The Big Read – Dongfeng (4/6) – The many roads that lead to Dongfeng-Nissan

Nissan is the most important foreign partner of Dongfeng. Both companies are so much intertwined that it’s hard to see who is who in the story. And there are many twists and turns, which makes the story difficult to tell. I could do it chronologically, but many storylines cross each other all the time. I could do by entity, but ownership and responsibilities keep changing. I could do it by brand, but some entities produce several brands and some brands are made by different entities. So this is my best possible attempt. You better stay focused.

Zhengzhou Light Vehicle Factory

As a remnant of the old regime, the National Army’s 12th Auto Repair Factory in Zhengzhou (Henan province) merges with Kaifeng Auto Repair Factory in 1949 to become Zhongyuan Highway Bureau Auto Repair Factory. This factory makes auto parts. What’s the relevance, you might ask. Well, this is the predecessor of Nissan’s first joint venture partner in China. But before we come to that, there’s quite a long way to go.

Zhongyuan develops its own light trick in the sixties and when production commences in 1969, the company changes its name to Zhengzhou Automobile Manufacturing Plant, we’ll call it Zhengqi for short. The Zhengzhou 130 truck is a flawed product. It has several design faults, structural defects and below-standard performance. But because Zhengqi is the only credible vehicle maker in Henan, it survives on the low sales for a few years.

In the early seventies Beijing Second Automobile Works develops a 2-ton truck, ‘benchmarked against’ the Toyota Dyna. This becomes of course the ever-present Beijing BJ130. The project is set up from the beginning as a ‘National Truck’. No less than 47 parts and light truck companies participate in the BJ130 ‘experience meeting’, organized by the Ministry of Machinery, and all go home with a full set of drawings. Zhengqi is one of them. In 1975 they replace their own truck with the BJ130 design. And this is an instant success, by 1979 production reaches almost 1,500 trucks per year.

In the early eighties the planned economy is abolished, entrepreneurship encouraged, and the BJ130 being pretty much “open source”, competitors to Zhengqi spring up everywhere in the country. By the dozens even, many of them producing below Zhengqi’s cost. So the company becomes loss-making and has to let go half of 4,000 employees. Therefore Zhengqi joins Dongfeng Motor Industry Association in 1983 and start producing EQ140 trucks and EQ643 buses. The financial problems vanish.

In 1985 Zhengqi and Dongfeng jointly develop a heavier, 3-ton truck, the EQ1060. It sells well and raises Zhengqi’s profile. For strategic reasons the company decides to pursue a joint venture with its partner. Which is in line with Dongfeng’s corporate strategy at the time, so in late 1987 Zhengqi becomes a joint venture between Dongfeng and Zhengzhou authorities. For the occasion, the enterprise name changes to Zhengzhou Light Vehicle Factory.

And then history repeats itself. The EQ1060 is produced throughout the Dongfeng conglomerate, components are easily available and Zhengqi faces another decline. Without funds to conduct its own R&D, the company sees only one way out: acquire it from a foreign party. And that’s where Nissan enters the picture. Nissan itself is also facing financial headwinds, so the joint venture between the two is built on a lot of borrowed money. In March 1993, Zhengzhou Nissan is established with the following shareholding: Zhengqi 35%, ICBC Bank 25%, CITIC 10%, Sanyou Machinery Manufacturing 25%, Nissan 5%. CITIC is a Chinese state-owned investment fund and Sanyou is Thailand-based associated company of Nissan.

