The Big Read – FAW (5/5) – Tianjin taxi’s and Toyota

Last week we learned about FAW’s self-owned Bestune brand, which holds close relations to Mazda. FAW enjoys another long lasting relationship with a different Japanese company, Toyota. This relationship finds its origin in Tianjin’s car industry, which comprised of the rather famous Xiali and Huali brands.

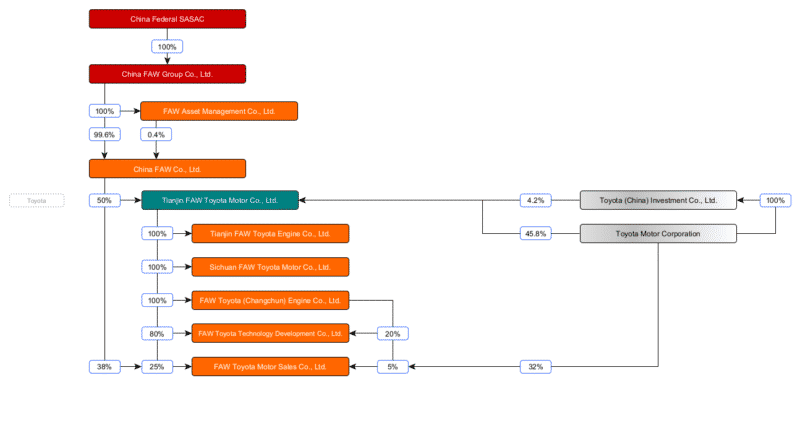

To clarify where we are, today we’re looking at this part of the FAW conglomerate:

Rise of the Tianjin automobile industry

Tianjin is a large port city immediately east of Beijing. With the port comes a large petrochemical and manufacturing industry, but remarkably enough, car production did not occupy a very important place for a long time. And although the Tianjin car industry may not be a large in size, it starts quite early. In the early 1950s there were a few small factories under control of the military, that assembled Ford Jeeps captured from the Kuomintang or made vans based on Daihatsu three-wheelers, which date back to the time of the Japanese occupation during the Second World War. However, these factories never produced large numbers of cars.

Nonetheless, in 1965 the city government establishes Tianjin Automobile Manufacturing Plant. This factory is the result of a deal with Beijing Automobile Works. BAW has just presented the BJ212 off-roader and the production line of the outgoing model, the BJ210, becomes available for the new Tianjin factory. Tianjin Auto makes this off-roader, now called TJ210 until 1978 almost exclusively for the military. Between 1973 and 1978 the company also assembles the TJ740, a mid-size sedan resembling a Toyota Crown. Only 63 copies are made, so it’s hardly series production. From 1978, Tianjin Auto assembles the TJ130, a copy of the Beijing BJ130 light truck.

In the early 1980s, the economic changes of the post-Mao era start to take effect. One of the first economic and technological development zones is located in Tianjin. This is an industrial area designated by the federal government for experiments with capitalist principles and free trade. The city government of Tianjin seizes this opportunity to revive their auto industry. They establish Tianjin Automobile Industry Group and merge all workshops, factories (including the mentioned Tianjin Auto) and suppliers into it.

Next course of action is finding a suitable car to be made. Like many Chinese companies, Tianjin looks to the east and finds Daihatsu from Japan. After some trial runs with knockdown kits of the 2nd generation Charade, Tianjin Industry and Daihatsu sign a technical partnership in 1986 that allows the Chinese to build two models under license: the Charade hatchback and the Hijet minibus.

The Hijet first appears on the market as Tianjin Huali. That is in 1987, a year later the Charade (this time the 3rd generation hatchback model) follows as Tianjin Xiali. The cars soon flood the streets of the cities Tianjin and Beijing, because they prove to be very popular as taxis. Its popularity spreads almost all over the country and, after adding the Charade sedan model, Tianjin even is the best-selling Chinese car brand for some time. And with that the brand gains its admirers. For example, the very first Geely is little more than a slightly modified Xiali with a Mercedes grille.

The Xiali and Huali models remain large unchanged for over eight years, but then Tianjin Industry needs to raise some money for a modified version and retooling of the factory. So in 1996 one of its subsidiaries, the Tianjin Mini Vehicle Factory (which produced the Daihatsu tricycles in the 1950s and assembled Xiali’s in the 1990s) is renamed Tianjin Xiali Automobile Co., Ltd. and listed it on the Shenzhen Stock Exchange. Tianjin Industry itself keeps about 85% of the shares. Tianjin Automobile, which assembled the minivans, is renamed as well to Tianjin Huali Automobile Co., Ltd. and becomes a wholly owned subsidiary of Tianjin Xiali. Xiali and Huali now become brand names. In the following year the company presents the updated Xiali models and even add self-developed long-wheelbase versions of both the hatchback and sedan.

