The Big Read: Story of BAW & BAIC (part 3)

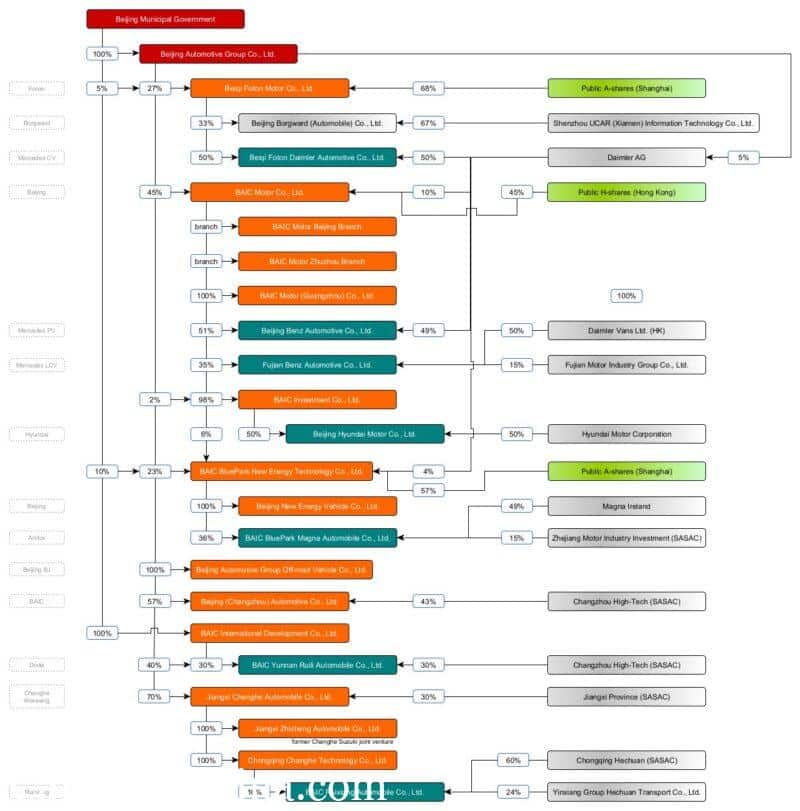

BAIC Group is an automotive conglomerate owned by the Beijing Municipal Government. Apart from its mainstream car brands and joint ventures with Hyundai and Mercedes-Benz, it also has a number of operations aimed at the budget market. Today we look at these lesser known brands and companies.

First, let me remind you of BAIC’s corporate structure. Below it I will address the remaining companies at the bottom of the graph one by one.

BAIC Yinxiang Automobile Co., Ltd. / BAIC Ruixiang Automobile Co., Ltd.

The city of Chongqing is the heart of China’s motorcycle industry. Many of the larger companies and better known brands originate from there. I won’t drag you into the China motorcycle industry, because it’s even more confusing than the car industry. Sometimes it need to be mentioned however, because several car manufacturers started first making motorcycles.

In Chongqing Long Fuyong is trading motorcycles in the early nineties and moves into parts manufacturing in 1993. Four years later he spots an opportunity, an engine factory about to close, and with the support of the wealthy Zhang family he becomes a real motorcycle manufacturer. The name of the company is Chongqing Yinxiang Motorcycle. Yinxiang starts to make self-branded motorcycles, but also uses several different names like Kembo, JLM and Jida. In 2002 Yinxiang sets up a joint venture with Korean company Hyosung and in 2005 acquires fellow motorcycle manufacturer Xianfeng.

Long Fuyong controls Yinxiang Motorcycle, but the company is part of Yinxiang Group, that has its main interest in large real estate projects in Chongqing. Yinxiang Group is controlled by Zhang Ping and his sister Zhang Xianli.Long and the two Zhangs have their mind set to car production and find a willing partner in BAIC Group. In August 2010 they establish BAIC Yinxiang Automobile, with 58% of the shares controlled by the Zhang family, 26% by BAIC Group and the remaining 16% by China Development Bank.

