OPINION | Audi, SAIC, and the Future of EV Integration

I believe the automobile industry saw an inflection point this past week, though the majority of the world didn’t think much of it. 2 days ago, Audi and China’s state-owned automaker SAIC Motor confirmed they reached an agreement to partner together on Audi’s next-gen EV platform in the Chinese market.

A little bit of history

In 1978, Germany’s Volkswagen signed a contract with SAIC to introduce advanced technology and develop the automobile industry. In 2023, VW’s Audi signed a contract with SAIC to introduce advanced technology and develop the automobile industry. However, 45 years later, the Chinese lead in technology.

Audi’s strategic decision to source SAIC’s EV platform for its next-gen product is not just a significant pivot in its portfolio but, more critically, an admission that in the fast-changing electric vehicles market, the company simply doesn’t have a competitive product lineup today and can’t navigate it alone anymore going forward.

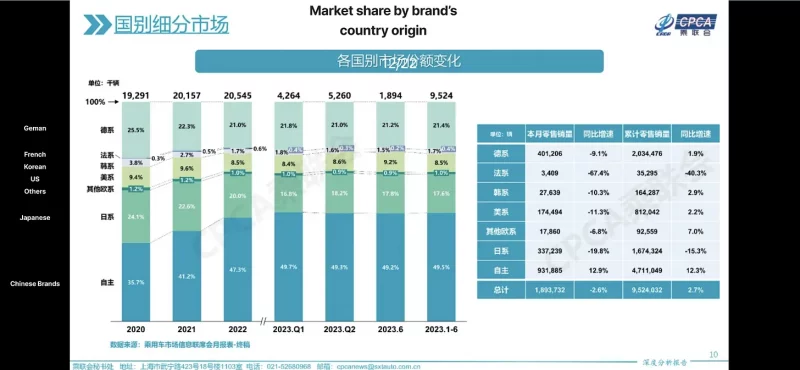

The data backs this up. Since 2020, foreign OEMs have seen a decline in market share to their domestic counterparts, propelled by BYD’s growth and a surge in Chinese EV startups (market share shifting from 35% to 49%). The sectors most affected were Japanese economy brands (with market share dipping from 24% to 17%) and German luxury brands (declining from 25% to 21%). In the NEV segments, their market shares are even less.

I believe 2 years from now, we’ll look back to this time as a watershed moment for the industry. Here’s why I think the implication of this deal is so important and what I think might happen over the next 12 months.

1. Legitimization of Chinese EV Technology

Audi, a brand historically synonymous with quality, innovation, and German engineering, is making a significant pivot to collaborate with SAIC on its next-gen platform. This sends a profound message to consumers, especially in China. Not too long ago, Audi was the vehicle of choice for many political leaders and important diplomats within the country.

For decades, Western brands like Audi have been perceived as superior in terms of technology, innovation, and quality. By partnering with SAIC on EVs, Audi has placed a significant vote of confidence in Chinese technology.

While this deal will likely help Audi put out a more competitive product in the short term, it’s unclear whether this helps or hurts them in the long run. The prevalent sentiment among Chinese consumers might become: “If Chinese EV technology is good enough for Audi & the Germans, then it should be good enough for me.” Ironically, this sentiment might further accelerate the transition to domestic EV brands, as local consumers would now see those vehicles through a different lens that equates them with quality and reliability.

Ultimately, how the consumers perceive the brand will come from what value the legacy OEMs can bring to the ecosystem. But what’s clear is that the current status quo no longer works.

2. The Ripple Effect on Other OEMs

Beyond the storied BBA (BMW, Mercedes-Benz, Audi) trio, I believe there’s now a palpable urgency among other foreign legacy brands, especially ones that do not have a competitive EV portfolio of their own. In the tech world, the early bird doesn’t just get the worm; it often gets the lion’s share of the ecosystem’s value.

Brands like Range Rover, Jaguar, Lexus, and Acura, while having distinct brand equities, operate in an ecosystem where platform integrations are becoming increasingly pivotal. The exclusivity inherent in these types of partnerships means that alliances, once formed, leave competitors scrambling. With SAIC now under the Audi/VW umbrella and firing the first shot, the race is on for these other brands to secure their platform partners, lest they be left behind in the next wave of EV evolution. I think we could see a reshuffling of alliances going forward.

3. The Geopolitical Supply Chain Implications

In tech, the supply chain has often been the unsung hero (or occasionally, the Achilles’ heel). Audi’s move potentially has broader ramifications for China’s supply chain ambitions. By integrating with a revered global brand, China’s supply chain ecosystem is poised to expand its influence internationally. If the China collaboration is successful, this could pave the way for more such collaborations and integrations abroad. If we were to look for a successful template, the Volvo/Geely one is probably a good template.

Obviously, this move can also have the opposite effect, where protectionism takes over, and the door to global markets gets shut in China’s face. It’s too early to tell which way the pendulum will swing, but I hope these partnerships will do more to tie these 2 economies together than push them apart.

Conclusion

The lines between tech’s platform dynamics and the automotive industry’s value chains are increasingly blurring. Audi’s strategic embrace of SAIC’s EV platform might well be a precursor to a new automotive order, where platform control is the linchpin of value creation and aggregation. Those attuned to these shifts will be best placed to navigate and thrive in the EV era’s evolving landscape.

Yilun Zhang is the Director of Product at Hertz, an EV enthusiast, and a China auto insider. You can find him on X (Twitter) or Substack