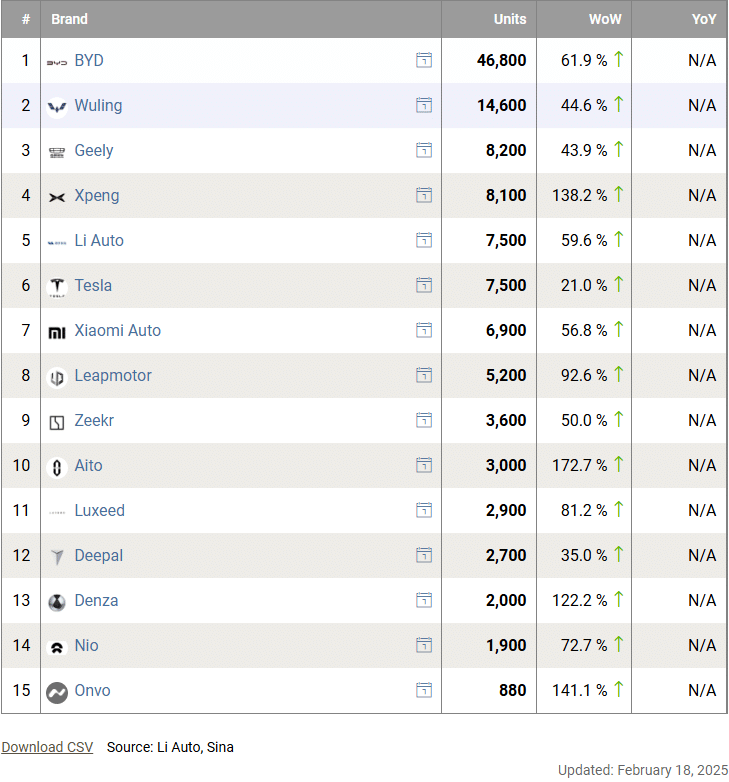

China EV registrations in week 7: Nio 1,900, Xiaomi 6,900, Tesla 7,500, BYD 28,900

In the second week of February, the China EV market was firmly up as the Chinese New Year holiday was over. Nio was up 70%, Xiaomi 56%, Tesla 21% and BYD 60%. Notably, Xpeng outsold Tesla, Xiaomi, and even Li Auto with 8,100 registrations., showing the success of its entry-level series Mona.

The weekly sales are published by Li Auto, and despite Li’s not explicitly saying it, they are based on insurance registration data. The numbers are rounded and present new energy vehicles (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China. Onvo registrations are not published by Li Auto but come from China EV DataTracker.

Keep in mind that insurance registration and sales/deliveries are different datasets. Regulator-related automotive associations report insurance registration, while delivery data are self-reported by automakers, which might include show cars, test cars, and other instruments.

Week 7 (W7) of 2025 was between February 10 and 16.

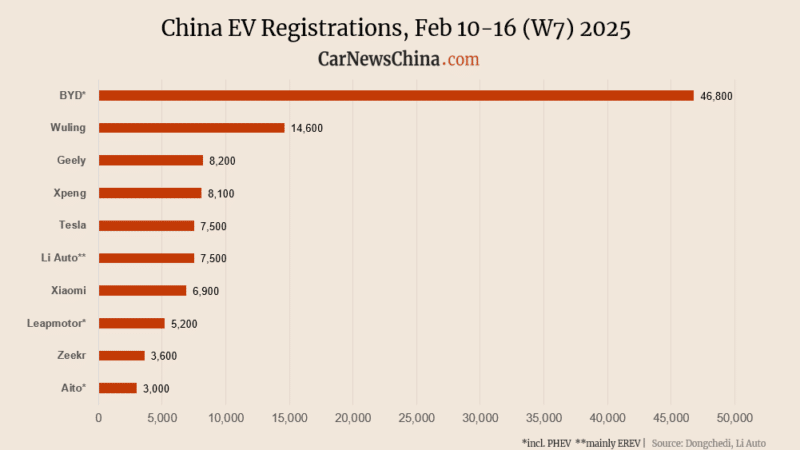

BYD got the first spot with 46,800 vehicle registrations, up 61.9% from 28,900 units the week before.

In January 2025, the company sold 296,446 passenger cars, down 41.8% from 509,440 in December and up 47.5% from 201,019 the previous year.

Cumulative vehicle sales in 2024 reached 4,250,370 vehicles, up 41.1% from 3,012,906 units in 2023.

