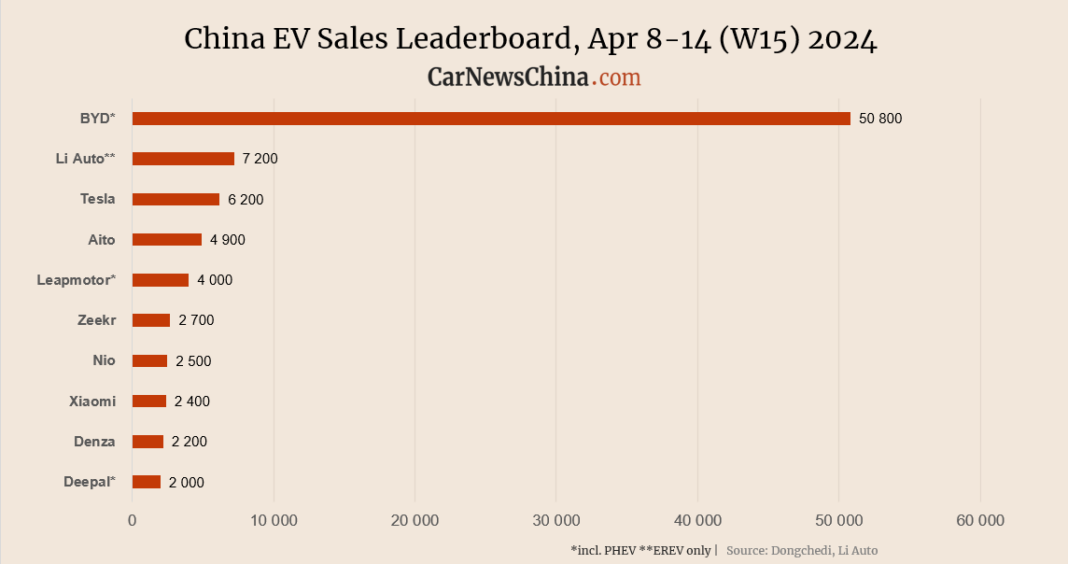

The market was mostly up in China during the 15th week of the year, April 8-14, with Zeekr being an exception. BYD registered 50,800 units, up 12%, Tesla 6,200 EVs, up 230%, Nio 2,500 EVs, up about 20% and newcomer Xioami 2,400 EVs, up about 120% from the previous week.

The weekly sales data were published by Li Auto, which recently stopped releasing the reports. Chinese outlet Dongchedi took over and started publishing the sales every Tuesday. The background data are weekly insurance registrations. The numbers are rounded and present new energy vehicles (NEV), the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

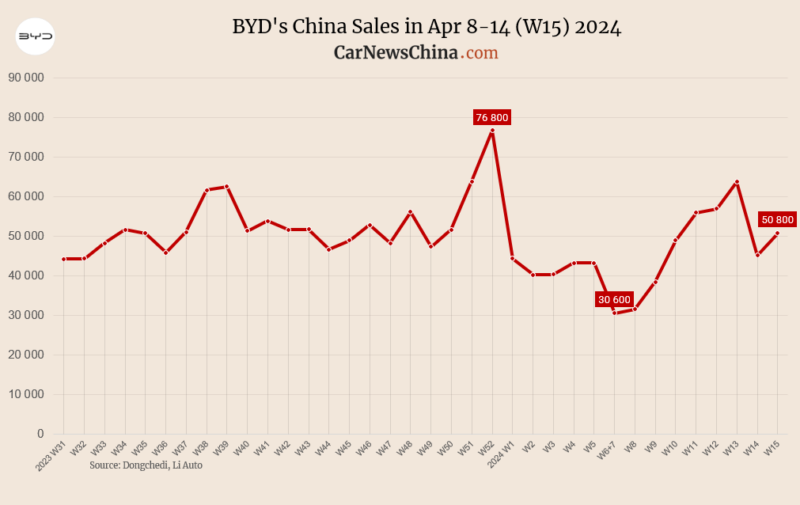

BYD got the first spot as usual, registering 50,800 units, up 12.39% from 45,200 units in the previous week. In the first half of the month, BYD sold 96,000 vehicles between April 1 and 14.

