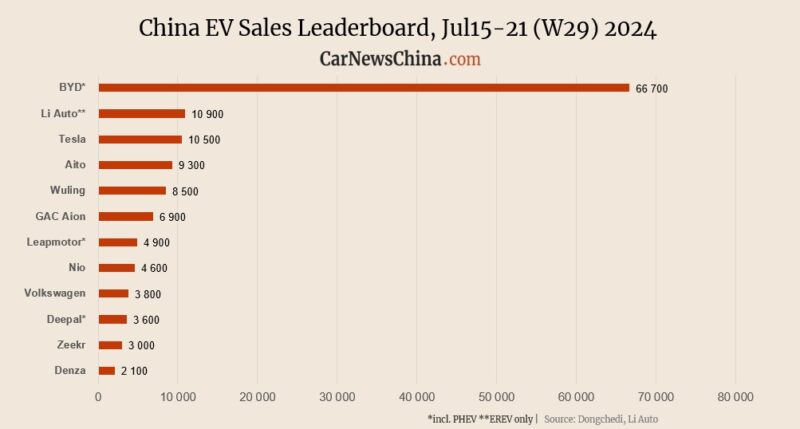

In the third week of July, the China EV market had mixed signals. Xiaomi vehicle registrations were down 35%, and Tesla was down 8%, while Nio was up 35%, and BYD was up 8%

Week 29 of the year (W29) was between July 15 and 21. The week W29 of 2023, used for year-on-year comparison, was between July 17 and 23.

The weekly sales are published by Li Auto, and despite Li’s not explicitly saying it, they are based on insurance registration data. The numbers are rounded and present new energy vehicles (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China. The data show only passenger vehicles (PVs).

BYD was the first, as usual, with 66,700 registrations, up 7.93% from 61,800 units registered the week before. In the first three weeks of the month, between July 1 – 21, BYD registered 187,300 vehicles in China.

Li Auto registered 10,900 EVs, down 3.54% from 11,300 units the week before and up 39.74% from 7,800 units in the same week the year before. In the first three weeks of the month, Li Auto registered 30,200 EVs in China.

Li Auto obtained a second spot in China’s EV registrations leaderboard, which is usually occupied by Tesla.

Tesla registered 10,500 EVs, down 7.89% from 11,400 units the week before and up 36.36% from 7,700 units in the same week the year before. In the first three weeks of the month, Tesla registered 28,400 EVs in China.

As of today, Tesla announced it is extending its 5-year zero-interest loan incentives offer until August 31 in China. The perk started in April and was initially planned to end on July 30. It was then prolonged until July 31 and now until August 31.

This means that a customer can have a Model Y SUV for 95 yuan (13 USD) and a Model 3 sedan for 85 yuan (11.6 USD) daily, according to Tesla China.

Aito registered 9,300 EVs, down 1.06% from 9,400 units the week before and up 830% from 1,000 units in the same week last year. In the first three weeks of the month, Aito registered 26,600 EVs in China.

GM’s Chinese joint venture, Wuling, registered 8,500 EVs, up 8.97% from 7,800 units the week before. In the first three weeks of the month, Wuling registered 23,000 EVs in China.

GAC Aion registered 6,900 EVs, down 2.82% from 7,100 units the week before. In the first three weeks of the month, GAC Aion registered 20,800 EVs in China.

Stellantis-backed Leapmotor registered 4,900 EVs, up 8.89% from 4,500 units the week before and up 75% from 2,800 units in the same week the year before. In the first three weeks of the month, Leapmotor registered 13,200 EVs in China.

Nio registered 4,600 EVs, up 35.29% from 3,400 units the week before and down 2.13% from 4,700 units in the same week the year before.

In the first three weeks of the month, Nio registered 13,300 EVs in China.

The last weeks of the month are usually weaker regarding vehicle registrations in China. However, it was reported that Nio would end its car purchase incentives by the end of the month, and thus, many customers most likely wanted to take the last chance to purchase Nio with a discount.

Volkswagen registered 3,800 EVs, up 5.56% from 3,600 units the week before. In the first three weeks of the month, Volkswagen registered an unspecified number of EVs in China.

Deepal registered 3,600 EVs, up 9.09% from 3,300 units the week before and up 5.88% from 3,400 units in the same week the year before. In the first three weeks of the month, Deepal registered 10,300 EVs in China.

Zeekr registered 3,000 EVs, down 9.09% from 3,300 units the week before and up 25% from 2,400 units in the same week the year before. In the first three weeks of the month, Zeekr registered 10,100 EVs in China.

Denza registered 2,100 EVs, up 10.53% from 1,900 units the week before and down 8.70% from 2,300 units in the same week the year before. In the first three weeks of the month, Denza registered 5,700 EVs in China.

Volkswagen-backed Xpeng registered 1,900 EVs, up 11.76% from 1,700 units the week before and down 26.92% from 2,600 units in the same week the year before. In the first three weeks of the month, Xpeng registered 5,400 EVs in China.

Xiaomi registered 1,500 EVs, down 34.78% from 2,300 units the week before. In the first three weeks of the month, Xiaomi registered 7,500 EVs in China. Xiaomi has only one car on the market – the Xiaomi SU7 sedan, which launched on March 28.

In June, Xiaomi delivered over 10,000 units in China with a target of achieving 120,000 vehicles by the year end.

IM registered 1,300 EVs, down 13.33% from 1,500 units the week before. In the first three weeks of the month, IM registered an unspecified number of EVs in China.