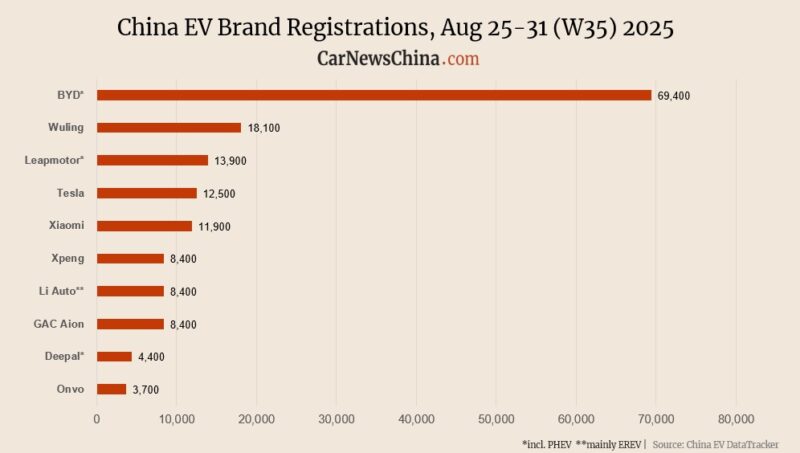

China EV registrations in week 35: Onvo 3,700, Tesla 12,500, Leapmotor 13,900, BYD 69,400

In the last week of August, EV sales in China were mostly up, with several exceptions. Tesla was up 21%, Leapmotor was up 15%, while Onvo was down 10% and BYD was down 1.7% compared with the previous week.

Nio Group registered 8,200 units, up 8.3% from the previous week.

What to watch:

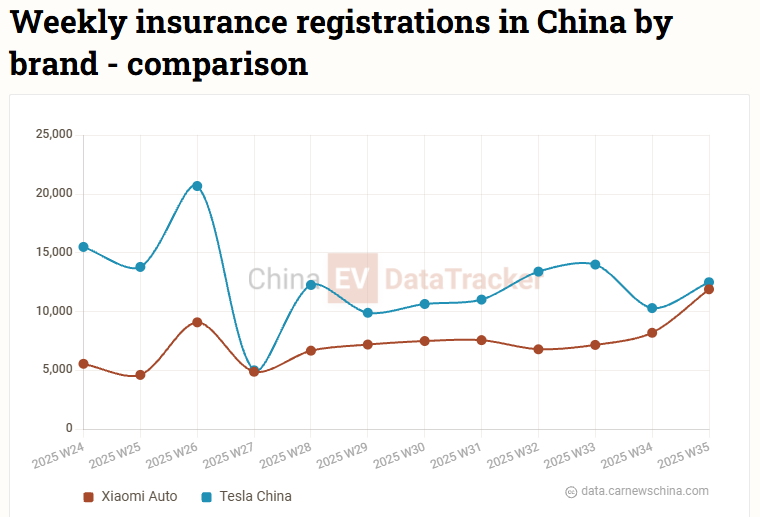

- Xiaomi broke 10k weekly milestones for the first time as YU7 production in F2 finally fully kicked in

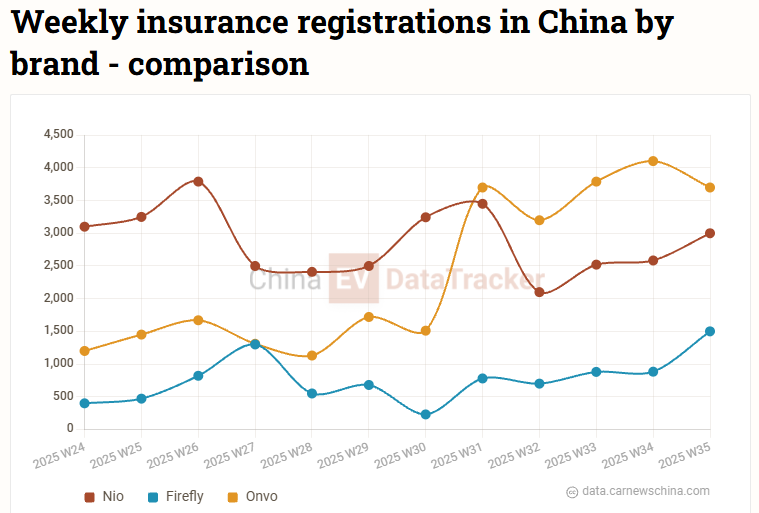

- Nio’s Firefly EV hit a record-breaking 1,500 units, up 70% from the previous week

