Xiaomi’s YU7 sees 200,000 pre-orders in three minutes, delivers 6,024 units in first month

The July sales figures for mid-to-large SUVs have been released. Xiaomi YU7 delivered 6,042 units in the last month. In the meantime, Xiaomi‘s sedan SU7 delivered 24,410 units.

On June 26, the day of its launch, Xiaomi Auto sold 200,000 units within the first 3 minutes, and 289,000 units within an hour. This number stands in stark contrast to the 6,024 units delivered in its first month.

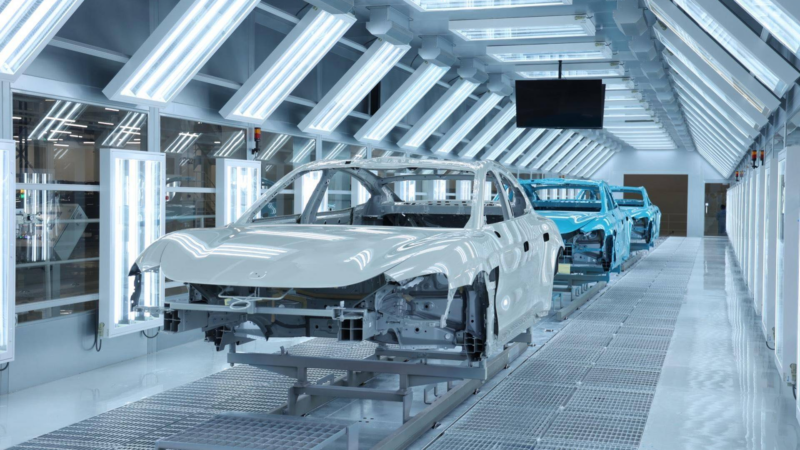

Xiaomi Auto’s Phase 1 factory has a capacity of 150,000 units annually and has been operational for a year. Furthermore, the Phase 2 factory was completed in mid-June 2025, with an expected capacity, after ramp-up, to match Phase 1.

The Xiaomi YU7 entered July sales statistics just five days after its launch, and vehicle production ramp-up naturally takes time. However, a monthly output of 6,000 units is notably low compared to industry benchmarks. As we reported, Leapmotor produced 10,000 B01 units 7 days after its launch.

2025 July Mid-to-Large SUV Retail Sales

| Rank | Model | Brand | July Sales | YTD Sales |

|---|---|---|---|---|

| 1 | Li L6 | Li Auto | 14,830 | 111,184 |

| 2 | Leapmotor C16 | Leapmotor | 6,586 | 37,747 |

| 3 | Li L7 | Li Auto | 6,237 | 53,611 |

| 4 | Xiaomi YU7 | Xiaomi | 6,042 | 8,276 |

| 5 | BMW X5 | BMW | 5,062 | 40,753 |

| 6 | Voyah Free | Voyah | 4,273 | 14,431 |

| 7 | Aito M7 | HIMA | 4,273 | 38,033 |

| 8 | Tang L | BYD | 4,249 | 22,938 |

| 9 | Luxeed R7 | HIMA | 3,950 | 46,050 |

| 10 | Wey Lanshan | Wey | 3,498 | 25,818 |

Editor’s comment

The delivery figures for the Xiaomi YU7 in July are certainly a cause for concern. Xiaomi Auto’s delivery target for this year is 350,000 vehicles, and having delivered 150,000 in the first half, they now need to deliver 200,000 in the second half. This means an average of 33,000 vehicles per month. In July, the combined deliveries of the SU7 and YU7 totalled 30,452 units. However, given that the second phase of the factory has only just commenced production, it’s anticipated that Xiaomi should be able to meet its annual target once production capacity has ramped up.

Nevertheless, with a substantial backlog of orders for the Xiaomi SU7, there’s a clear competition for production between the YU7 and SU7. When the YU7 was launched, only around 10% of SU7 pre-order holders switched to pre-order the YU7. This indicates that the YU7’s introduction hasn’t alleviated the delivery pressure on the SU7, and the YU7 itself faces considerably greater delivery challenges. Currently, the delivery time for any YU7 model exceeds 10 months, which is far from ideal for customer experience. With significant changes to vehicle purchase tax policies each year, and the rapid evolution of new energy vehicles, waiting 10 months for a car seems both excessive and illogical. Consequently, Xiaomi recently began requesting some customers to pay the full amount upfront, aiming to prioritise delivery for those with a stronger purchase intent.

However, the combined backlog of orders for the YU7 and SU7 remains a significant challenge for Xiaomi. The Xiaomi YU7 garnered 315,900 orders within 72 hours of its launch, yet, as noted, Xiaomi’s production target for the entire year is only 350,000 vehicles, which also includes the highly popular SU7 orders. Xiaomi might consider introducing new models to encourage customers to transfer their existing orders, but such a delaying tactic may not prove effective, much like the YU7’s launch did little to ease the SU7’s delivery issues.