Actual car production starts in 2014 when a new factory in Chongqing’s Hechuan district is erected. BAIC Yinxiang introduces the Huansu brand (later Hyosow in English), which translates as ‘Magic Speed’. The first crossover models are based on BAIC Motor’s E-series and Huansu also presents a MPV based on a BAIC Wevan model. Huansu targets a lower market then BAIC’s main brands and sells mainly in rural areas and third and fourth tier cities. Still the brand becomes an instant hit and outsells BAIC Motor’s brand in 2015 and 2016.

There are some more members of the Zhang family with businesses of their own, although related to the activities of Yinxiang Group. Zhang Xianqin and Zhang Pingfeng also see possibilities in the car market. Together they create Bisu Automobile and enter a technical cooperation agreement with BAIC Yinxiang. That means that the Bisu models, that enter the market from December 2016 onwards, are reworked version of BAIC Huansu cars.

The meteoric rise of BAIC Yinxiang and its Huansu and Bisu brands proceeds an even more spectacular and dramatic collapse. The first signs of trouble appear already in 2017 and a year later protesting BAIC Yinxiang workers claiming unpaid wages reach the mainstream news. Not much later production is halted. Then more stories appear. BAIC Yinxiang workers being fired after taking part in the protest and then forced from their homes to make place for some Yinxiang Group real estate development. Or Huansu car dealers telling they were forced to order (and pay for) a certain amount of cars they never received.

In 2019 BAIC Yinxiang makes a failed attempt to restart production, but the whole thing is too big of a mess. It takes almost three years to untangle the web of financial shenanigans and find a solution. In April of this year a Chongqing court rules over the bankruptcy and re-organization proceedings and it turns out that BAIC Yinxiang was built mainly on debt. The accumulated debt reaches almost 16 billion yuan, while the company assets total less than 2 billion yuan.

Needless to say the company is declared insolvent, but at the same time a rescue plan is adopted. A total of 2 billion yuan will be invested in the company, now renamed BAIC Ruixiang Automobile. 300 million yuan comes from BAIC Group (through a newly established subsidiary Chongqing Changhe Automobile), 487 million from Yinxiang Group and 1,2 billion from an investment fund owned by the Chongqing municipal government. Large creditors (banks, suppliers) will be paid off in the coming five years, small creditors (workers, dealers) probably won’t see a lot of their money back.

The Huansu and Bisu brands had a lifespan of four and two years respectively and will not be resurrected. BAIC already presented the first car of the saved company, while it submitted several others for production permits to the Ministry of Industry. The new car is called X5 and will be sold under the Ruixiang brand.

BAIC (Changzhou) Automotive Co., Ltd.

BAIC Changzhou is a strategic cooperation between BAIC Group and the municipal government of Changzhou (Jiangsu province). The project starts in 2015 and comprises of factory making new energy vehicles. Main products are electric buses, but also a few passenger cars for BJEV.

BAIC Yunnan Ruili Automotive Co., Ltd.

Besides its automotive activities BAIC also has some investments in aviation and aerospace. Through these investments BAIC comes into contact with Yunnan Jingcheng Group. Jingcheng is a supplier to the aviation industry, mainly as a manufacturer of hydraulic systems, The company owns its own airline as well. Ruili Airlines is one of China’s local carriers. The Jingcheng Groups belongs to the state-owned China Aviation Industry Corporation, which once owned Changhe as well.

BAIC and Jingcheng Group establish a joint venture in 2013. Since 2015 this joint venture produces a car called Doda V8. The name might get your motor running, but I can save you a quick Google search. The Doda is not a V8-powered sports car, it’s a minivan. In fact it’s BAIC’s version of the Joylong iFLY, an unlicensed copy of the Toyota Alphard. BAIC Ruili mainly makes slightly higher end versions, that can serve very well as an airport shuttle.

More recently BAIC Ruili is producing of some Changhe and Weiwang models as well. These cars are not intended for the Chinese domestic market, but for export to neighboring Asian countries. Under Xi Jinping’s “Belt and Road” initiative BAIC Ruili concluded a lucrative deal with Myanmar, which ultimately should lead to a Burmese assembly factory on the basis of CKD kits.

Jiangxi Changhe Automobile Co., Ltd.

I’ve mentioned the name a few times already: Changhe. Now it’s time to get to know the brand. It is one of the car brands that spun off the military industry in the eighties, so we have to make a little side trip to aviation.

