Tesla sales in China down 9% to 28,731 in April, while BEV market 38% up

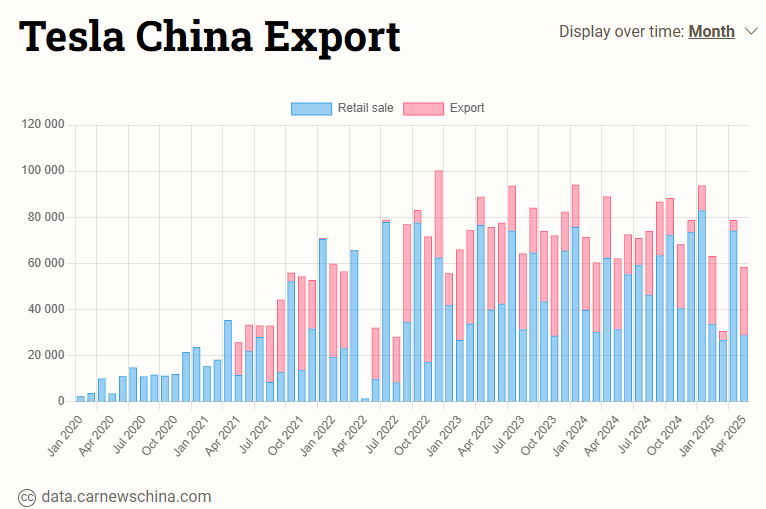

Tesla sold 28,731 cars in China in April, down 8.6% year-on-year and down 62.1% from 78,828 vehicles in March. The sales of automaker’s best seller, Model Y, fell 24% to 19,984 units, compared with 26,356 in the same month last year.

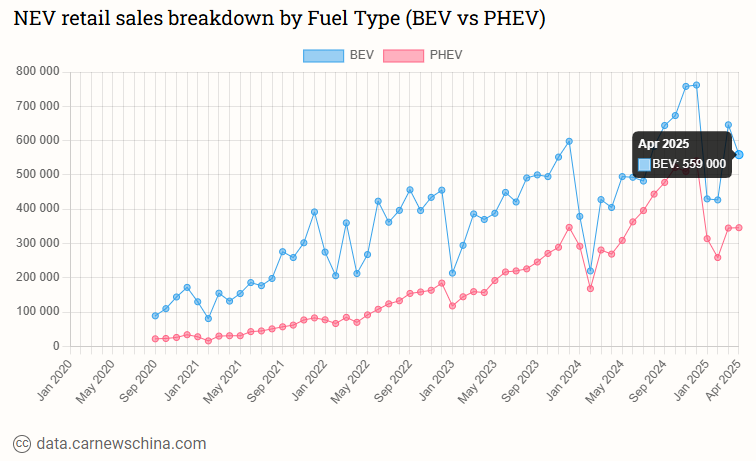

In total, 559,000 all-electric cars were sold in China in April, up 38% from 405,000 in the same month last year.

Tesla’s export from China reached 29,728 cars in April, slightly down 3% from 30,746 units compared with last year.

Tesla’s share of China’s all-electric vehicle market was 5.1% in April, down 11.5% from March.

In total, Tesla China sold 58,459 cars in April, including domestic sales and exports. That is 6% down year-on-year and 26% down from 78,828 units in March.

As Tesla China domestic sales fluctuate due to export periodicity, it is always good to look at quarterly or year-to-date data to have the whole picture.

Between January and April 2025, Tesla sales in China were 163,338 units, down 0.3% from the same period last year. Tesla China exported 67,875 units, down 43% from 119,202 units in January-April last year. In total, Tesla’s China factory sold 231,213 cars, down 18% from 283,043 units in January-April 2024.

Editor’s comment

While Tesla’s sales slump in Europe and other regions is mainly attributed to public dissatisfaction with its CEO, Elon Musk, in China, Musk is barely a topic. The reason is that there is simply too much competition against Tesla. The Model 3 sedan has been in trouble for several years, and even the refresh didn’t change that trend. Too many affordable and fierce sedans wanted to eat their lunch: BYD Seal, Zeekr 007, Nio ET5, Xpeng P7, Xiaomi SU7, and dozens others.

Thus, Tesla China sales were highly dependent on a single model – its SUV Model Y, which resisted quite well, despite facing models such as Xpeng G6, Onvo L60, Li Auto L6, BYD Sealion 7 or Zeekr 7X. In 2024, its sold 480,309 units in China and was responsible for 73% of Tesla’s sales. But it seems the fame of the US automer’s stronghold is fading away now as competition in Middle Kingdom is simply too much: on one hand China EV startups fighting for survival put pressure on price, on the other they inovate at “China speed”, making new model development cycle 2-3 years, offering 800V charging (Tesla still has 400V architecture on Model Y and Model 3), connectivity, ADAS and also a bit patriotism as young Chinese buyers don’t have fear of buying Chinese products like their parents, who still remember 90s. The lack of new models is finally hurting Tesla in China.