BYD and Geely tie for 10th place among global producers as they argue over PHEV systems and Geely joins with Renault for NEV powertrains

Today BYD and Geely tied for tenth place in global automotive share. This helps explains the continuing arguments between the two kicked off by BYD’s DM-i 5.0, its fifth generation PHEV technology, which launched earlier this week.

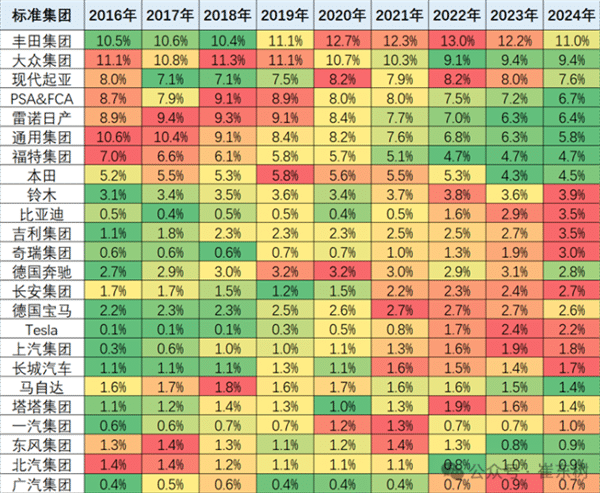

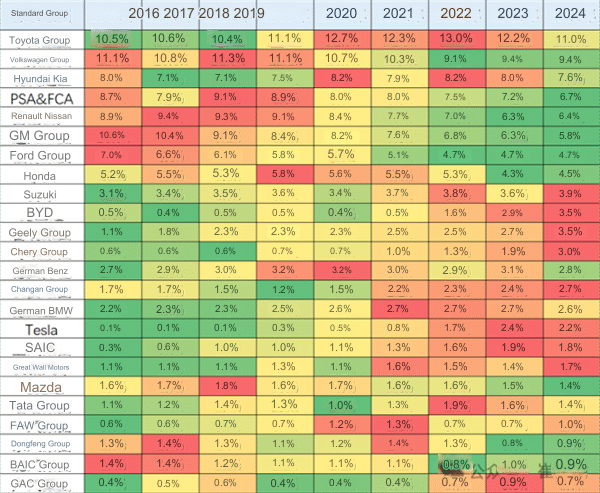

Today Cui Dongshu, secretary general of the China Passenger Car Association, announced the changes in the ranking of Chinese companies in the global market share table. 2024 is the first year that any Chinese brands have broken into the top 10. BYD just missed out in 2023 with eleventh place. So far this year both BYD and Geely have 3.5% share. Right behind BYD and Geely this year is Chery in twelfth place and managing to increase market share to 3.0% from just 1.9% the year before, possibly helped by the brand’s strong showing in Russia. Changan came in at 14th place. Also featuring in the top 20 were SAIC in 17th position with 1.8% and Great Wall in 18th position with 1.7%. Bottoming out the table which shows the first 25 places were state owned producers FAW, Dongfeng, BAIC, and GAC. The only one of these to see much increase in the period from 2016 has been GAC with the others either stagnating or having falling shares. Presumably 2024 data is for the year up to the end of April.

With Geely and BYD breaking away last year as the most successful Chinese brands globally it gives perspective to the current fight over PHEV technology. This all centers around the three key figures from Tuesday’s announcement which BYD claims are world beating namely: 46.06%, 2.9 l/100 km, and 2,100 kilometers. The Chinese Internet is still full of articles about the sparring between the two companies over the matter.

Initially the argument centered around who has the most efficient engine. Geely displayed a certificate from CATARC (China Automotive Technology and Research Center) showing that they had an engine with 46.1% thermal efficiency. BYD responded that its engine was actually in mass production whereas Geely’s wasn’t and later a certificate emerged for a BYD engine with efficiency of 46.5%. Round 1 to BYD.

The argument now seems to have moved on to the second BYD claim, 2.9 l/100 km. Geely vice president and spokesperson Yang Xueling retweeted a Weibo (China’s Twitter equivalent) post questioning the DM-i fuel consumption figure sarcastically adding “It’s really good, I guess the older generation of scientists would think the same way if they were still alive.”

The comment is a direct result of the 2.9 l/100 km being because BYD is using the old NEDC standard rather than the WLTC figure that the Ministry of Industry and Information Technology (MIIT) uses for its declaration list information. The WLTC figure for the system is 3.8 l/100 km.

Earlier this week we gave a more detailed breakdown in the difference between the two measurements but for now let’s suffice with saying the WLTC test not only lasts longer, it more closely matches real world conditions than the NEDC one.

Yang Dongsheng, senior vice president of the BYD Group and the chief designer of DM technology has countered that NEDC more closely matches the reality in first-tier Chinese cities.

Under the NEDC test the average speed is 33 km/h whereas with WLTC it averages as 47 km/h. BYD says that its research showed that the average speed in first-tier cities, like Beijing and Shanghai, is 25 km/h or even as low as 23 km/h and in second-tier cities it is around 30 km/h. BYD goes further and claims that the normal driving speed in China is less than 30 km/h. Round 2 seems perhaps to be a tie with Geely looking marginally stronger.

A number of media tests of the BYD Qin L managed to achieve a range of over 2,400 km although under what conditions this was achieved doesn’t seem to have been outlined.

Editor’s note:

It seems that competition between the two companies is really hotting up. A release of the next generation NordThor PHEV system from Geely this year rather than the previously communicated next year is a distinct possibility.

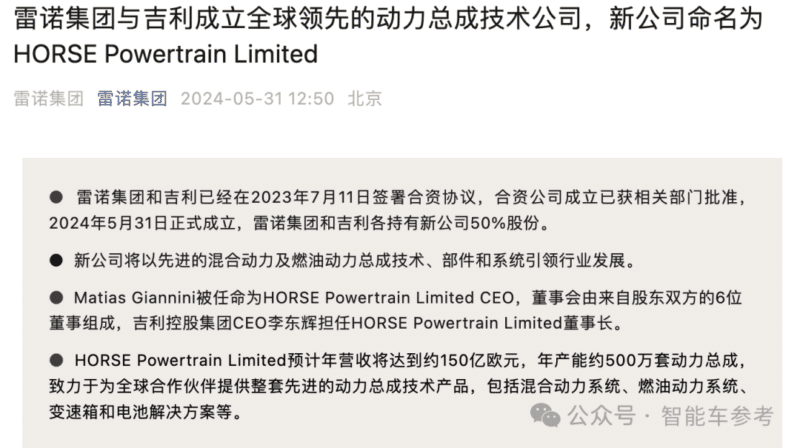

Earlier today saw the official establishment of Horse Powertrain Limited with Matias Giannini as CEO. The company is the result of a joint venture agreement between Geely and Renault signed in July 2023. Horse Powertrain will act as a tier 1 dedicated powertrain supplier for new energy vehicles. This is likely to see Geely’s NordThor system go global.

It should be noted that some Chinese media put the places of Chery and the following Chinese producers one position higher due to the tie for tenth place so for example making Chery eleventh rather than twelfth.

Sources: Fast Technology, Fast Technology