China has a fairly sizeable aviation industry. They make everything from drones, via fighter jets to large passenger jets. I am by no means an aviation expert, but my brief research into the Chinese industry does reveal surprising parallels with the car industry. In the aviation sector, there are also a large number of suppliers and technical development takes place via a combination of purchased technology, cooperation with major international players and some in-house development.

Perhaps I should first explain why it is suddenly about flying machines. Well, Changhe is primarily a helicopter manufacturer, and the automotive department is at best an afterthought and certainly not owned by Changhe itself anymore. I’ll get back to that in a moment.

Anyone who thinks that the Chinese car industry is an inextricable web of companies, brands, collaborations, takeovers and divorces, should take a closer look at the military industrial complex of the country. That industry has the same kind of business dynamics, plus everything has been controlled for a very long time by a completely opaque government apparatus. I will not go into too much detail about this and will limit myself to a brief explanation.

Until 1982 China had a planned economy, in which supply and demand were determined by one party: the government. This government distributed means of production, labour, raw materials and money and determined how many of which products had to be made. Moreover, aviation is also closely intertwined with the military industry, where government control is everywhere. In those years, the aviation sector was controlled by all kinds of committees, state offices and ministries, which also changed names regularly.

In 1982 the planned economy was abolished and the entire defense sector was divided into five major groups. For each group, respectively arms and ammunition, shipping, aviation, aerospace and nuclear engineering, a government body with a more or less corporate structure was established. In 1993 they are really incorporated with a proper board of directors. In 1999, all groups were split in two to promote research and speed of innovation through mutual competition. This situation still exists for all sectors, except aviation. The two airline groups merged again in 2008, although part of the commercial airline business was spun off.

Changhe Aircraft Industries Corporation is founded in 1969. Then still under the influence of a government commission, called the Seventh Ministry of Mechanical Industry. Today, Changhe is part of the merged aviation group called Aviation Industry Corporation of China (AVIC).

Changhe Aircraft has been making helicopters since its inception, for both the commercial and military market. The company has a close technical cooperation with Sikorsky and a joint venture with Agusta-Westland. Initially Changhe mainly makes helicopters designed by Agusta, but the company also designs the first fully Chinese helicopter, the Changhe Z11 in 1994.

As early as the 1970s, one of Changhe’s factories, the Changhe Machinery Factory, started experimenting with the production of a bus. A pilot is being run with a 15-passenger model, but large-scale production is not forthcoming. The shift to vehicles is driven by the reduced demand for military products. The ministry overlooking the industry signs a licensing agreement with Suzuki in the early 1980s, whereby several military companies focus on making Alto’s and Carry’s. You find a more extensive list in the Story of Changan. Changhe Machinery Factory starts making Carry minivans.

Between all the factories that start making Suzuki replicas, Changhe and Changan excel. Both manufacturers grow to an annual production of around 100,000 units at the end of the 1990s. Changhe boosts its production (a little) with the acquisition of Anhui Huaihai Machinery Factory in 1997, a munitions factory that also makes the Carry minibuses.

Perhaps more importantly, Changhe also establishes a formal relationship with Suzuki itself. In 1995, both companies form a joint venture. This is Changhe’s gateway into passenger cars, because Suzuki brings the Wagon R to the joint venture. The car is sold as Beidouxing (Big Dipper) in China. It comes with Suzuki logos, but sells as Changhe-Suzuki, meant to distinguish it from the Suzuki’s from the Changan joint venture.

In November 1999, Changhe Machinery Factory becomes Jiangxi Changhe Automobile and is spun off as an independent subsidiary of Changhe Aircraft. Two years later, Jiangxi Changhe is listed on the Shanghai Stock Exchange. The proceeds of the IPO are used to develop its first self-designed car. This Changhe Ideal relies entirely on the Wagon R technology, but the Ideal does have an upgraded chassis with a considerably longer wheelbase. Funnily enough, Suzuki launches a redesigned version of the Beidouxing (called X5), based on the Ideal chassis.

With the minivans, Changhe distances itself further and further from their Japanese partner. Each iteration of the design becomes a little more original and with the introduction of the Furuida (Freedom) in 2007 all resemblance to Suzuki vans has disappeared. It’s different under the skin: Changhe now has an engine factory where they assemble Suzuki technology.

