China power battery installation rankings for H1 2025: CATL and BYD hold a combined 66.6% market share

According to data released by the China Automotive Battery Innovation Alliance (CABIA), China’s cumulative power battery installation reached 299.6 GWh in the first half of 2025, marking a year-on-year growth of 47.3%.

| Rank | Company | Total Installation | NCM | LFP |

|---|---|---|---|---|

| 1 | CATL | 128.6 | 38.81 | 89.79 |

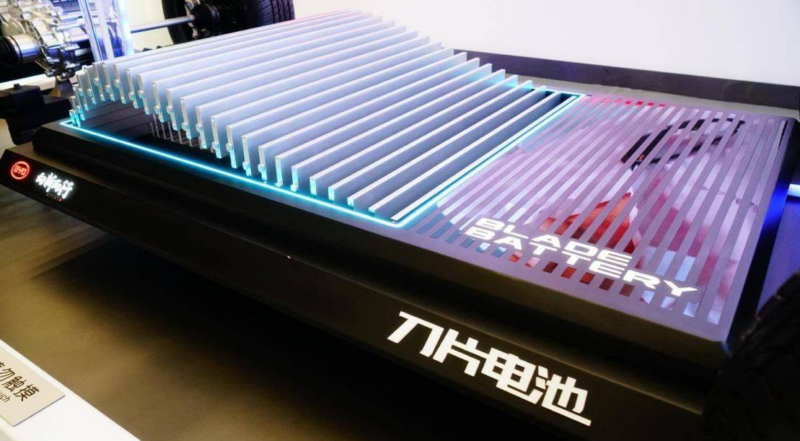

| 2 | BYD | 70.37 | 0.02 | 70.34 |

| 3 | CALB | 19.46 | 5.85 | 13.61 |

| 4 | Gotion Tech | 15.48 | 0.29 | 15.2 |

| 5 | EVE Energy | 12.21 | 0.52 | 11.7 |

| 6 | Sunwoda | 9.07 | 1.06 | 8.01 |

| 7 | Svolt Energy | 8.4 | 3.13 | 5.27 |

| 8 | Rept Battero | 6.59 | 6.59 | |

| 9 | Zenergy | 5.95 | 0.23 | 5.72 |

| 10 | Jidian | 4.23 | 4.23 |

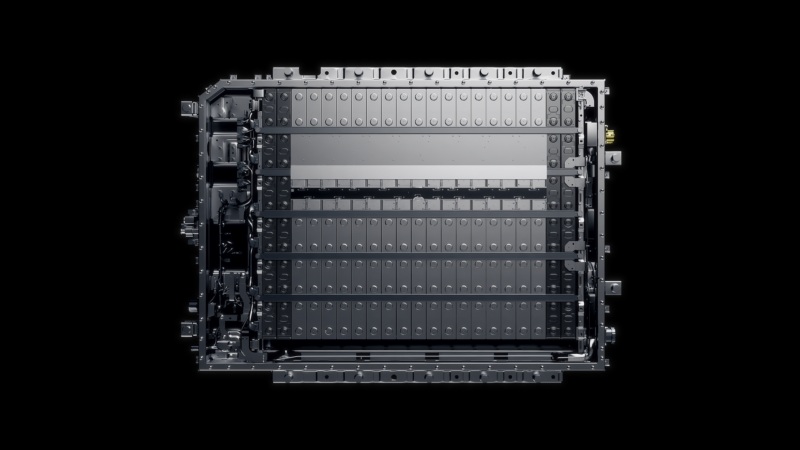

In the first half of the year, CATL (Contemporary Amperex Technology Co., Limited) maintained its leading position with an installation volume of 128.6 GWh, capturing 43.05% of the market. However, this represents a decline of 3.33 percentage points compared to the same period last year. BYD followed closely with an installation volume of 70.37 GWh and a market share of 23.55%, also experiencing a slight decrease of 1.55 percentage points. Together, these two giants accounted for 66.6% of the market, indicating a concentration of the market.

Gotion Tech saw a year-on-year market share increase of 1.62 percentage points, while Rept Battero achieved a 0.35 percentage point growth.

According to Chinese auto media CNAutoNews, overall, the industry is experiencing a gradual decline in market concentration. In June, the top ten companies accounted for 94.2% of the installation volume, down 1.8 percentage points from the previous year. Cumulatively from January to June, the top ten companies held a 93.6% share, a decrease of 2.5 percentage points year-on-year. This trend suggests that while the leading companies still hold significant market power, new entrants and specialised firms are gradually finding their footing, leading to a more diversified industrial ecosystem.

Editor’s comment

The data reveals that CATL continues to reign as the leader in the power battery market, maintaining absolute dominance in NCM batteries and performing strongly in LFP batteries, the latter being BYD’s area of expertise. However, due to cost considerations, more automakers are actively working to lessen their dependence on these two giants, leading to a gradual reduction in market concentration. Notably, Great Wall’s Svolt secured seventh place and Geely’s Jidian took tenth in H1 installation volumes, indicating that this trend toward diversification may intensify.