According to news on November 26, people familiar with Huawei said that the company hopes to create an open electrification platform with the participation of the automotive industry.

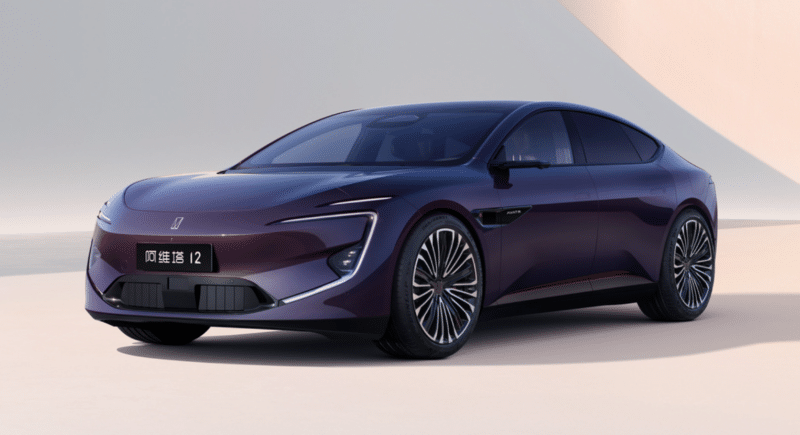

Collaborating with Changan signifies a pivotal step in Huawei’s broader platform strategy within the smart car domain. The tech giant aims to extend its cooperation on this open platform to include more automotive companies, exploring new models for cooperation that are open and mutually beneficial. Following in the footsteps of the collaboration between Avatr and Huawei, establishing a new company in partnership with Changan suggests that Changan’s sub-brands, like Avatr and Deepal, will engage in extensive collaboration with this newly formed entity.

Looking ahead, Huawei’s smart car selection business is poised to deepen its collaboration with other brands with the launch of the AITO series of models. Collaborative efforts with companies such as Seres, Chery, and more will focus on technological innovation, product definition, quality control, channel sales, and brand marketing, aiming to accelerate progress in these domains.

On November 25, Changan solidified its commitment to this partnership by signing an “Investment Cooperation Memorandum” with Huawei Technologies Co., Ltd. The memorandum outlines Huawei’s plans to establish a company dedicated to the research and development, design, production, sales, and service of automotive intelligent systems and component solutions. The investment from Huawei in the target company is strategic, reflecting a comprehensive collaboration.

The envisioned business scope of the target company includes automotive intelligent driving solutions, automotive intelligent cockpits, intelligent automotive digital platforms, intelligent car clouds, AR-HUD, and intelligent car lights. It is expected to focus on related technologies, assets, and services within this ambit. The final transaction documents will summarize the detailed business scope and implementation plan.

The following is an English translation of the original memorandum:

I. Overview

On November 25, 2023, Chongqing Changan Automobile Co., Ltd. (hereinafter referred to as “Changan Automobile” or the “Company”) signed an “Investment Cooperation Memorandum” with Huawei Technologies Co., Ltd. (hereinafter referred to as “Huawei”) in Longgang District, Shenzhen City, Guangdong Province 》. After negotiation between the two parties, Huawei plans to establish a company engaged in the research and development, design, production, sales and service of automotive intelligent systems and component solutions (hereinafter referred to as the “target company”). The company plans to invest in the target company and carry out strategic cooperation, and both parties will jointly support The target company is to become an industry leader in automotive intelligent systems and component solutions based in China, facing the world, and serving the industry.

The memorandum of cooperation signed this time is a document of intent. Relevant cooperation matters require further negotiation. The company will subsequently perform the approval procedures based on the progress of relevant matters and perform its information disclosure obligations in a timely manner.

II. Main contents of the memorandum

1. Cooperation:

Party A: Huawei Technologies Co., Ltd.

Party B: Chongqing Changan Automobile Co., Ltd.

2. Cooperation method: Party A establishes a target company whose business scope includes automotive intelligent driving solutions, automotive intelligent cockpits, intelligent automotive digital platforms, intelligent car clouds, AR-HUD and intelligent car lights, etc., and will be exclusively used within the business scope of the target company The relevant technology, assets and personnel will be injected into the target company, and the specific business scope and loading plan will be determined in the final transaction documents. In this transaction, Party B and its related parties plan to contribute capital to acquire the equity of the target company, with the proportion not exceeding 40%. The specific equity proportion, capital contribution amount and term shall be discussed separately by both parties.

3. Cooperation principles: The target company will operate independently based on market-oriented principles and adopt a market-oriented management system and salary incentive framework. Both parties commit to long-term cooperation and strategic coordination with the target company. In principle, components and solutions within the business scope will be provided by the target company to vehicle customers. In principle, Party A will not engage in business that competes with the business scope of the target company, and Party B will comprehensively promote strategic coordination with the target company.

4. The target company will gradually open its equity to investors such as existing strategic partner car companies and car companies with strategic value, becoming a company with diversified equity.

5. Trading prerequisites:

5.1 Party B completes due diligence on the business, legal, financial and other aspects of the target company, and there is no significant adverse impact in the due diligence or reaches a satisfactory solution to Party B with Party A regarding the major issues discovered during the due diligence;

5.2 Complete the substantive loading of the target company according to the loading plan agreed upon by both parties;

5.3 Party B has passed the internal decision-making process for approving this transaction and related agreements in accordance with legal procedures;

5.4 This transaction has obtained applicable government approvals in accordance with applicable laws;

5.5 There should be no applicable laws or actions by government agencies that restrict, prohibit or cancel this transaction;

5.6 No events that have a significant adverse impact on the target company’s financial status, results and forecasts have occurred;

5.7 The transaction documents (including the Equity Purchase Agreement, Shareholders Agreement, Articles of Association and other documents related to this transaction as defined under the final transaction documents) have been duly executed, delivered and effective.

6. The parties plan to sign the final transaction documents within 6 months after the signing date of this memorandum, including the equity purchase agreement, shareholders’ agreement, articles of association of the target company and other documents related to this transaction as defined under the final transaction documents.

III. Impact on the company

This cooperation will accelerate the construction of complete, independent, and leading full-stack intelligent vehicle capabilities for the intelligent era, and realize the company’s comprehensive and stable transformation into an intelligent low-carbon travel technology company. This memorandum is a document of intention and will not have a significant impact on the company’s operating results this year. The implementation of this memorandum will have no significant impact on the independence of the company’s business.

IV. Risk warning

The cooperation memorandum signed this time is an intentional agreement based on the willingness of both parties to cooperate. The specific capital contribution ratio and transaction consideration have not yet been finalized. Subsequent project cooperation is subject to the signed final transaction documents. There is still uncertainty in the specific implementation content and progress, including Possibility of project termination. The company will perform approval procedures based on the progress of relevant matters and perform information disclosure obligations in a timely manner. Investors are advised to make prudent decisions and pay attention to preventing investment risks.

V. Documents available for inspection

“Investment Cooperation Memorandum”

Special announcement

Board of Directors of Chongqing Changan Automobile Co., Ltd.

Source: iTHome