As noted earlier, the two state-owned aviation groups merge into a company called AVIC in 2008. Part of that merger is the divestment of all non-essential activities, which includes the automotive industry. The aviation groups had four such companies in their portfolio. Changhe of course, as well as Guizhou Yunque, Harbin Hafei and Dongan Engine. Yunque is already sold in 2004 (prior to the merger) to Jinhua Qingnian (Youngman). The other three companies are sold to Changan in one go. Jiangxi Changhe is also delisted from the stock exchange.

And there ends our foray into the aircraft industry. As of now, Jiangxi Changhe and Changhe Aircraft have are entirely unrelated, although they continue to share the same company name.

The relationship between Changhe and Changan is very tense from the start. Both companies have joint ventures with Suzuki and it is clear that the Changan board wants to merge the two. Changhe’s managers are not interested, because they suspect the survival of their company is in jeopardy. They are strengthened in that belief when Changan discontinues the Hafei brand (also a manufacturer of Suzuki-based minivans) and reassigns the plants to their joint venture with Ford. Protests and strikes at the Changhe plant follow, until a more suitable partner is found.

In 2013, Jiangxi Province acquires Changhe in its entirety from Changan, including the Changhe-Suzuki joint venture and immediately sells 70% of the shares to BAIC Group. Changhe has thus become a subsidiary of BAIC. This doesn’t mean the problems are over, because not much later BAIC picks a fight with Suzuki. BAIC Group proposes to drop the Suzuki name and sell all cars as Changhe. In addition, they want to develop a new mid-range sedan on the Suzuki Liana platform. The Japanese don’t like the proposal. The plan for Changhe’s version of the Liana is shelved, but the Suzuki logos disappear from some of the products.

Ultimately, Suzuki solves the problem by leaving the Chinese market entirely. Both joint ventures with Changhe and Changan are ended in mid-2018. As a result most of Changhe’s initial success is wiped out. A production of 100,000 cars per year is nowhere in sight. In 2019, sales drop to about 27,000 units, in 2020 to a paltry 7,000. In an attempt to revive the company BAIC puts Changhe in charge of its Wevan brand and sets up Chongqing Changhe Automobile Technology to oversee the BAIC Yinxiang restructuring. As we’ve seen in that part of the story, it takes until earlier this year to put the complicated rescue plan into motion. If it’s enough and if Changhe can survive as a brand remains to be seen.

BAIC Group names and final words

In the first part of the article I introduced BAIC Group and wrote that the holding company underwent several changes over the years. For completeness sake, let’s take a short look at the main events.

The group was erected as Beijing (Municipal) Automotive Industry Company in 1973, as a bureau under supervision of a municipal committee. It combined about ten automotive enterprises and eighty factories under a unified management. It was renamed Beijing (Municipal) Automotive Industry Corporation in 1980.

The bureau was dissolved in 1987 and replaced by the Beijing Automotive Industry Joint Company. This was no longer a government commission, but more or less a cooperative union of enterprises. Still there was no central board of directors. Some minor changes to its operating structure were made in 1992 and that meant a new name: Beijing Automotive Industry Corporation.

In 1994 the group was finally formally incorporated as holding company and renamed again to Beijing Automotive Industry Group Corporation. In 2000 the group changed name to Beijing Automotive Holding Co., Ltd and its current name was adopted in 2010: Beijing Automotive Group Co., Ltd.

BAIC started out as manufacturer of (military) off-roaders and that stayed its core business for a long time. In the nineties it gained prominence as commercial vehicle manufacturer with Foton and a decade later, Xu Heyi built the passenger car industry. For about fifteen years BAIC enjoyed success after success.

And then all the trouble came at once. Since late 2018 almost the entire group seems to be caught in a downward spiral. Sales and revenues are dropping quickly. The only two exceptions are Foton and Beijing Benz, these business units remain profitable. At the height of the commercial difficulties, Xu Heyi retired and BAIC’s management has been in chaos since. It’s clear most of the group’s business units need an overhaul and fresh new products. Let’s just hope the company will reinvent itself before it’s too late.

Read more Automakers Stories

Every week we publish one exiting article about history of famous Chinese Automakers. Check the ones you haven’t read yet.