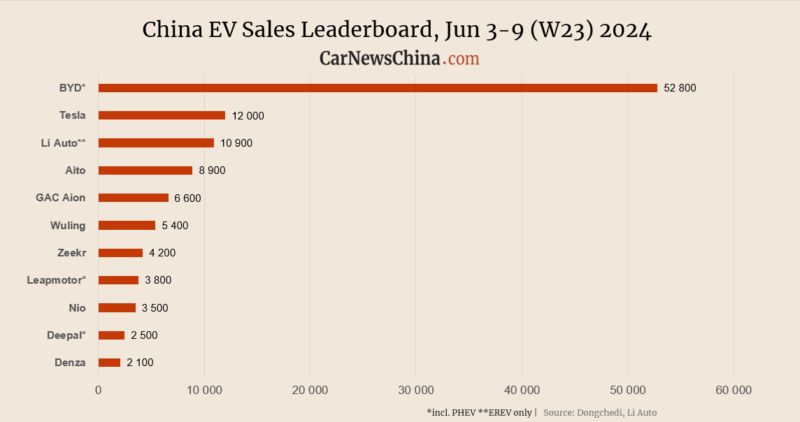

In week 23 of the year (June 3 – 9), the China EV market was mostly down, with few exceptions, such as Li Auto and Aito. Xiaomi sales were down 5% compared with the week before, Nio was down 50%, Tesla was down 20%, and BYD sales were nearly flat.

Li Auto publishes the weekly sales data, which resumed publishing registration data after a few weeks without any official explanation. The numbers are rounded and present new energy vehicles (NEV), the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

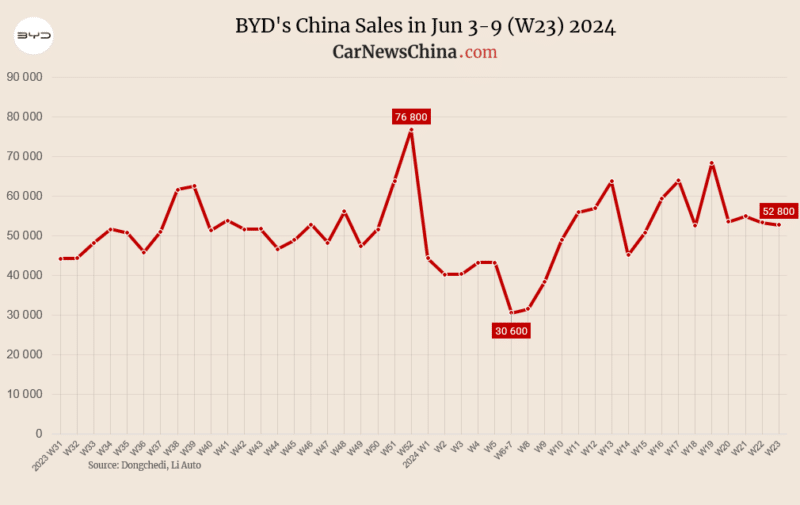

BYD took the first spot, registering 53,400 vehicles, down 1,12% from 53,400 units the week before. Last month, in May, BYD delivered 330,488 vehicles in China.

BYD doesn’t stop its EV offensive, flooding the market with dozens of new BEVs and PHEVs, accelerating the price war, and waiting for other EV makers to start losing the wheels. Aside from the BYD badged brand, BYD has three premium sub-brands: YangWang, Fang Cheng Bao, and Denza.

Under the leading BYD brand, the Shenzhen-based automaker recently launched two new plug-in hybrids, BYD Seal 06 and BYD Qin L. According to automotive survey agency CarFans, both models received 80,000 locked-in orders two weeks after the launch. BYD confirmed that Qin L delivered 5,000 units in three days following the launch. Moreover, BYD Song L DM-i, a new PHEV variant of the all-electric Song L, was officially announced and is poised to enter the market soon.