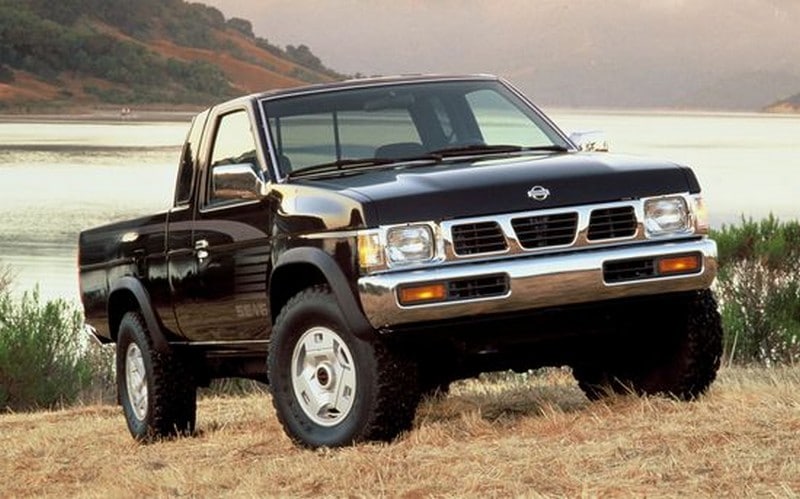

In pushing through the joint venture Zhengqi has taken some procedural shortcuts. Henan province issues all licenses in due time, but the state ministries are not amused by the lack of bureaucratic compliance. They threaten with liquidation of the joint venture, after the ICBC-investment is deemed illegal (which forces CITIC to take over the shares) and only issue the relevant permits in 1996. Zhengqi’s capital investment is financed through a loan from CITIC, with the parent company as collateral. The joint venture starts assembling the Nissan D21 pickup.

With Nissan’s very small participation, the Japanese don’t feel obliged to actively inject new technology or car models into the joint venture. It takes years of pressure from CITIC, and Nissan being rescued by Renault, before the Japanese buy out their Thai partner in 2001. Just before that in late 1999 the D22 Navarra pickup was added, but more important is the arrival of the Palladin SUV on the same chassis in 2003. That’s also the year of the Dongfeng-Nissan joint venture. We’ll return to Zhengzhou Nissan later on.

Yue Loong Automobile Factory

Yan Qingling is born in Shanghai in 1908, studies in Berlin and returns to his country to work in his father’s machinery factory during the 1930s. In 1948 he moves to Taiwan. Following in his father’s footsteps, he becomes an entrepreneur and a prominent figure in the mechanization effort of the country. In 1951 he starts the Taiyuan Textile Company and two years later the Yue Loong Machinery Factory. Yue Loong initially makes engines and parts, but soon turns its attention to cars. In 1956 it trial produces some Willys jeeps.

In 1957 Yue Loong starts a long-lasting relationship with Nissan, securing the marketing rights of the brand in Taiwan. Under stringent protection laws Yue Loong can quickly gain market share and becomes a car producer in 1960, when the Datsun Bluebird is assembled from CKD-kits. The company is renamed Yue Loong Motor Company. For many years the company manufacturers Nissan cars under license and sells them under the Yue Loong brand.

In 1969 Yan Qingling starts another car manufacturer, China Motor Corporation, for the production of light commercial vehicles. China Motor does the same kind of deal with Mitsubishi Motors as Yue Loong has with Nissan. In 1976 Yue Loong is listed on the Taiwan stock exchange, which brings me to the corporate structure. There is no parent holding to these companies, but they are all tied together by cross shareholdings in each other and by the Yan family. A bit like a Japanese keiretsu. In 1981 Yan Qingling dies and his wife Wu Shunwen takes over. She stays in charge of Yue Loong until 2007 when their only son, Yan Kaitai takes the reign.

In 1992 Yue Loong streamlines its corporate identity and becomes Yulon. Two years later Yulon starts a gradual rebranding of its products. Instead of marketing the cars as Yulon, the company begins to use the Nissan brand. In this manner Yulon provides an opening for self-developed and self-branded cars, but these a still a few years away. First we reach the year 2003 again. Yulon splits itself in two companies. Yulon Motor will take care of manufacturing and R&D, while the newly established Yulon Nissan Motor will be responsible for marketing and sales. Yulon Nissan is joint venture with a 40% interest for the Japanese manufacturer.

The significance of telling the early part of the Yulon story becomes apparent in the next chapter.

Guangzhou Jingan Yunbao Automobile Co., Ltd. and Fengshen Automobile Co., Ltd.

When China conceived the joint venture policy in the eighties, it also put high tariffs on imported cars and car parts (up to 80%) and put very strict rules on production from CKD-kits. All for the good of their own industry. In the early nineties, Guangdong province tried to strengthen its own car industry by circumventing these rules. It did away with CKD-rules and high tariffs on parts. It led to crazy shenanigans, all very well explained in a number of articles on ChinaCarHistory.

Guangdong’s leniency was condoned for a while by the central government and allowed ambitions entrepreneurs to buy a batch of cars in the Hong Kong market, take off some parts (like wheels or mirrors) and ship the cars and parts separately to Guangdong. There the parts were reattached to the car and the vehicle sold at much lower prices than the same cars from import or joint venture production.