Toyota and China

Depending on your point of view, you can call Toyota a very early or a very entrant to the Chinese market. Already during the Japansese occupation in 1930s and 1940s Toyota had at least two (and maybe more) assembly plants on Chinese soil. They produced mainly light trucks and off-roaders to support the Japanese army. After Japan’s surrender these factories were of course nationalized by the new rulers.

Thereafter is long period of limited involvement with the Chinese market. Of course there is some export, but Toyota’s main interest lies with Jinbei Automobile. That company produces minivans based on the Hiace models. Jinbei and Toyota had a technical cooperation agreement, but at the same time many small Chinese outfits made reverse engineered copies of the same car. Toyota once contemplated a full joint venture with Jinbei, but was blocked by FAW, at the time Jinbei’s owner.

So Toyota’s first car production in China in five decades is a small scale operation in Sichuan province. Chengdu Jincheng Auto Repair Factory is established in 1958 and serves as workshop for car maintenance of government owned vehicles. In the late 1970s the garage also starts assembling its own vehicle, a station wagon based on a light truck chassis. In 1984 the company gets rid of the repair business and specializes in car manufacturing. The company is renamed to Chengdu Bus Manufacturing Plant and has a capacity of 1500 vans per year. A few years later Chengdu Bus acquires the Chengdu 2nd Bus Manufacturing Plant and both continue under the new name Sichuan Bus Manufacturing Company. After a few good years sales decline in the early nineties. Sichuan Bus then targets Toyota and after long negotiations, in November 1998 the company merges into a joint venture between Sichuan province and Toyota. New name: Sichuan Toyota Motor Co., Ltd. New product: Toyota Coaster buses.

By then Toyota has also built up an appetite for localized passenger car production in China, but faces an immediate obstruction. As many of the global car manufacturers entered the Chinese market in the 1990s, the central government is getting worried about overcapacity and no longer approves new joint ventures. Toyota takes this setback as an opportunity and makes a long-term plan. In Japan they acquire a majority interest in Daihatsu and then they start sending subsidiaries in the components industry over to China, to set up production facilities. So when Toyota finally sign a joint venture agreement with Tianjin Auto Industry in June 2006, the entire supply chain is already up and running. Just build the vehicle assembly plant and off we go.

Construction of the factory begins, but the Chinese government adds one final twist to the story.. They consider Tianjin Auto to small and too underfinanced to be credible partner for an international corporate giant as Toyota. So the government forces a merger of Tianjin Auto with FAW, which is of course owned and controlled by the federal government. I say merger, in reality it’s closer to a take-over of Tianjin Auto by FAW. Toyota has no objections. They gain a much stronger partner and direct access to the government.

The final transactions take place in 2002 and the deal eventually creates three re-organized companies.

- Tianjin FAW Toyota Motor Co., Ltd. (share ratio: 40% Toyota, 30% FAW Xiali, 20% FAW, 10% Toyota China). This is the main joint venture for Toyota vehicles. The first products are the Vios (Yaris) and Corolla.

- Tianjin FAW Xiali Automobile Co., Ltd. (share ratio: 51% FAW, 34% Tianjin Industry, 15% publicly traded). The former Tianjin Xiali, now majority owned by FAW. The company continues making the Charade-based models, but also gets access to the Toyota Vios/Yaris platform.

- FAW Huali Automobile Co., Ltd. (75% FAW, 25% Toyota). The former Tianjin Huali. The company discontinues the Hijet derivatives and replace them with two other models from Daihatsu, the Grand Move and Terios, under the local names Happy Messenger and Dario.

The tragic end of Huali and Xiali

Huali does not survive long as an independent brand due to poor sales. In 2006 the brand name is dropped and production of the factory switches to Xiali models. In 2008 Toyota sells its shares in the company to FAW. The Happy Messenger however remains in production for several years with FAW Hongta Yunnan, a light commercial vehicle plant. The car is sold through FAW Jilin’s sales channel under the FAW Jiaxing brand name. The fate of the Dario is obscure. Most likely the production line is sold to Tieniu Group, who uses it for its new brand Zotye. The Zotye 2008 (Nomad) is after all a Terios copy. Some sources however claim that Zotye obtained the tooling indirectly from Daihatsu, through a Taiwan middle man. Neither story has been confirmed.

Until 2018 Huali carries on as assembly plant for Xiali, but then it’s used as small change for a new FAW investment. FAW becomes one of the strategic investors in a startup called Future Mobility, better known under its brand name Byton. This startup develops electric cars, but does not have a production license. FAW’s contribution is transferring Huali to Byton, its only and most important asset is of course the production permit. However, Byton runs into financial difficulties in 2020 and at the latest news this year seems to suggest the company has filed for bankruptcy proceedings with the Chinese courts.

