Due to a decline in demand and a slow stabilization of the domestic fuel vehicle market, the Chinese car market’s inventory rose to 3.41 million units in February. The Y-O-Y growth reached 10%, resulting in a stock crisis. Together with a current price war, it brings difficult times to the Chinese car market.

Stock in February increased from last month

The latest inventory situation of China’s national passenger car market was released on March 18 by Cui Dongshu, the Secretary General of the China Passenger Car Association. The national car market experienced a decline of 37% in January due to the early Spring Festival (Chinese New Year), the withdrawal of subsidies, and the departure of car purchase tax incentives.

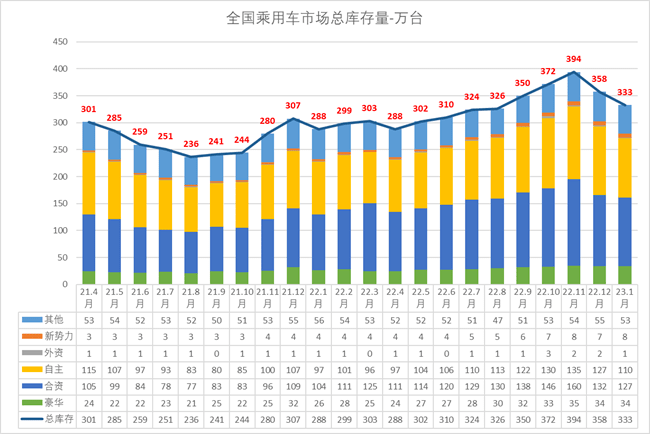

In February, retail sales of passenger cars reached 1.39 million units, a year-on-year increase of 10% and a month-on-month increase of 8%. However, due to relatively cautious production in February, the domestic fuel vehicle market stabilized relatively slowly. As a result, the manufacturers’ and dealers’ stock rose to 3.41 million units at the end of February. It is estimated that the inventory can support retail sales for 64 days.

The Chinese market usually divides cars into Chinese brands, luxury brands, and joint venture brands. Luxury brands refer to car brands such as BMW, Mercedes, Audi, Lexus, Cadillac, Volvo, etc. Joint venture brands refer to non-Chinese automotive brands other than luxury brands.

The stock of Chinese and joint venture brands rose slightly in February, while the inventory of luxury brands rose to a high level. The inventory of Chinese brands is equivalent to 54 days of sales, the stock of joint venture garages is 64 days, and the stock of luxury brand cars is equivalent to 70 days of sales.

According to the disclosure, more than 75% of the inventory is ICEs, while the rest is PHEVs and EVs. Considering that PHEVs and EVs account for more than 35% of the total sales in the Chinese market, EVs’ stock is equivalent to approximately 40-50 days of sales. ICEs’ stock is equivalent to approximately 70 days of sales.

In recent months, the inventory of mainstream automotive companies with joint venture brands has significantly decreased, reflecting the strong risk prevention awareness and improved inventory safety of joint ventures.

Cui Dongshu suggested that companies should timely track environmental and market changes, accelerate the early clearance of substandard inventory, and carefully set the production and sales rhythm for the future market. They should pay special attention to the channel inventory structure, timely adjust production for fuel vehicles, and timely digest the historical inventory of dealers.

Editor’s Comment:

Car sales in China in the first two months have fallen by more than 20% over the same period last year due to the Federal Reserve rate increase and China’s economic downturn. At the same time, due to the expansion of EV market share, ICE received a large squeeze, and inventory levels of some car companies are increasing.

Moreover, new cars below 6B (Chinese emission standard, alternative to EURO7) will not be registered in China after July 1, 2023, due to the Chinese government’s carbon emissions and environmental policies. Due to the price war and inventory crisis, most of China’s automotive enterprises are in an unprecedentedly tricky time.

Source: CPCA; Dongchedi

No related articles available.