In August, the China automaker’s EV sales were mostly up. Nio Group was up 55%, Huawei’s HIMA was 32% up, Geely was 95% up, and BYD was mainly flat, with a 0.2% increase compared to the same month last year.

Xiaomi do not report their exact numbers, but they mentioned that the company sold over 30,000 EVs. In July, it was also “over 30k” and in June, it was “over 25k”. Tesla China also doesn’t share its numbers, but in the first three weeks of July, it registered 37,700 EVs, meaning the China sales will be around 50,000 units. The Tesla China export will be revealed later this month by CPCA.

The sales represent passenger vehicle (PV) sales of new energy vehicles (NEV) of Chinese automaker groups globally for July. NEV is a Chinese term for all-electric vehicles and plug-in hybrids. At the bottom of the article, the breakdown of group sales to particular brands is available. Some automakers didn’t publish their results at the time of publication (SAIC, for example) and will be updated later.

Chery hasn’t yet published their data, and it will likely be updated tomorrow.

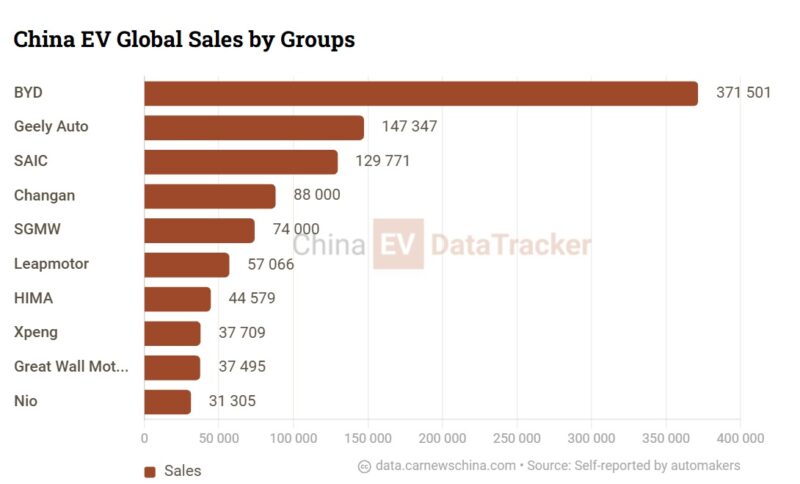

China EV sales in August by Group

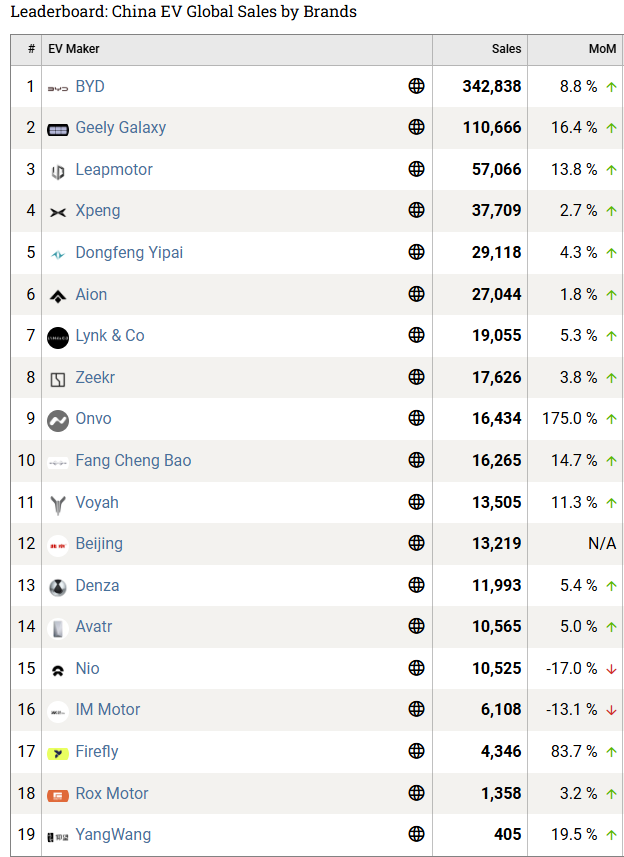

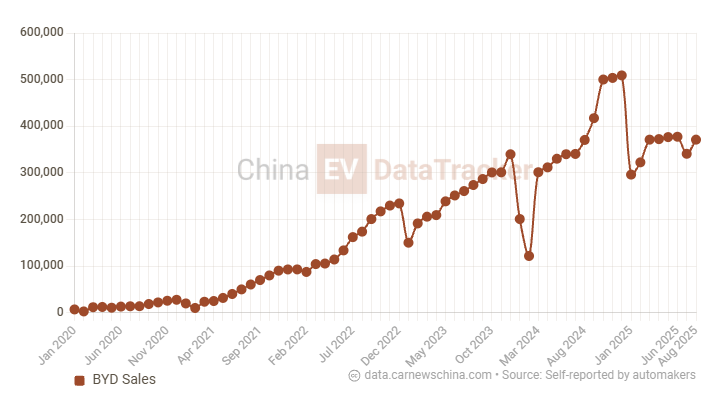