- Nio’s Onvo fell 10% as it peaked the week before, after the L90 delivery start

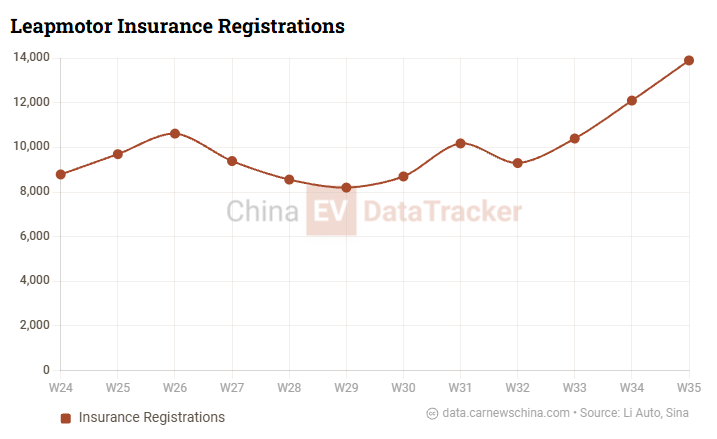

- Leapmotor reached an all-time high, with a 99% year-over-year increase, out-selling Tesla in China

- This brand is a black horse in China’s EV market. Backed by Stellantis, it has had a great year, mostly unnoticed.

The weekly brand’s EV sales were published by Li Auto. However, Li Auto ceased publishing them in March 2025 after the China Association of Automobile Manufacturers (CAAM) “recommended” that Li Auto, media and any third parties end it. CAAM says weekly data “undermines the industry order” and “fuels vicious competition.” Since then, Li Auto has published only its own weekly EV registration.

The weekly data are used by consultants, analysts, or investors to see the sales trend and forecast monthly deliveries. They show how many cars were registered for road traffic, which can be later compared with automakers’ self-reported monthly sales, which, unlike registrations, include cars for showrooms, test cars, and other uses.

Most of China’s media have followed CAAM’s recommendation to stop publishing weekly figures. CarNewsChina continues to publish weekly insurance registrations, based on China EV DataTracker data.

The numbers are rounded and present the brand’s new energy vehicle (NEV) sales in China, the government term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

Week 35 of 2025 (W35) was between August 25 and August 31.

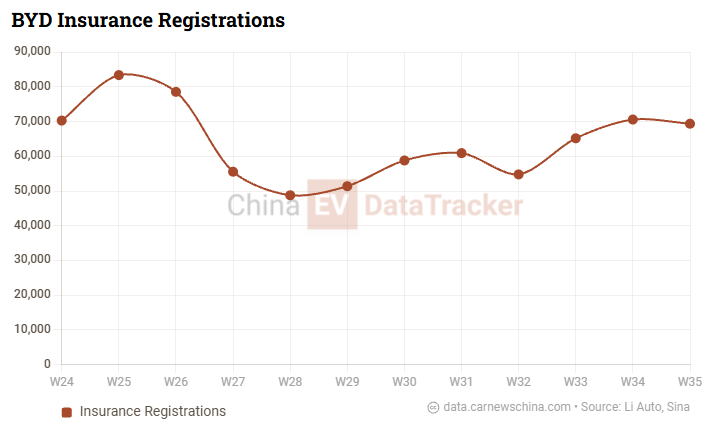

BYD brand registered 69,400 vehicles, down 1.7% from 70,600 the week before and down 21.85% from 88,800 in the same week last year.

