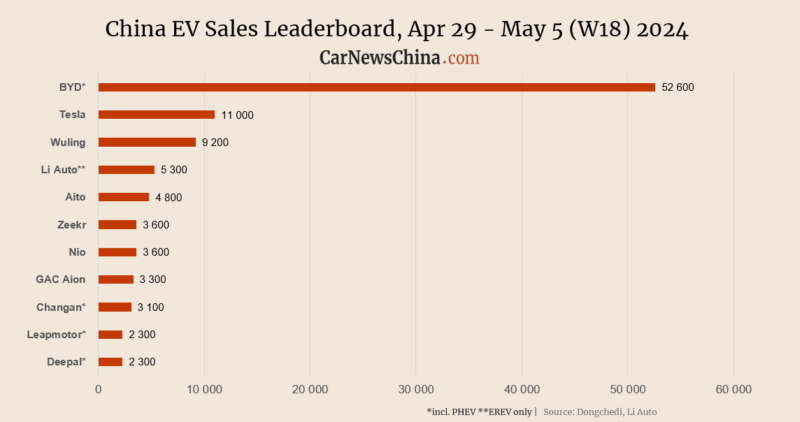

The whole market was down in week 18 (April 29 – May 5) of the year due to the Labor Day holiday. Xiaomi registered 1,300 units of SU7, down 24%, Nio was down 28%, Tesla was 26% down, and BYD nearly 18% down from the week before.

The weekly sales data were published by Li Auto, which resumed publishing registration data after a few weeks break without any official explanation. The numbers are rounded and present new energy vehicles (NEV), the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

As usual, BYD took the first spot, registering 52,600 vehicles, down 17.81% from 64,000 units the week before. BYD vehicles cost 69,800 – 269,800 yuan (9,600 – 37,400 USD) in China.

Following BYD, Tesla secured the second position with 11,000 vehicles sold, marking a decrease of 25.68% from the previous week’s 14,800 units. Tesla vehicles cost 231,900 – 824,900 yuan (32,000 – 114,400 USD) in China.

Last week, Elon Musk, Tesla CEO, visited Beijing to meet with Chinese Premier Li Qiang, whom he has known well since the early days of the Giga Shanghai factory. The discussed topic is unknown, but Bloomberg reported at the time that the main regulatory obstacle to launching Full Self-Driving (FSD) assisted driving features in China has been removed as Tesla partnered with Baidu for their mapping software and data storage.

Tesla model sales breakdown:

- Model Y: 10,400

- Model 3: 600

GM’s Chinese joint venture with state-owned SAIC, Wuling, ranked third, with 9,200 registered vehicles. Its best-seller is the small hatchback Wuling Bing, a BYD Seagull competitor. Wuling vehicles cost 32,800 – 169,800 yuan (4,500 – 23,500 USD) in China.

Li Auto captured the fourth position with 5,300 vehicles sold, experiencing a decline of 25.35% from the prior week’s 7,100 units. In China, Li Auto vehicles cost 231,900 – 824,900 yuan (32,000 – 114,400 USD). Li Auto historically sold only SUVs, which are not all-electric but EREV (extended range electric vehicle), meaning there is a small ICE engine that is not connected to the wheels and powers the battery or the e-motor.

On March 1, the company launched its first all-electric car, a futuristic-looking Li Mega MPV. The acceptance was unconvincing, and Li Mega registered 150 units in W18.

The Beijing-based EV maker delivered 25,787 vehicles in April, showing a 0.41% increase from the same month the previous year but a decrease of 11.03% from March.

Li Auto sales breakdown:

- Li L7: 1,900 units

- Li L9: 1,300 units

- Li L8: 1,100 units

Aito took the fifth position with 4,800 vehicles sold, down from the previous week’s 7,000 units, marking a decline of 31.43%. Aito vehicles cost 249,800 – 569,800 yuan (34,400 – 78,900 USD) in China.

Aito sales breakdown:

- Aito M7: 1,700 units

- Aito M9: 2,900 units

- Aito M5: 140 units

Nio followed closely with 3,600 vehicles sold, also down from the previous week’s 5,000 units, marking a decline of 28.00%. Nio vehicles cost 298,000 – 598,000 yuan (41,100 – 82,800 USD) in China.

In April, Nio delivered 15,620 EVs, marking a 31.64% increase from the previous month and a 134.60% increase from the same April in the previous year.

Nio sales breakdown:

- Nio ET5/ET5T: 1,600 units

- Nio ES6: 1,200 units

- Nio EC6: 500 units

- ES8+ET7+EC7+ES7: 300 units

Zeekr sold 3,600 vehicles, down from the previous week’s 5,000 units, marking a decline of 28.00% and closely copying Nio’s trend. Zeekr vehicles cost 200,000 – 789,000 yuan (27,600 – 109,400 USD) in China.

Stellantis-backed Leapmotor sold 2,300 vehicles, down 42.50% from the previous week’s 4,000 units.

BYD’s brand Denza, a former joint venture with Mercedes-Benz, registered 1,600 vehicles, down 36.00% from the previous week’s 2,500 units.

Volkswagen-backed Xpeng sold 1,400 vehicles, down 48.15% from the previous week’s 2,700 units.

Xpeng plans to launch its mass-market brand Mona in June, with a starting price of 150,000 yuan (21,000 USD). Guangzhou-based EV builder delivered 9,393 vehicles in April, marking a 4.07% increase from March and a 32.69% increase from the previous year.

Xpeng sales breakdown:

- XPeng G6: 450 units

- XPeng G9: 340 units

- XPeng X9: 260 units

- XPeng P7: 240 units

Xiaomi sold 1,300 vehicles, down 23.53% from the previous week’s 1,700 units. Xiaomi sells only one car – the Xiaomi SU7 sedan, launched on March 28, deliveries started in early April.