BYD sold 371,501 passenger vehicles, up 8.9% from July and up 0.2% from the same month last year.

In 2025 so far (January – August), BYD sold 2,830,415 vehicles, up 22.1% from the same period last year.

The automaker has a sales target of 5.5 million vehicles for 2025.

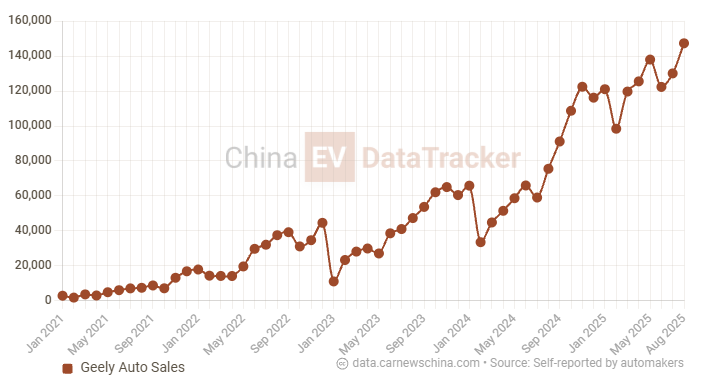

Geely Auto sold 147,347 vehicles, up 13.2% from July and up 95.2% from the same month last year.

In 2025 so far, Geely Auto sold 1,002,622 vehicles, up 120.5% year-on-year.

SAIC sold 129,771 EVs, up 10.9% from July. Changan sold 88,000 EVs, up 11.4% from July. GM’s Chinese joint venture with SAIC and Wuling – SGMW – sold 74,000 vehicles, up 0.1% from July.

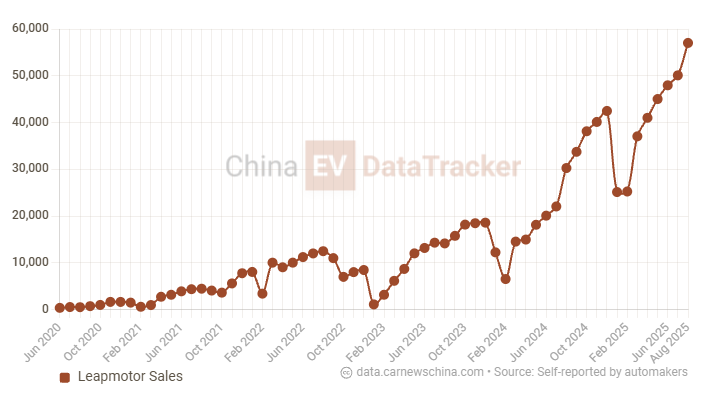

Stellantis-backed Leapmotor sold 57,066 vehicles, up 13.8% from July and up 88.3% from the same month last year.

In 2025 so far, Leapmotor sold 328,859 vehicles, up 136.4% year-on-year.

For Leapmotor, this is the second time it has surpassed 50,000 sales. It is also the 28th consecutive month of year-over-year growth since April 2023.

Leapmotor aims to reach a 500,000-unit sales target in 2025.

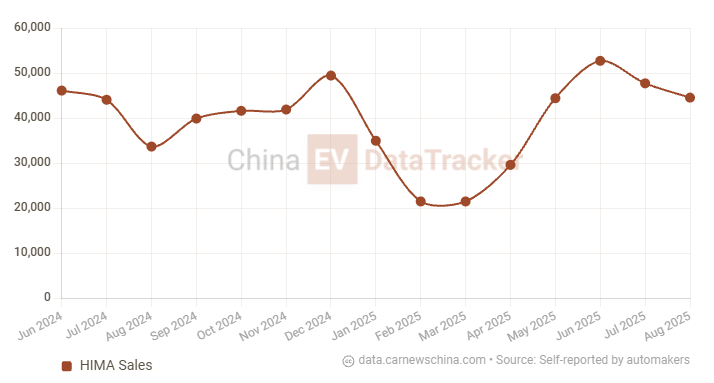

Huawei’s HIMA sold 44,579 vehicles, down 6.6% from July and up 32.3% from the same month last year.