Leapmotor registered 13,900 vehicles, up 14.9% from 12,100 the week before and up 98.57% from 7,000 in the same week last year. In the first whole four weeks of August, Leapmotor registered 45,700 vehicles.

In August, Leapmotor delivered a record 57,066 vehicles, representing an 88.3% year-over-year increase.

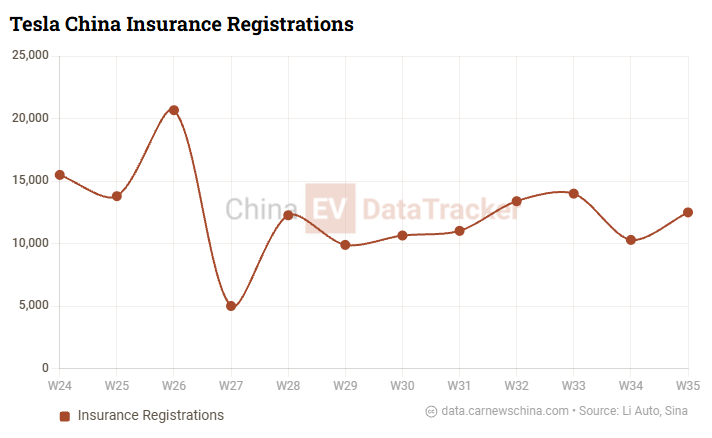

Tesla registered 12,500 vehicles, up 21.4% from 10,300 the week before but down 13.19% from 14,400 in the same week last year. In the first whole four weeks of August (4-31), Tesla registered 50,200 vehicles in China.

That suggests the Tesla sales in China will be way over 50,000 units. Tesla doesn’t share China deliveries, but they will be revealed by CPCA later this month.

Xiaomi registered 11,900 vehicles, up 45.1% from 8,200 the week before and up 310.34% from 2,900 a year earlier. In the first four weeks of August, Xiaomi registered 34,070 vehicles.

Model breakdown:

- SU7 sedan: 6,330 units

- YU7 SUV: 5,540 units

The company said that they delivered over 30,000 units in August. Thanks to EV registrations, we can estimate that it will be around 35,000 units.

Xpeng registered 8,400 vehicles, up 2.4% from 8,200 the week before and up 140.00% from 3,500 in the same week last year. In the first four weeks of August, Xpeng registered 32,400 vehicles.

Xpeng delivered 37,709 units in China, representing a 170% year-over-year increase.

Li Auto registered 8,400 vehicles, up 10.5% from 7,600 the week before but down 25.66% from 11,300 in the same week last year. In the first four weeks of August, Li Auto registered 26,900 vehicles.

GAC Aion registered 8,400 vehicles, up 44.8% from 5,800 the week before and up 15.07% from 7,300 a year earlier. In the first four weeks of August, GAC Aion registered 24,600 vehicles.

Deepal registered 4,400 vehicles, up 10.0% from 4,000 the week before and up 4.76% from 4,200 in the same week last year. In the first four weeks of August, Deepal registered 16,100 vehicles.

Onvo registered 3,700 vehicles, down 9.8% from 4,104 the week before. No year-on-year data is available. In the first four weeks of August, Onvo registered 14,794 vehicles.

Model breakdown:

- L90 large SUV: 2,150 units

- L60 SUV: 1,523 units

Nio registered 3,000 vehicles, up 16.1% from 2,584 the week before but down 50.00% from 6,000 in the same week last year. In the first four weeks of August, Nio registered 10,204 vehicles.

Nio ET9 flagship registered 40 units.

Firefly registered 1,500 vehicles, up 69.9% from 883 the week before. No year-on-year data is available. In the first four weeks of August, Firefly registered 3,963 vehicles.

Nio Group registered 8,200 units, an 8.3% increase from the previous week. In the first full weeks of August (4-31), Nio Group registered 29,061 EVs in China.

Nio Group delivered 31,305 units in August, up 55.2% from last year.

Zeekr registered 3,400 vehicles, down 5.6% from 3,600 the week before and down 26.09% from 4,600 in the same week last year. In the first four weeks of August, Zeekr registered 13,600 vehicles.