Last week, BYD unveiled its assisted driving tech, God’s Eye, in China. The Shenzhen-based automaker intends to equip all its EVs with advanced assisted driving software, meaning even the entry-level 69,800 yuan (9,500 USD) BYD Seagull will receive it. BYD claims it wants to “democratize assisted driving.”

Wuling registered 14,600 vehicles, marking a 44.6% increase from 10,100 units in the previous week.

Geely saw 8,200 registrations, up 43.9% from 5,700 units a week earlier.

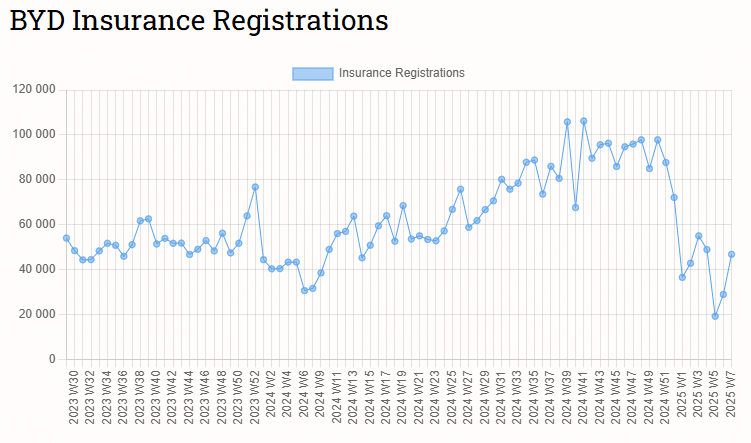

Xpeng recorded 8,100 registrations, surging 138.2% from 3,400 units the prior week.

Xpeng sold 30,350 passenger cars in January 2025, down 17.3% from 36,695 in December and up 267.9% from 10,668 the previous year.

Last year, Xpeng sold 190,068, up 34.2% from 2023. He Xiaopeng claimed that he is confident Xpeng will double its sales in 2025, meaning the company targets nearly 400,000 sales this year.

The main motor behind Xpeng’s sales is its entry-level series, Mona, which launched in August 2024. It sells a single car, the entry-level lift-back sedan Mona M03, which starts at 119,800 yuan (16,500 USD). Mona M03 was responsible for about 50% of Xpeng’s sales in January.

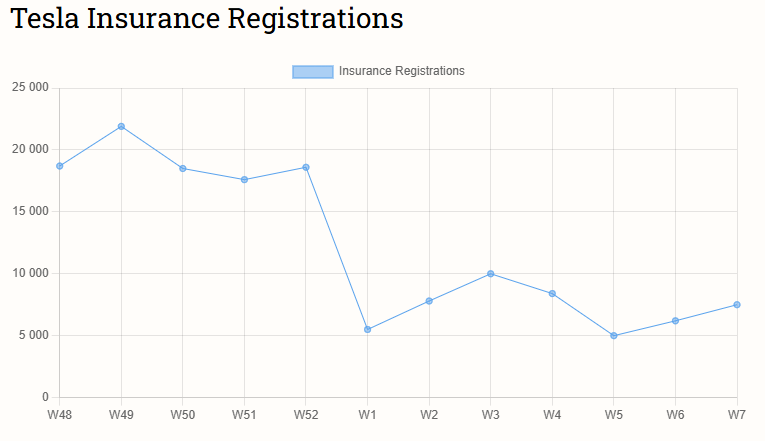

Tesla registered 7,500 vehicles, a 21.0% increase from 6,200 units the week before.

Li Auto saw 7,500 registrations, up 59.6% from 4,700 units in the prior week.

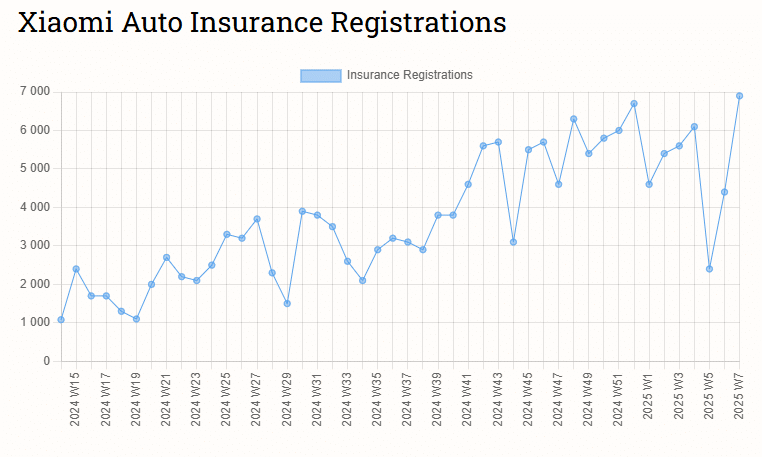

Xiaomi recorded 6,900 registrations, growing 56.8% from 4,400 units a week before.

