Chinese EV makers threatened by an aluminum shortage

China’s new energy vehicles are in trouble again. Aluminum foil production capacity is bottlenecked.

Previously, we reported that due to the Malaysian epidemic, Chinese new energy vehicle manufacturers are short of chips, and the black market prices of semiconductors have been rising all the way.

Unfortunately, the chip problem has not been effectively resolved, and new issues are coming to plague China’s new energy vehicle manufacturers!

That is, China’s aluminum foil industry is in short supply.

On September 17, Gao Jingzhong, general manager of North China Aluminum Co., Ltd., stated at the China Automotive New Material Application Summit that the partner company requested them make 3,000 tons of aluminum foil a month. However, they had problems with insufficient production capacity and were unable to keep up with the supply.

On September 23, Huang Wei, secretary of the board of directors of Shantou Wanshun New Material Group Co., Ltd., said in an interview with a Chinese reporter: “The company has an existing production capacity of 83,000 tons of aluminum foil and is currently in full production.”

The imbalance between supply and demand in China’s aluminum foil industry is that the development of new energy vehicles is the main driving force for the explosive growth of the need for power battery-grade aluminum foil.

The enormous demand for new energy vehicles is power batteries, and Battery aluminum foil is used as a current collector for lithium-ion batteries. Under normal circumstances, the lithium-ion battery industry uses rolled aluminum foil as the positive electrode current collector. The thickness of rolled aluminum foil varies from 10 to 50 microns.

Furthermore, the batteries used in new energy vehicles are essentially the same as the AA batteries used in households, and both have positive and negative electrodes.

Lithium batteries used in new energy vehicles usually have cylindrical and square shapes. The positive electrode includes a current collector composed of lithium cobalt oxide (or lithium nickel cobalt manganate, lithium manganate, lithium iron phosphate, etc.) and aluminum foil. The negative electrode is formed of a current collector composed of graphitized carbon material and copper foil.

The battery is filled with the organic electrolyte solution. It is also equipped with a safety valve and PTC components (used by some cylindrical lithium batteries) to protect the battery from damage in abnormal conditions and output short circuits.

These parts are indispensable. If the price of a specific part of the raw materials increases, the cost of power batteries will increase, and new energy vehicles will also increase.

What makes new energy automobile manufacturers sad is that aluminum foil has begun to increase in price, which is very large!

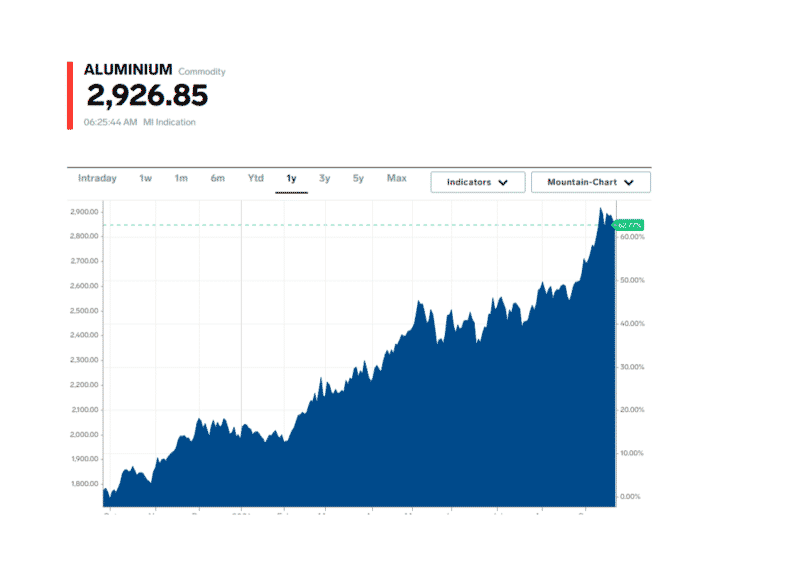

According to data from the London Metal Exchange on September 13, the price of aluminum once touched US$3,000 per ton, the highest level since July 2008. On the same day, the cost of aluminum on the Shanghai Stock Exchange reached 23,895 yuan per ton, the highest price in 15 years, only one step away from the highest point in history (24,990 yuan/ton).

According to ICCSSINO data, in August 2021, battery-grade 16um aluminum foil was quoted at 28,000 yuan/ton, and battery-grade 12um double-sided aluminum foil was quoted at 32,000 yuan/ton. Year-on-year growth of 27% and 23%.

Chinese suppliers shortage sum up

Why China’s aluminum foil production capacity is tight, CarNewsChina sorted out the following reasons based on public information:

1. Small and medium-sized aluminum processing enterprises cannot withstand the test of market fluctuations and withdraw from the market, so the production capacity of aluminum foil is limited;

2. To complete the carbon neutrality task, the Chinese government has imposed restrictions on high energy consumption manufacturing enterprises, such as restricting the output of metal aluminum;

3. Chinese aluminum foil companies are under-prepared. They did not expect that there would be such a tremendous demand for aluminum foil, and it would take time to expand production capacity.

According to estimates by ZhongTai Securities, in 2025, the overall demand for battery aluminum foil may reach about 378,000 tons, with a compound growth rate of 32% from 2021 to 2025.

Not just chips. Malaysia increase also aluminium shortage

Moreover, the aluminum supply from Malaysia is also disrupted due to Covid-related lockdowns. Digitimes Asia reported that suppliers Chemi-Con and Nichicon had to close their facilities in Malaysia because of Covid lockdowns in July and August. Even after ending the lockdowns, they’ve reportedly only returned to around 60 percent of their workforce, which has forced them to cap their manufacturing capacity.

Chemi-Con and Nichicon have a significant portion of the global aluminum capacitor market share. According to DTA, shipments of aluminum capacitors from Malaysia could decrease 30 and 60 percent, and lead time can increase over six months.

It is undeniable that due to the extended production expansion time of the aluminum foil industry, the development of the new energy vehicle market, and the growth of energy storage demand, the aluminum foil industry has had a supply gap in recent years. And the supply gap will further increase.

Source: 21Jingi

No related articles available.