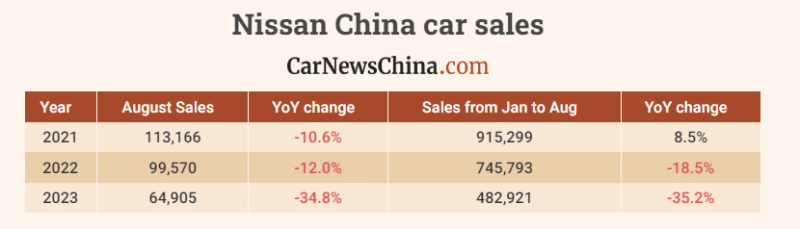

On September 7, Nissan China released its sales performance data for August 2023. Nissan China’s sales for the month reached 64,905 units, reflecting a substantial year-on-year decline of 34.8%. To put this into perspective, in August 2022, Nissan’s sales in China were recorded at 99,570 units. A year earlier, in August 2021, the numbers stood even higher at 113,166 units, marking a consecutive two-year decline.

In August 2023, Dongfeng Nissan, which encompasses the Nissan, Venucia, and Infiniti brands, sold 61,967 units. The light commercial vehicle segment under Zhengzhou Nissan contributed an additional 2,938 units.

From January to August 2023, Nissan’s sales volume in China amounted to 482,921 units. This figure shows a 35.2% year-on-year decrease compared to the same duration in 2022 when sales reached 745,793 units. Going further back to 2021, Nissan’s Chinese sales during the same period stood at 915,299 units, indicating a significant downward trajectory for two successive years.

Speech by the Chairman of the Nissan China Management Committee

Mr. Shohei Yamazaki, Senior Vice President of Nissan Motor Corporation, Chairman of the Nissan China Management Committee, and President of Dongfeng Motor Co., Ltd., addressed the challenges Nissan faces in the ever-evolving Chinese market. He emphasized the need to ensure sustainable business development and hasten the introduction of new products.

“With the launch of the Nissan ARIYA 500 and Venucia DD-i super hybrid models in July this year and the launch of the all-new third-generation Nissan Qashqai in August, Nissan’ss presence in China has been further enriched,” Mr. Yamazaki stated. The Nissan Qashqai, over the past 15 years, has garnered numerous accolades and has witnessed cumulative sales exceeding 1.7 million units in the Chinese market.

Nissan is lagging in EV adoption

One of the significant contributors to Nissan’s recent challenges has been the rise of domestically produced electric vehicle (EV) models in China. Nissan’s transition to EVs has been relatively sluggish. Presently, Nissan China offers only one EV, the ARIYA, which achieved cumulative sales of 1,469 units from January to July this year. In stark contrast, pure electric vehicles constitute approximately 25% of new car sales in the Chinese market. Yet, EVs account for a mere 0.3% of Nissan’s recent car sales in China, signifying a considerable gap.

Nissan’s early success in China was anchored in its competitive pricing and fuel efficiency. However, the landscape has evolved, with EV prices consistently decreasing in the Chinese market, eroding Nissan’s economic advantage.

Nissan’s experience in China isn’t unique. Other Japanese automakers like Honda have also faced challenges. Honda, for instance, reported sales of 610,000 vehicles in China from January to July 2023. This figure marks a nearly 25% year-on-year decline compared to the same period in 2022, when sales amounted to 800,000 units.

The impact of the evolving Chinese EV market on traditional automakers is becoming increasingly evident, necessitating swift adaptation and innovation to regain a competitive edge.

Source: Nissan China; iTHome