Its second brand, Denza, is also very active. The new Denza N9 flagship SUV, expected to launch at the end of the year, was recently spied in China, revealing its similarity in powertrain to the Z9 GT. Additionally, the Denza Z9 GT, a 900 hp shooting brake, was spotted during road tests on June 10, indicating its upcoming launch in the second half of this year.

Denza sells three models: D9 MPV, N7, and N8 SUVs.

Its third brand, Fang Cheng Bao, is not behind, as its upcoming hard-core SUVs, Bao 3 and Bao 8, were recently spotted in China in new spy shots, including the interior.

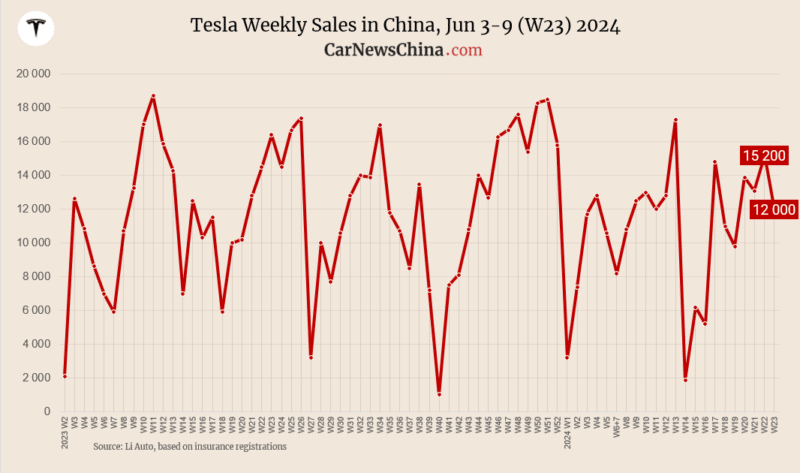

Tesla won second place, registering 12,000 vehicles, down 21.05% from 15,200 units the week before and 17.65% up from 10,200 last year. The week 23 (W23) of 2023 was June 5 – 11.

In April, Tesla introduced a 0% interest loan on vehicle purchases in China. Customers only need to pay a 79,900 yuan (11,200 USD) deposit to receive the loan, payable in up to 5 years.

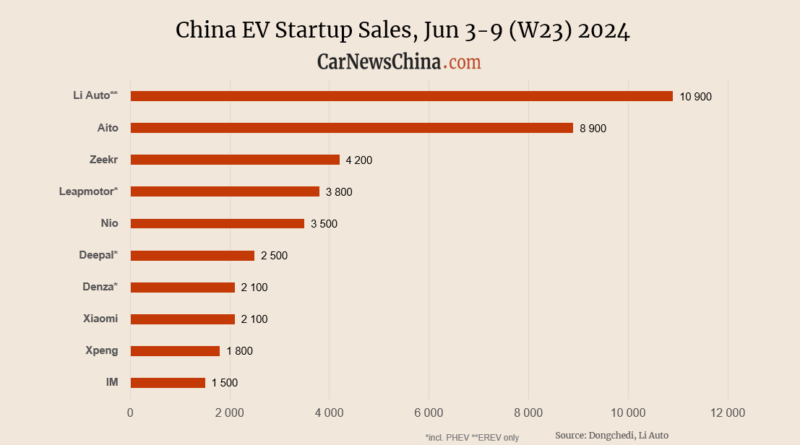

Li Auto secured the third spot overall and first spot among EV startup builders, registering 10,900 vehicles, up 29.76% from 8,400 units the week before and 53.52%, up from 7,100 the same week last year. Last month, Li Auto delivered 35,020 vehicles in China.

Huawei-backed Aito came in fourth, registering 8,900 vehicles, up 27.14% from 7,000 units the week before and 709.09% up from 1,100 last year. Last month, Aito delivered 32,973 vehicles in China.

GAC Aion took fifth place, registering 6,600 vehicles, down 12.00% from 7,500 units the week before. Last month, GAC Aion delivered 40,073 cars in China.

Wuling came sixth, registering 5,400 vehicles, down 38.64% from 8,800 units the week before. Last month, Wuling delivered 44,611 cars in China.