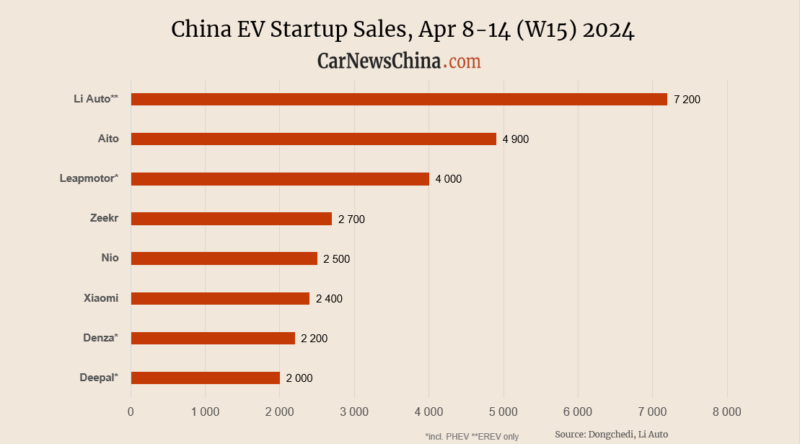

Li Auto secured the second position, with 7,200 units registered, marking a significant increase of 29.26% from 5,570 units in the previous week. Throughout the first half of the month, Li Auto managed to sell 12,770 vehicles between April 1 and 14.

Li Auto sales breakdown:

- Li L7: 3,300 units (SUV)

- Li L9: 1,600 units (SUV)

- Li L8: 1,300 units (SUV)

- Li L6: 750 units (SUV)

- Li Mega: 260 units (MPV)

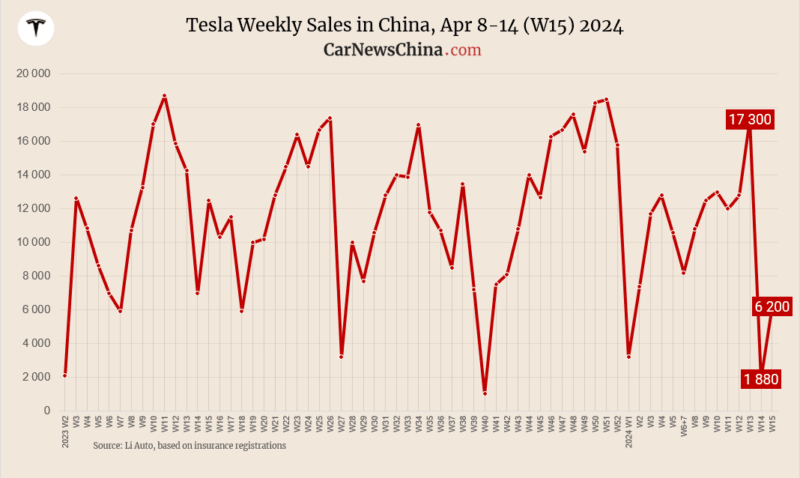

Tesla claimed the third spot with 6,200 units, showing an impressive surge of 229.79% compared to the 1,880 units in the previous week. Within the initial two weeks of April, Tesla achieved sales of 8,080 vehicles.

Tesla sales breakdown:

- Model Y: 4,600 units

- Model 3: 1,600 units

Aito stood fourth, recording 4,900 units, indicating a growth of 18.36% from 4,140 units previously. In the first half of April, Aito sold a total of 9,040 vehicles.

Stellantis-backed Leapmotor secured the fifth position, with 4,000 units registered, marking a growth of 23.84% from 3,230 units in the previous week. Between April 1 and 14, Leapmotor managed to sell 7,230 vehicles.

Zeekr saw a decrease of 16.15%, registering 2,700 units compared to 3,220 units in the previous week. In the first half of April, Zeekr sold a total of 5,920 vehicles.