Jingan Yunbao was one of the companies taking part in this practice. Details on the company are shrouded in mystery, but it seems it was established in 1992 by An Yunbao with financial support of the Jingan Import & Export Company. There are two differences between Yunbao and many other new car companies in Guangdong. Yunbao actually invests in a plant and assembly line and it doesn’t rely on shady trade of car batches, but gets its kits directly from a manufacturer. In this case: Yulon. The Taiwanese company supplies the Cedric sedan, several version of the Patrol off-roader and the Vanette van. From 1998 on Yulon also provides the Bluebird. All these license produced Nissan models are sold as Yunbao vehicles.

Meanwhile, Dongfeng from the mountains of central China, tries to set up a southern branch. There are attempts in Huizhou (where it assembled a few Citroen Xantia and XM models in the mid-90s) and Shenzhen, before the company set up shop in Guangzhou. First it’s mainly a real estate project, but of course it wants to produce cars as well. When Yunbao introduces the Bluebird, it’s exactly the kind of car the Dongfeng executives have in mind. Great market potential and from a manufacturer that might be interested in cooperation. So Dongfeng devices a strategy to lure Nissan in.

The first step is to set up a company named Fengshen Automobile in early 2000. It’s a jont venture between Dongfeng (45%), Yunbao (30%) and Yulon (25%). Fengshen takes the Yunbao Bluebird and starts upgrading it. It also installs a production line in one of the Xiangyang factories.

Meanwhile the central government finally began restricting Guangdong’s policies, when lots of companies started to complain about unfair competition. It started with investigations into smuggling and ended with bringing Guuangdong in line with the rest of the country at the turn of the century. Over were the wild-west car manufacturing practices. An Yunbao got investigated for tax fraud and fled the country, leaving Yunbao Automobile in huge debt.

For Dongfeng this was a potential financial problem, Yunbao being a partner in Fengshen, but created an opportunity at the same time. Dongfeng started buying out Yunbao creditors, until it was the largest creditor itself and then filed for bankruptcy of the company. It struck a deal with the remaining creditors, had Yunbao declared insolvent and swept up all the assets in an auction. With Yunbao gone, all assets were injected into a new company Guangzhou Fengshen, that became the parent of Fengshen and Yiangyang Fengshen. Over in Taiwan, when Yulon Motor split itself, the shareholding in Fengshen became part of Yulon Nissan.

Dongfeng Motor Co., Ltd.

So finally we have all the building blocks in place for the Dongfeng Nissan joint venture. Negotiations took place in 2000 and Nissan proposed a joint venture with Fengshen Automobile. This was what Dongfeng had been aiming for, but it didn’t please the authorities. They wanted a larger Nissan involvement, also including commercial vehicles, and withheld a permit. So the talks continued, but when Nissan savior Carlos Ghosn visited Dongfeng in late 2001, it was clear a deal was close. Contracts were signed in 2002 and in May 2003 the joint venture was officially founded under the name Dongfeng Motor Co., Ltd (DFL).

Nissan’s 50% part of the deal came in cash, Dongfeng contributed in real estate and manufacturing infrastructure. Dongfeng merged three big companies and some smaller ones into the joint venture. Of course Fengshen Automobile, including Guangzhou Fengshen and Xiangyang Fengshen were part of the deal. In 1999 Dongfeng had incorporated a number of Xiangyang facilities (for commercial vehicles) as Dongfeng Automobile (DFAC) and this was the second asset of DFL. The small factory in Huizhou was added too.

The third large entry took a little more time. This was of course Zhengzhou Nissan, the joint venture between Zhengzhou Light Truck, CITIC and Nissan. Since Dongfeng held no direct interest, DFAC acquired the shares from Zhengzhou Light Truck and CITIC and so the factory became a joint venture (between DFAC and Nissan) inside the larger joint venture DFL. Dongfeng was part owner of Zhengzhou Light Truck, but since that company had no product left to make after losing Zhengzhou Nissan, the factory was sold to Haima Automobile in 2006. Zhengzhou Nissan became directly owned by DFL in 2017, when DFAC and Nissan transferred all their shares.

Next week

Now Dongfeng Nissan is up and running, we will look at the wide variety of products the joint venture puts on the road. And we will greet the (temporary) return of Yulon.

Read more Automakers Stories

Every week we publish one exiting article about history of famous Chinese Automakers. Check the ones you haven’t read yet.