Geely’s Zeekr maintained its position, registering 4,200 vehicles, unchanged from 4,200 units the week before and 110.00% up from 2,000 last year. Last month, Zeekr delivered 18,616 cars in China.

Stellantis-backed Leapmotor took eighth place, registering 3,800 vehicles, down 11.63% from 4,300 units the week before and 26.67% up from 3,000 last year. Last month, Leapmotor delivered 18,165 cars in China.

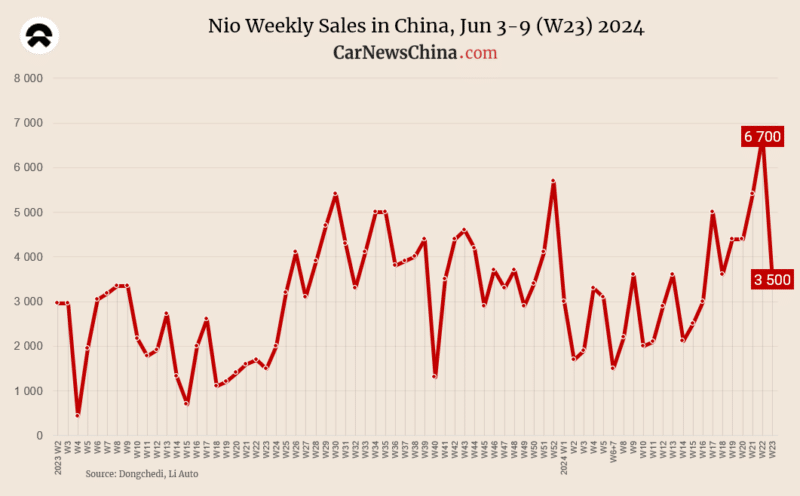

Nio came ninth, registering 3,500 vehicles, down 47.76% from 6,700 units the week before and 150.00% up from 1,400 last year. Last month, Nio delivered a record-breaking 20,544 vehicles in China, surpassing its all-time high of 20,462 last July.

Nio expects the June deliveries to be between 17,800 and 19,800 vehicles.

On May 15, Nio launched its first sub-brand, Onvo, and introduced the Onvo L60 coupe-SUV. The EV will compete with the Tesla Model Y in China, and pre-sale started at 30,500 USD. Delivery is set for September.

Nio plans to launch its second sub-brand, Firefly, in Q4 2024 in China. This is quite surprising as Firefly was initially meant as a Europe-bound brand. The launch was expected to take on the Old Continent, starting with an entry-level EV hatchback competing with VW ID.3. However, due to Nio’s disappointing sales in the EU, the company had to change strategy for Firefly, and the debut will take place in China.

Changan’s Deepal ranked tenth, registering 2,500 vehicles, down 7.41% from 2,700 units the week before and 66.67% up from 1,500 last year. Last month, Deepal delivered 14,371 cars in China.

Denza took eleventh place, registering 2,100 vehicles, down 16.00% from 2,500 units the week before and 19.23% down from 2,600 last year. Last month, Denza delivered 12,223 cars in China.

Xiaomi came twelfth, registering 2,100 units of SU7 sedan, down 4.55% from 2,200 units the week before. Last month, Xiaomi delivered 8,630 SU7 in China.

Last month, the company raised its 2024 delivery target from 100,000 to 120,000 units, reflecting a 20% increase. The SU7 all-electric sedan launched on March 28 and received strong market acceptance, with over 88,000 orders by the end of April. This month, Xiaomi’s factory will shift to double production to meet high demand.

From weekly numbers, we can see the plant’s production capacity is still fluctuating as the plant started trial production only earlier this year. The official production capacity is 150,000 vehicles per year in the first phase and 300,000 in the second phase.

Volkswagen-backed Xpeng took the thirteenth spot, registering 1,800 vehicles, down 28.00% from 2,500 units the week before and 20.00% up from 1,500 last year. Last month, Xpeng delivered 10,146 cars in China.