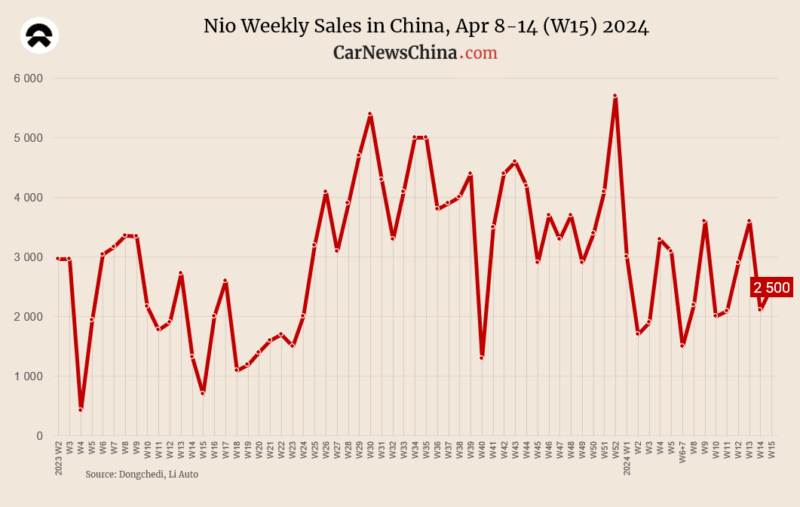

Nio recorded 2,500 units, marking a growth of 18.48% from 2,110 units previously. Nio managed to sell 4,610 vehicles between April 1 and 14.

Nio sales breakdown:

- Nio ET5/ET5T: 1,100 units (small sedan/station wagon)

- Nio ES6: 750 units (SUV)

- Nio EC6: 300 units (coupe-SUV)

- Nio ET7+ES8+EC7+ES8: 300 units

Xiaomi witnessed a remarkable increase of 122.22%, with 2,400 units of Xiaomi SU7 compared to 1,080 units in the previous week. In the first half of April, Xiaomi sold a total of 3,480 vehicles. The Beijing-based electronic giant launched its first car, Xiaomi SU7, on March 28, and deliveries of the Founders Edition (FE) started in early April. The FE is a name for about 5,000 cars assembled in the weeks before the March launch. The proper deliveries will begin in late April.

Volkswagen-backed Xpeng secured 1,600 units, showing a notable increase of 31.15% from 1,220 units in the previous week. Throughout the first half of April, Xpeng managed to sell 2,820 vehicles.

Xpeng sales breakdown:

- Xpeng G6: 430 units (small SUV)

- Xpeng G9: 400 units (large SUV)

- Xpeng X9: 390 units (MPV)

- Xpeng P7: 260 units (sedan)

Ha! And the collapse of Tesla in China is well underway. Dar, who would’ve thunk it? Here we have an American CEO who paid cold, hard cash for his own facility in China. China wouldn’t be interested in taking the facility off of the CEOs hands, now would they? Lmao! And it’s proceeding exactly as I predicted and wrote on the electek forums back in 2019. Back then I told everyone that the communists would butter Musk up because they know Musk to be a gullible fool who will do anything to make a buck, even if it means disparaging the United States to lick Jinping’s ass. And disparage the United States he did! Making fun of California COVID authorities when those authorities shut him down in Fremont, only to remain as quiet as a mouse when the Shanghai authorities shut his Shanghai factory down.

I saw all this coming a mile away.

My ongoing prediction for Tesla gigafactory Shanghai: Tesla will continue to lose Chinese market share in China as it gains market share everywhere else. Eventually, Tesla will sell so few Teslas in China that the Chinese authorities will tell Musk that his operation is no longer needed in China, and that the only thing his factory is doing is making Teslas to be exported throughout the rest of the world. Therefore, he will be ordered to shut down shop in China, and sell his factory to the CCP at a steep discount to it’s acquisition cost.

The Chinese get a state of the art factory, Teslas are no longer sold in China, and Musk gets flushed out of the country. Ca-ching!!!

Elon became the richest person in the world and was able to buy Twitter later due to the megafactory in Shanghai, China. Now it is only absolutely normal that there is a bump in the road for the growing EV industry. You cannot be on top of the mountain all the time. By the way, the Chinese government did not order Elon to sell his factory in Shanghai while a blatant TikTok plunder in broad daylight is happening right before our eyes. Shameless is spelled as s-h-a-m-e-l-e-s-s.