Beijing-based consumer electronic giant sells a single car, the SU7 sedan. It launched on March 28, 2024, starting at 215,900 yuan (29,700 USD) for the version with a 73.6 kWh battery with a 700 km CLTC range. On January 25, Xiaomi announced it reached 150,000 cumulative deliveries. In January alone, the company delivered over 20,000 units.

Leapmotor registered 5,200 vehicles, a 92.6% increase from 2,700 units the previous week.

Zeekr saw 3,600 registrations, up 50.0% from 2,400 units in the prior week.

Aito recorded 3,000 registrations, surging 172.7% from 1,100 units a week earlier.

Luxeed registered 2,900 vehicles, marking an 81.3% increase from 1,600 units the previous week.

Deepal saw 2,700 registrations, up 35.0% from 2,000 units in the prior week.

Denza recorded 2,000 registrations, growing 122.2% from 900 units a week before.

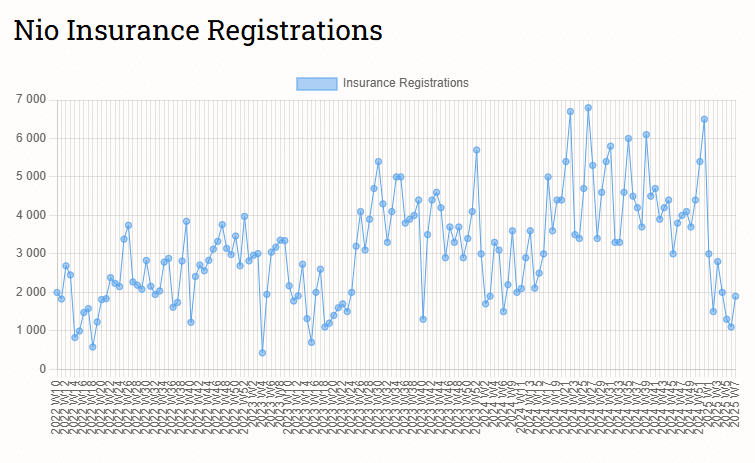

Nio registered 1,900 vehicles, up 72.7% from 1,100 units the previous week.

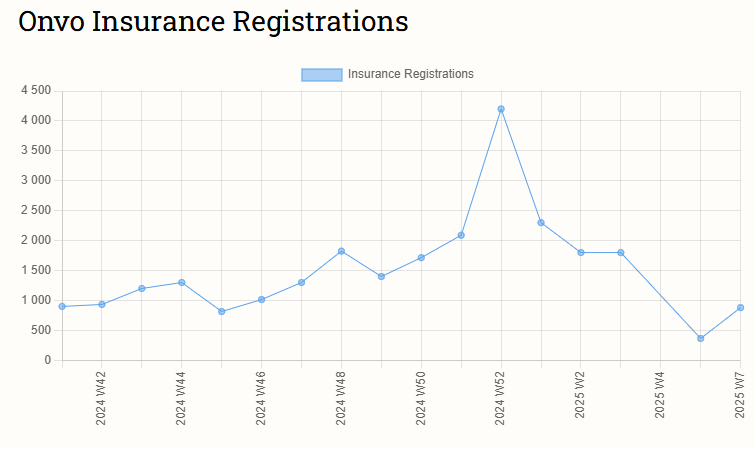

Nio’s brand Onvo registered 880 units, up 141.1% from 365 units the week before. Onvo sells only one car, the L60 SUV, which was launched in September 2024. It is a Model Y rival that supports battery swaps and starts at 206,900 yuan (28,500 USD) with a battery or 149,900 yuan when purchased without a battery with BaaS (battery as a service).

Onvo will launch a large 7-seater SUV, reportedly called L80, in May this year. The EV completed a trial production test in January and will be unveiled next month. CarNewsChina obtained spy shots from the road testing on Monday, revealing the massive SUV in heavy camouflage.

Together, Nio Group registered 2780 units in week 7.

Nio group sold 13,863 passenger cars in January 2025, down 55.5% from December but up 37.9% from the previous year.

Nio’s main brand sold 7,951 cars in January, down 21% from 10,055 units in the same month last year and 62% from 20,610 in December. Onvo sold 5,912 units in January, down 44% from 10,528 in December.