Volkswagen-backed Xpeng targets 50% overseas sales by 2035, expanding to 60 countries this year

Xpeng Motors is aiming for 50% of its vehicle sales to come from international markets within the next decade, a sharp increase from just 10% last year, according to CEO He Xiaopeng. As part of this long-term strategy, the Chinese EV maker plans to enter 60 countries by the end of 2025 – twice as many as the previous year.

Xpeng didn’t specify the overall 2035 sales target, but the company previously announced that it is confident in delivering approximately 380,000 vehicles in 2025, doubling its sales from last year.

In July 2023, Volkswagen invested approximately 700 million USD in Xpeng, acquiring a 4.99% stake. For VW, this strategic partnership included plans to co-develop two mid-sized, Volkswagen-branded electric vehicles for the Chinese market featuring Xpeng’s tech, with production expected to begin in 2026. For Xpeng, it brought an appetite for overseas expansions.

The Guangzhou-based EV maker is concentrating its efforts on Europe, Southeast Asia, the Middle East, and Latin America, with plans to invest more heavily in around a dozen key markets. Co-president Gu Hongdi stated that Xpeng is working to tailor its offerings to local needs, including product adjustments and enhancements to service infrastructure.

In its latest move in March, the automaker officially expanded to Poland, the Czech Republic, Slovakia, and Switzerland, where it appointed its local distributors.

Rather than relying solely on imports and exports, Xpeng wants to establish a more localised presence in international markets through R&D, manufacturing, and service networks. The current focus is on establishing robust local support systems, encompassing charging infrastructure, maintenance services, and OTA (over-the-air) updates.

While recent U.S. tariff increases won’t affect the company—since it doesn’t sell in that market—Xpeng considers Europe its top priority outside China. The Guangzhou-based automaker is exploring production opportunities in the region and anticipates launching several new models there over the next three years.

Xpeng also plans to build its first overseas assembly plant in Indonesia, marking a significant step toward localising production.

Looking ahead, He predicts that only five to seven NEV brands will remain competitive globally over the next decade. Xpeng plans to invest 4.5 billion yuan (approximately 616 million USD) in AI this year and launch L3 autonomous driving capabilities in China by the end of 2025.

The company is also pushing into new tech frontiers, including flying vehicles and humanoid robots. Xpeng’s flying car unit, AeroHT, expects to receive type certification for its “Land Aircraft Carrier” model by year-end, with production and deliveries beginning in 2026. Meanwhile, its IRON humanoid robot is currently undergoing testing, with mass production targeted for next year.

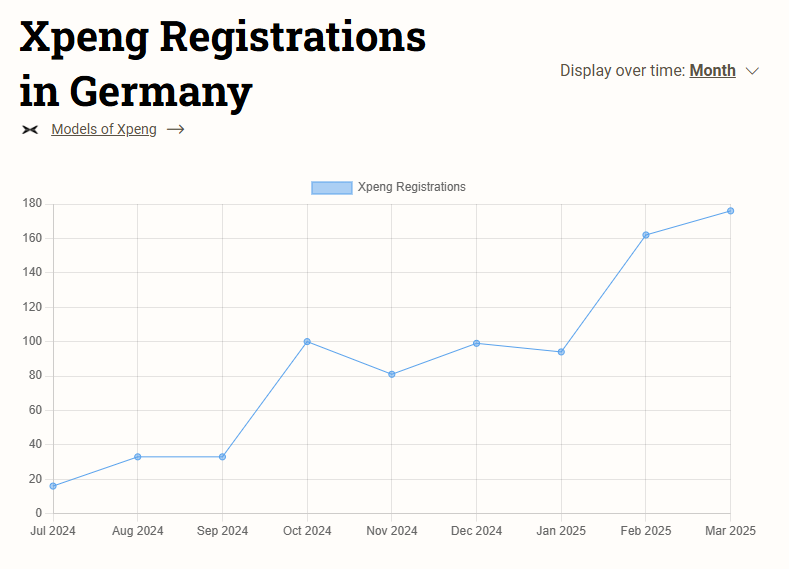

Last year, Xpeng expanded to Germany, where it sold about 800 cars so far, with 176 deliveries in March. In October 2024, the additional tariff of 20.7% went into effect for Xpeng’s imports as a result of the EC’s anti-subsidy investigation. The company now faces a total tariff of 30.7% on its import of EVs into the EU.