Unfortunately, for Xiali, the story is remarkably similar. The brand is experiencing a small revival with the arrival of FAW capital and Toyota technology. The models based on the Vios/Yaris are reasonably successful and there remains a market for the old, super-cheap Charade-based Xiali’s as well. The Xiali name has become synonymous with the lower end of the market. In 2014 Xiali introduces a second brand name, Junpai, which is positioned slightly higher in the market. The brand makes derivatives of Besturn models and compact sedans based on Volkswagen technology. Neither Xiali nor Junpai prevent FAW Xiali from becoming a loss-making company.

To offset these losses, FAW Xiali sells its stake in the Toyota joint venture to parent company FAW, 15% in 2016 and the remaining 15% in 2018. FAW and Tianjin Industry also issue more shares to the stock market, dropping their joint interest from 85% to approximately 65%. It’s not enough and at the end of 2019, FAW Xiali ceases production of all Xiali and Junpai models.

There is final attempt to rescue the company. Late 2019 FAW Xiali enters into a joint venture with Bordrin, a little-known new energy startup. While FAW Xiali contributes almost all of its assets (factory, tooling and equipment, land-use rights and most important: production permit), it ends up with a 20% share, while Bordrin owns 80% of Tianjin Bordrin Technology. In December 2019, all remaining assets of FAW Xiali are transferred to FAW and the empty shell company is offloaded to a railway company.

Formally, Xiali still lives on in the joint venture with Bordrin. As it turns out, Bordrin is a cash-strapped company as well. Even with a fully functional factory at their disposal, Xiali production never restarts. Then, in mid-2020, not helped by the Covid pandemic, Bordrin runs out of money and eventually goes bankrupt, taking Xiali down with it. It’s the sad end of an once iconic brand.

Rise of the Tianjin automobile industry, revisited

The doom and gloom of the last section notwithstanding, the city of Tianjin today has a thriving car industry. And that’s all thanks to Toyota. After the late start, Toyota enjoys a rapid growth in China that still continues today. We’ve already seen that Toyota brought its entire supply chain to the Tianjin region and after the first factory was completed, two more followed in quick succession. So it may not be how the city authorities envisaged it decades ago, but Tianjin is now firmly on China’s car industry map.

Toyota quickly expands its product portfolio. The Prius, Reiz, Crown and RAV4 are all added to the FAW Toyota lineup, later followed by the Izoa and Avalon. Still, it’s not sufficient for the Japanese and they seek other ways to increase sales and production. To make room for a new joint venture with Guangzhou Automobile, first Toyota’s bus joint venture has to be restructured. FAW acquires all shares in the Sichuan Bus Company, so now FAW Toyota and Sichuan FAW Toyota count as a single joint venture. Besides the buses, Sichuan FAW Toyota also produces various models of the Land Cruiser range.

After the turmoil surrounding Huali and Xiali, the cooperation between FAW and Toyota undergoes a major overhaul. Tianjin FAW Toyota, now a 50/50 joint venture between both parties, becomes the holding company of all joint activities, including the passenger car and bus production, sales organizations, R&D, engine factories and other supply chain companies. In this way, a huge auto-manufacturing giant eventually rises in the city of Tianjin.

Final words

During the reforms of the Chinese economy, which started in the 1980s, FAW mainly strengthens its truck production. FAW Jiefang grows to become the most important and largest manufacturer of medium and heavy commercial vehicles in China.

In the field of passenger cars, FAW is initially growing mainly through the acquisition of smaller, local factories. Second, the joint ventures with Mazda, Volkswagen and Toyota follow. And finally, FAW focuses on developing its own technology under its own management with Hongqi and Bestune. During the third phase FAW also divests from many of the acquired manufacturers of the first phase.

In the new energy field FAW is obviously not at the leading, but tying its developments to the rejuvenation of Hongqi, made them a credible actor in the upper echelon of the market. Hongqi has conquered a space between the NIO’s and Xpengs. And who knows, perhaps the Byton M-Byte re-appears as a Hongqi model. FAW does miss out on the lower end of the market, where Wuling and BYD rule the waves. Maybe FAW has its eyes on the Volkswagen MEB-platform? FAW has very strong and stable partners with Volkswagen and Toyota and the development of the premium brand Hongqi is progressing spectacularly. The remaining step seems to be increasing the appeal of the Bestune models and gain a substantial foothold in the mainstream market as well.

Read more Automakers Stories

Every week we publish one exiting article about history of famous Chinese Automakers. Check the ones you haven’t read yet.