Huawei’s 3,000km solid-state battery patent with 5-minute charge ignites industry race

Huawei has stepped up its ambitions in advanced energy storage with a patent for a sulfide-based solid-state battery that offers driving ranges of up to 3,000 kilometres and ultra-fast charging in just five minutes. The development signals a significant push by the tech giant to stake a claim in the fast-evolving solid-state battery landscape.

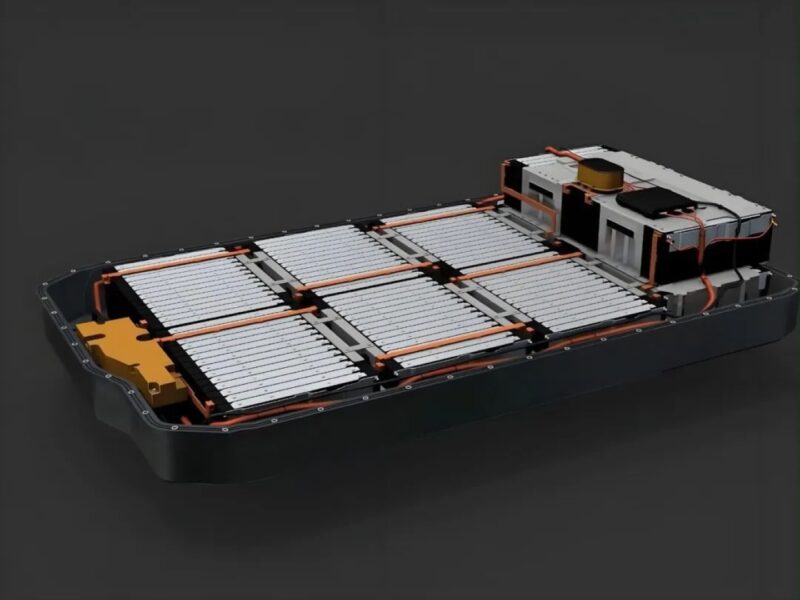

The patent outlines a solid-state battery architecture with energy densities between 400 and 500 Wh/kg, potentially two to three times that of conventional lithium-ion cells. The filing also details a novel approach to improving electrochemical stability: doping sulfide electrolytes with nitrogen to address side reactions at the lithium interface, a long-standing obstacle to the commercialisation of sulfide-based batteries. Huawei’s design aims to boost safety and cycle life by mitigating degradation at this critical junction.

Huawei’s involvement in solid-state battery research reflects a broader trend among Chinese technology and automotive companies. While Huawei does not manufacture power batteries, it has shown increasing interest in upstream battery materials. Earlier in 2025, the company filed a separate patent on the synthesis of sulfide electrolytes — a key material known for its high conductivity but also high cost, sometimes exceeding the price of gold.

China’s EV and tech sectors are aggressively exploring solid-state battery technologies to reduce reliance on established battery suppliers such as CATL and BYD. Companies like Xiaomi, and Nio, depend on third-party battery manufacturers. Still, they are seeking ways to integrate vertically and regain control over this high-cost component, which can account for more than half of an EV’s production cost.

We reported recently that Xiaomi filed a patent for a composite electrode structure to optimise ion transport. The move highlights the strategic value that Chinese tech firms now place on battery innovation, not just for vehicles but potentially for mobile electronics.

While Huawei’s claims of a 3,000-kilometre range and five-minute charging have generated widespread attention, experts warn that such figures remain theoretical and would require charging infrastructure that is not yet commercially available. Nonetheless, the technical promise and Huawei’s involvement have sparked renewed interest and concern among global competitors. Japanese and South Korean media have voiced apprehension about China’s accelerating lead in next-generation battery technologies.

Globally, traditional leaders like Toyota, Panasonic, and Samsung have invested in solid-state battery R&D for over a decade. Toyota, for instance, unveiled a prototype in 2023 claiming a 1,200-kilometre range and 10-minute charge time, targeting commercialisation within five years. However, China has rapidly caught up. According to public data, Chinese entities now file over 7,600 solid-state battery patents annually, representing 36.7% of global activity.

Meanwhile, Chinese battery manufacturers are preparing for industrialisation. CATL aims to begin pilot production of a hybrid solid-state battery by 2027. Going High-Tech’s “Jinshi” battery — featuring 350 Wh/kg energy density and 800 Wh/L volume density — has entered small-scale production. At the same time, Beijing WeLion has begun manufacturing a 50 Ah all-solid-state cell with national certification.

Still, significant hurdles remain. Solid electrolytes generally have lower ionic conductivity than their liquid counterparts, and interfacial resistance continues to limit efficiency. High production costs, currently between 8,000 and 10,000 yuan per kWh (approx. 1,100–1,400 USD), hinder mass-market adoption.

Nevertheless, Huawei’s entry adds momentum to China’s effort to lead the next wave of battery innovation. If breakthroughs like this can be commercialised, they may help rewrite the rules of electric mobility, reducing range anxiety, slashing charge times, and enabling a new level of energy independence for automakers and tech firms alike. Whether these promises materialise will depend on how fast laboratory results can be translated into scalable manufacturing.