China EV registrations in week 31: Nio 3,450, Onvo 3,700, Xpeng 9,071, Tesla 11,000, BYD 60,930

In week 31 of the year, the China EV market had mixed signals. Nio registrations were up 6%, Onvo was up 145%, Xpeng was up 8%, Tesla 3% and BYD 4%, compared with the week before.

Nio Group registered 7,930 units, up 59% from the week before. Onvo L60 had 1,720 registrations, and the new L90 large SUV had 1,980.

Key events to watch:

- Onvo outsold the main Nio brand for the first time as L90 deliveries kicked in

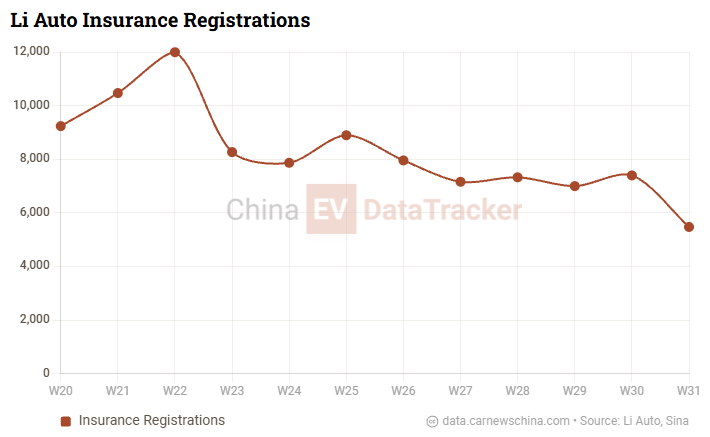

- Li Auto sales weakness continues as the performance of new all-electric models is beyond expectations. The company previously did only EREVs.

- Leapmotor broke the 10k threshold for the second time in 2025 as sales remain strong

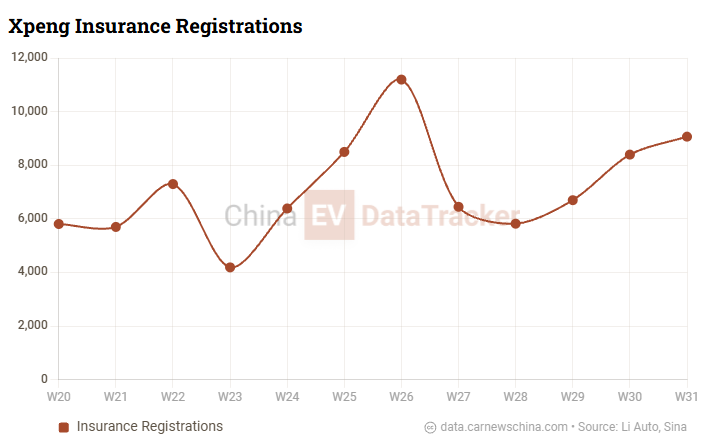

- Xpeng grew for the third week in a row, hitting 312% growth compared with the same week last year

The weekly brand’s EV sales were published by Li Auto. However, Li Auto ceased publishing them in March 2025 after the China Association of Automobile Manufacturers (CAAM) “recommended” that Li Auto, media and any third parties end it. CAAM says weekly data “undermines the industry order” and “fuels vicious competition.” Since then, Li Auto has published only its own weekly EV registration.

The weekly data are used by consultants, analysts, or investors to see the sales trend and forecast monthly deliveries. They show how many cars were registered for road traffic, which can be later compared with automakers’ self-reported monthly sales, which, unlike registrations, include cars for showrooms, test cars, and other uses.

Most of China’s media have followed CAAM’s recommendation to stop publishing weekly figures. CarNewsChina continues to publish weekly insurance registrations, based on China EV DataTracker data.

The numbers are rounded and present the brand’s new energy vehicle (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

Week 31 of 2025 (W31) was between July 28 and August 3.

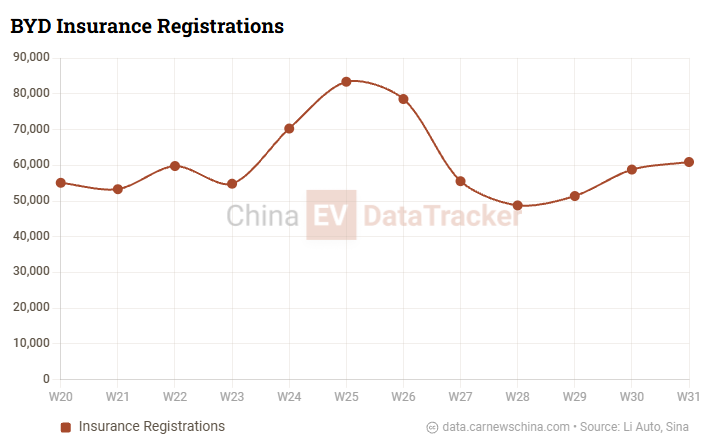

BYD registered 60,930 vehicles, up 3.6% from 58,810 the previous week. Year-on-year, this marks a 24.0% decline from 80,200.

