In April 2022, the total power battery production capacity reached 29GWh in China, a year-on-year increase of 124.1% and a month-on-month decrease of 26.1%, according to the China Industry Technology Innovation Strategic Alliance for Electric Vehicle (CAEV). Out of the 29GWh total capacity, 13.3GWh were installed on electric vehicles, a year-on-year increase of 58.1% and a month-on-month decrease of 38.0%.

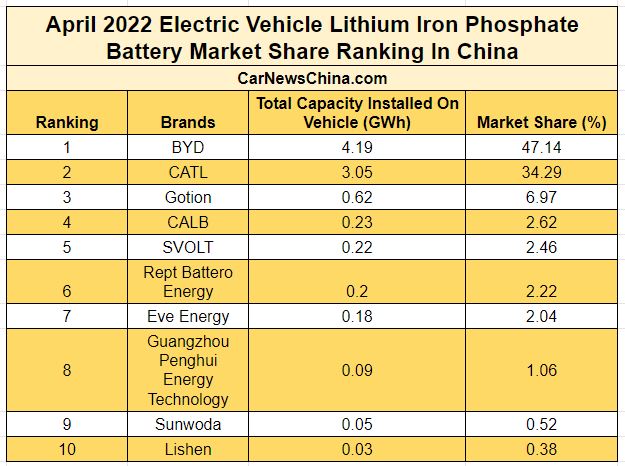

In April, BYD surpassed CATL to rank first with 4.19GWh of lithium iron phosphate batteries (LFP) installed on electric vehicles, accounting for 47.14% of the LFP market share. BYD’s Blade battery cells are designed based on LFP battery cells. BYD claims Blade batteries are the safest solution for EVs as they almost can’t catch fire, even if damaged.

LFP battery is known for its low cost and safety, but its low-temperature performance and energy density are poor. Today, battery companies have gradually improved the performance of LFP batteries. For example, in 2020, BYD launched the Blade battery. The energy density of the Blade battery system can reach 140Wh/kg, which is comparable to ternary lithium batteries.

BYD’s performance in the LFP power battery market is positively correlated to its electric vehicle sales performance. Earlier in April, BYD also announced that it would stop selling fossil-fuel powered vehicles. In April, BYD 106,000 units of electric vehicles, achieving a double growth year-on-year.

CATL came in second with 3.05GWh of LFP batteries installed on electric vehicles, accounting for 34.29% of the LFP market share. Earlier in March, CATL’s market share was as high as 50.49% with 7.02GWh of LFP installed on electric vehicles compared to BYD’s 3.98GWh. CATL’s market share fell by 12.21% in just one month.

LFP batteries are taking more and more market share of ternary batteries. In April, 4.4GWh of ternary batteries were installed on electric vehicles, accounting for 33% of the total market share, a year-on-year decrease of 15.6%. On the contrary, 8.9GWh of LFP batteries were installed on electric vehicles, accounting for 67% of the total market share, achieving a year-on-year increase of 177.2%.

CATL came in first with the highest total battery capacity installed on electric vehicles – 5.08GWh of LFP and ternary batteries combined, accounting for 38.28% of the total market share, even when its largest single customer Tesla sold only 1,512 vehicles in China in April this year with production suspension in the first half of April.

The production loss of Tesla’s Shanghai plant was about 2,000 vehicles per day. Based on the 18-day shutdown in April, the production loss totaled 36,000 units. Based on a rough estimate of 60KWh of battery capacity for Model 3, this corresponds to about 2.16GWh of battery capacity.

In contrast, BYD, with its stellar performance in the LFP power battery market, its overall power battery installation capacity has increased significantly in April with 4.27GWh. Back in March, 4.12GWh of BYD’s power batteries were installed on electric vehicles, accounting for 19.24% of the total market share.

Sum Up

It is obvious that BYD and CATL are leading in this fierce competition. There are still 24 manufacturers outside the top 10 LFP and ternary battery manufacturers that are competing for just 4% of the market share. Considering that the leading battery manufacturers are still expanding their production on a large scale, this 4% market share may only get smaller and smaller.

ABOUT CAEV

CAEV was established on December 2010 under the guidance and support of the Ministry of Science and Technology formed based on the principle of innovation, collaboration, and mutual benefit. It aims to promote the development of electric vehicle technologies.