In 2025 so far, HIMA sold 297,185 vehicles, up 139.8% year-on-year.

HIMA is Huawei’s automotive alliance, comprising five brands: Aito, Luxeed, Stelato, Maextro, and Shangjie (SAIC).

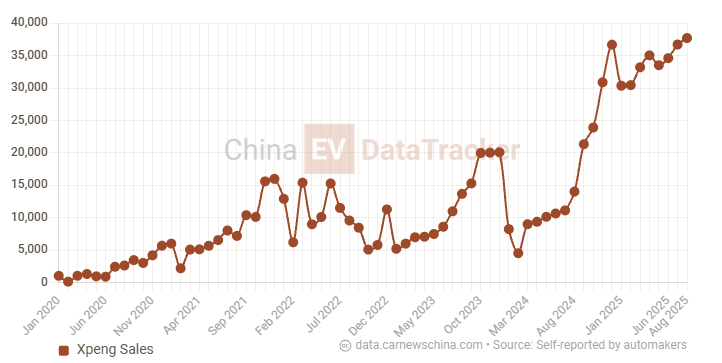

Volkswagen-backed Xpeng sold 37,709 vehicles, up 2.7% from July and up 168.7% from the same month last year.

In 2025 so far, Xpeng sold 271,615 vehicles, up 251.8% year-on-year.

Great Wall Motor sold 37,495 EVs, up 8.4% from July and up 50.9% from the same month last year.

In 2025 so far, Great Wall Motor sold 232,502 EVs, up 28.2% year-on-year.

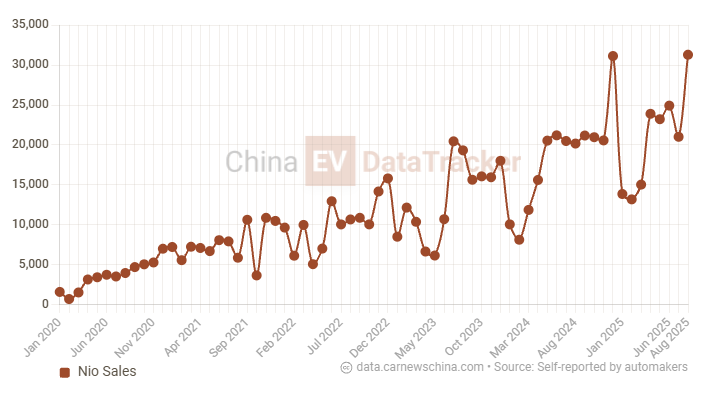

Nio Group sold record-breaking 31,305 vehicles, up 49.0% from July and up 55.2% from the same month last year.

In 2025 so far, Nio Group sold 166,472 units, up 305 from the same period last year.

Premium Nio brand sold 10,525 units, down 50.4% year-over-year, its third consecutive month of YoY decline.

Entry-level Onvo grew 175% to a record-breaking 16,434 units compared to July. That is thanks to the good acceptance of the large 6-seater Onvo L90.

Budget brand Firefly sold a record-breaking 4,346 units, up 83.7% from July.

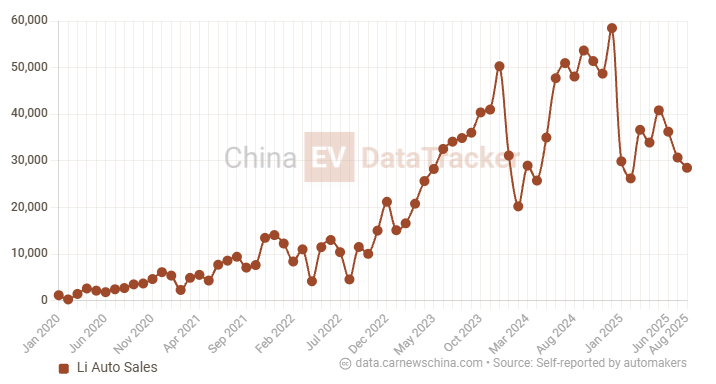

Li Auto sold 28,529 vehicles, down 7.25% from July and down 40.7% year-over-year. As of 2025, Li Auto has sold 263,198 vehicles, a 8.6% year-over-year decrease.

Those were the results by Groups. Here is China EV Global Sales by Brand Leaderboard.