Fang Cheng Baoregistered 3,430 vehicles, up 9.6% from 3,130 the previous week.

Breakdown to models:

- Ti3: 1,960

- Bao 5: 1,120

- Bao 8: 350

Denza registered 2,350 vehicles, up 2.6% from 2,290 the previous week and up 11.9% from 2,100 a year ago.

Breakdown to models:

- D9: 1,620

- N9: 410

- Z9: 290

Yangwang registered 60 units, including 50 units of the U7 sedan and the U8 hardcore SUV.

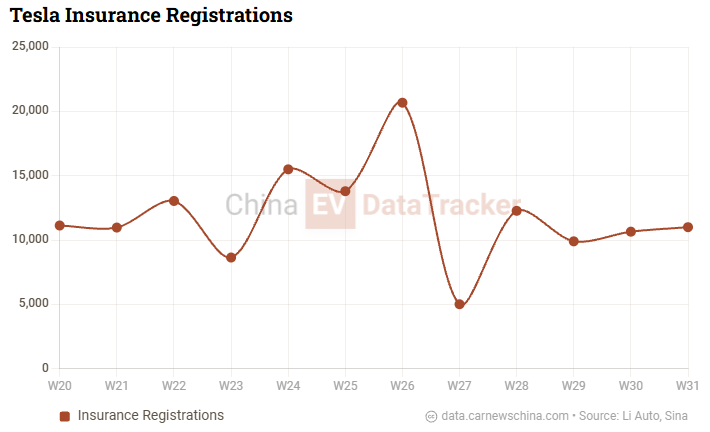

Tesla registered 11,000 vehicles, up 3.3% from 10,650 the previous week. Compared to the same week last year, registrations dropped 12.0% from 12,500 units.

Breakdown to models:

- Model Y SUV: 8,900 units

- Model 3 sedan: 2,100 units

Stellantis-backed Leapmotor registered 10,181 vehicles, rising 17.0% from 8,700 the previous week and up 75.5% from 5,800 last year.

Huawei’s Aito registered 9,610 vehicles, down 8.5% from 10,500 the previous week. Year-on-year, this represents a 4.5% increase from 9,200.

Volkswagen-backed Xpeng registered 9,071 vehicles, up 8.0% from 8,400 the previous week. That’s a 312.3% surge from 2,200 a year ago.

Xiaomi registered 7,577 vehicles, up 1.0% from 7,500 the week before. Year-on-year, it nearly doubled, up 99.4% from 3,800.

Breakdown to models:

- SU7 sedan: 5,270

- YU7 SUV: 2,300

Li Auto registered 5,476 vehicles, down 26.0% from 7,400 the previous week. Compared to last year, it dropped 53.6% from 11,800.

Deepal registered 3,947 vehicles, down 8.2% from 4,300 the previous week and up 46.2% from 2,700 last year.

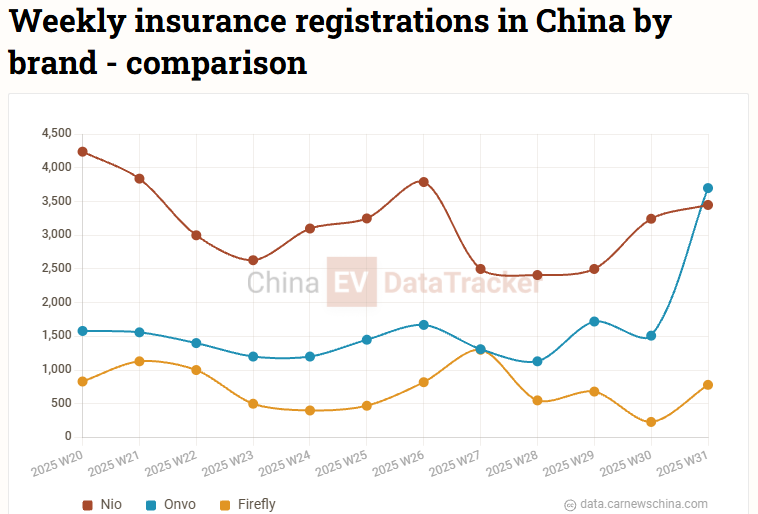

Onvo registered 3,700 vehicles, a sharp 145.0% rise from 1,510 the previous week.

Nio registered 3,450 vehicles, up 6.3% from 3,245 the previous week but down 40.5% from 5,800 a year ago.

Firefly registered 780 vehicles, up 239.1% from 230 the previous week.

Geely’s Zeekr registered 2,908 vehicles, down 11.9% from 3,300 the previous week and down 29.1% from 4,100 last year.

Avatr registered 1,850 vehicles, down 2.6% from 1,900 the week before.