu, Secretary-General of the China Passenger Car Association, noted that the national passenger car inventory reached 3.5 million units by the end of April 2025, an increase from previous months, and is expected to continue rising, especially during the upcoming slow sales season from May to July.

In response to these challenges, the Ministry of Commerce’s Department of Consumption Promotion reportedly convened a meeting with car manufacturers and industry organisations in late May to discuss “zero-mileage used cars” and further promote used car circulation.

Industry experts suggest that to address these issues, relevant departments should strengthen the regulation of used car registration and market entry, establish a comprehensive vehicle lifecycle traceability system, and clarify industry management standards to control the immediate resale after registration strictly. Furthermore, car manufacturers, especially those in the new energy vehicle sector, should shift their focus from sales volume to product quality and service. Consumers are also advised to be vigilant, prioritising product quality and service guarantees over just price when purchasing a vehicle.