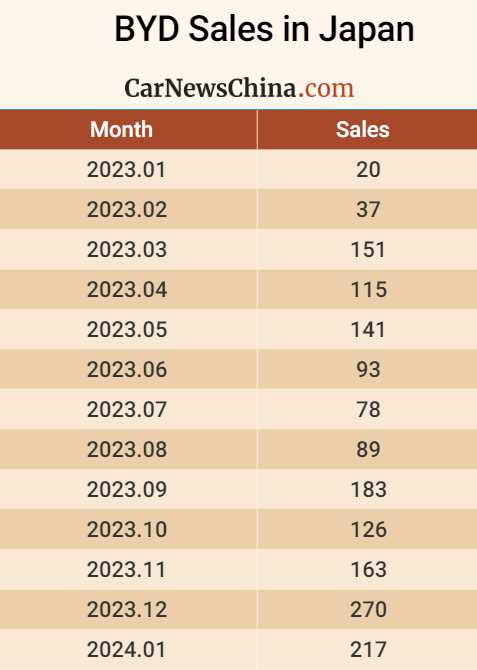

According to data released by the Japan Automobile Importers Association (JAIA) on February 6th, the total number of imported electric vehicles in Japan reached 1,186 units in January, marking an 11% increase compared to last year. Notably, BYD‘s sales accounted for approximately 20% of these imports, with 217 vehicles sold during the month, a sixfold increase from the previous year.

BYD officially entered the Japanese passenger car market in January 2023, launching two all-electric models, the Dolphin and the ATTO 3, with the latter being the international version of the Yuan Plus, familiar to many. The ATTO 3, in particular, has garnered popularity due to its advanced safety features, attracting a broad range of customers, including those trading in luxury cars and individuals over 60.

However, BYD’s local representatives have acknowledged that, despite these early successes, the overall sales volume for imported EVs remains modest, and brand recognition is still relatively low, indicating a need for further market penetration and awareness efforts.

BYD plans to introduce the Seal, an all-electric sedan, to the Japanese market by spring 2024, with ambitions to expand its sales network to 100 outlets by the end of 2025. This move is part of BYD’s strategy to solidify its presence in Japan, responding to the growing demand for diverse and innovative electric vehicles.

Current status of Japan’s EV market

The Japanese EV market currently features 118 models from 17 brands, including notable entries such as the Volkswagen ID.4, Audi Q4 e-tron, and upcoming models like the BMW iX2, Alfa Romeo, Jeep’s first electric vehicle, and Volvo’s compact SUV, the EX30. These additions highlight the increasing competition and variety in the Japanese EV landscape, offering consumers a wide range of electric mobility options.

The surge in interest and sales of foreign EVs in Japan indicates a broader trend. In 2023, imports of electric vehicles from foreign manufacturers exceeded 20,000 units for the first time, reaching 22,890 units and representing a 59.6% increase from the previous year. This growth reflects a gap in the domestic EV offerings from Japanese manufacturers, with foreign brands stepping in to provide a diverse selection of electric vehicles to Japanese consumers.

The JAIA has noted the rising influence of overseas manufacturers in the Japanese EV market, underscoring a shift in consumer preferences towards more sustainable and innovative transportation solutions.

BYD’s performance in January is a clear signal of the company’s growing influence in the Japanese market and the broader acceptance and interest in electric vehicles among Japanese consumers.

Source: iTHome