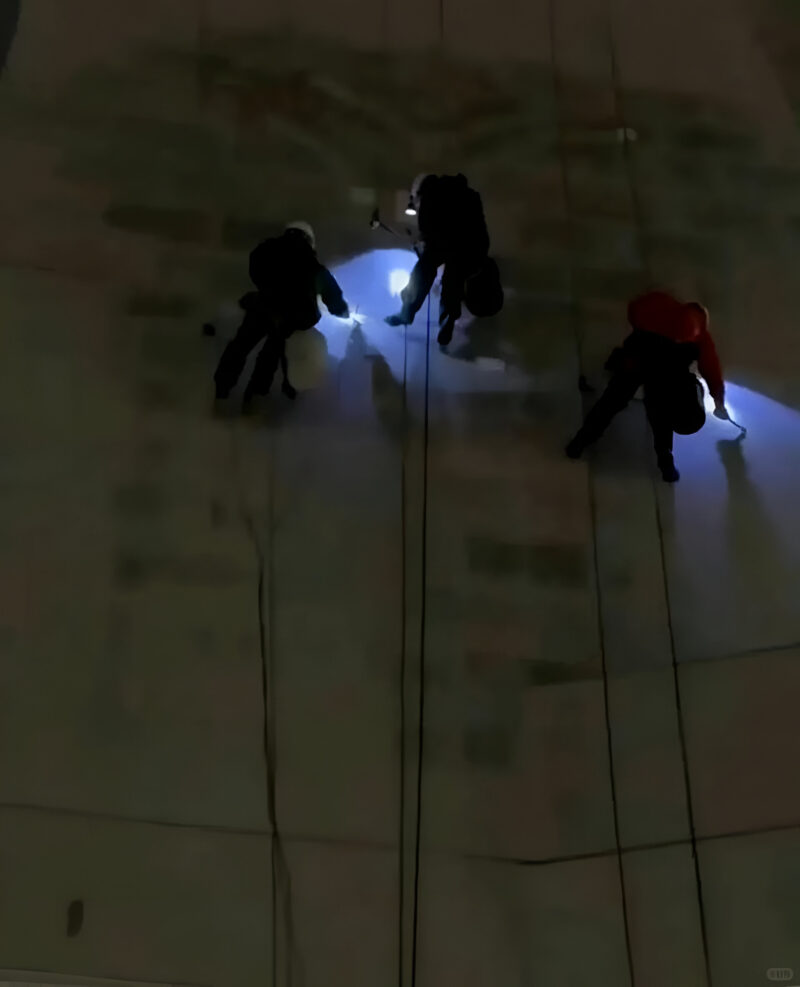

A netizen recently posted photos showing Neta Auto’s logo being removed overnight from its Shanghai HQ. Workers dismantled the signage using ropes and scrapers, leaving only faint traces. Neta confirmed the removal was due to the lease expiring last month and said the company is preparing to relocate, though the new office address hasn’t been disclosed.

Once considered a dark horse among China’s electric vehicle (EV) startups, Neta Auto is now at the centre of a power struggle that could determine the company’s fate. Multiple sources have confirmed that state-owned shareholders of Neta’s parent company, Hozon New Energy Automobile, are moving to convene a board meeting to remove founder Fang Yunzhou from his dual roles as chairman and CEO. The dramatic development comes as the company grapples with staggering losses, a broken supply chain, and factory shutdowns.

Fang, who founded Hozon in 2014 and has served as its legal representative since has been a central figure in Neta’s rise and fall. Although once viewed as an innovative leader, he is now facing severe criticism from government-linked shareholders over his handling of the company’s finances and strategy. These previously supportive shareholders have grown frustrated after cumulative losses surpassed 18.3 billion yuan (2.5 billion USD), and the company’s debt ratio soared to an alarming 217%.

The tension has escalated to the point that another state-owned investor is reportedly pushing for Hozon to enter bankruptcy restructuring, signalling a potential collapse of one of China’s prominent EV startups. According to insiders, these investors demand fundamental structural reform rather than a simple leadership reshuffle.

Neta’s mixed-ownership model makes the situation unique, combining private entrepreneurial leadership with state capital. While this structure initially offered policy and funding advantages, it has become a source of conflict. State investors focused on risk mitigation and long-term stability have clashed with Fang’s more aggressive expansion strategies, particularly his push into Southeast Asia and his goal of turning a profit by 2026.

The financial collapse has also affected operations. Internal sources report unpaid debts to suppliers exceeding 6 billion yuan (833 million USD), with battery giant CATL among those halting deliveries. As a result, Neta’s domestic production has stopped, further delaying overseas orders despite having secured a 2.15 billion yuan (nearly 300 million USD) credit line in Thailand.

Neta’s downward spiral was already evident in its sales figures. After peaking in 2022 with 152,000 units, deliveries dropped to 127,500 in 2023 and plummeted by nearly half in 2024 to just 64,549 vehicles. Reports of mass layoffs, store closures, and supplier protests only worsened public perception. Even aggressive cost-cutting, such as employee equity incentives and business streamlining, has failed to stabilize the company.

Fang’s leadership has recently come under even greater scrutiny. After stepping in as CEO following Zhang Yong’s departure in late 2024, he set ambitious goals: a public listing, global expansion, and positive gross margins by 2025. None have materialized, and Neta’s liquidity issues have worsened. A proposed debt-to-equity swap to reduce supplier debt also stalled, further eroding confidence.

As state shareholders push for Fang’s ouster and even bankruptcy proceedings, the future of Neta hangs in the balance. If the board vote goes through, Fang could lose control of the company he built, marking a dramatic fall from grace for one of the EV sector’s early pioneers.