BYD and Xiaomi overtake Tesla as ‘top choice’ for Chinese car buyers, UBS survey shows

Chinese consumers are moving on, and Tesla is no longer seen as a technology leader, the report notes. According to the UBS survey, only 14% of Chinese consumers consider Tesla their top choice EV brand, down from 18% a year earlier and far below its 30% peak in 2020. Meanwhile, domestic players BYD and Xiaomi have surged ahead, boosted by “strong product offerings”, “technological innovation”, and “pricing that better matches market expectations”, USB says.

Local wins, global slide

Tesla’s decline isn’t just a local story. Globally, consumers seeing it as their top choice EV brand fell from 22% to 18%. In the U.S., preference slipped to 29%, down from 38%. It’s now at 15% in Europe, overtaken by Audi and BMW.

The reasons vary by region. In China, Tesla is no longer seen as a tech leader. In Europe, Elon Musk’s political visibility may be hurting the brand. In the U.S., the vehicle lineup feels thin, and affordability remains an issue.

Xiaomi: from phones to pole position

Xiaomi’s transition from consumer tech to electric cars is paying off. Its SU7 sedan sold 26,223 units in April, beating Tesla’s Model 3 in the same month. The newly unveiled YU7 SUV is aimed squarely at Tesla’s Model Y, with features like city-level assisted driving and a large display, all expected to be priced competitively.

BYD, meanwhile, continues its dominance. In April, it outsold Tesla in Europe for the first time, and its lead in China is solid. Tesla’s own China sales fell 60% from March to April, down to 28,731 units.

Tech edge no longer guaranteed

Local Chinese EV brands are undercutting Tesla in terms of both features and price. Xpeng’s new sedan offers smart driving features at half the cost of a Model 3. Xiaomi and others now ship vehicles with urban NOA (Navigate on Autopilot) in the 200,000 yuan range. Tesla’s FSD (Full Self-Driving), by contrast, remains expensive and under-delivers in China.

Tesla’s next move?

With local competition ramping up, Tesla faces pressure to adapt, either through pricing, features, or both. For now, BYD and Xiaomi are reshaping consumer expectations, and Chinese buyers respond by looking inward.

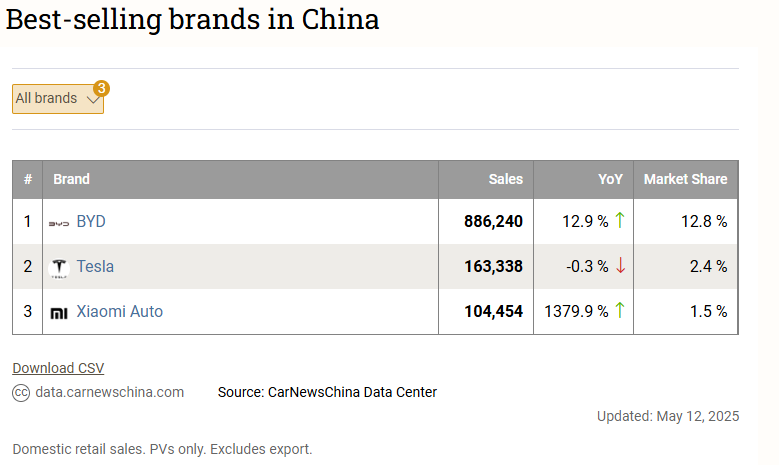

In 2025 (January – April), Tesla sold 163,338 vehicles in China, down 0.3% from the same period last year.

In the same period, BYD sold 886,240 cars in China, up 12.9% year-on-year. Xiaomi sold 104,454 EVs, up 1379.9% from last year; however, keep in mind that Xiaomi started delivering cars only in April 2024.