China EV sales in week 50: BYD 51,700, Tesla 18,300, Nio 3,400

In week #50 of this year, December 11-17, the China EV market was up as temporary December price cuts kicked in. Many automakers introduced those discounts in an end-of-year sales push to fulfill their annual targets. BYD was up 9%, Tesla was up 19%, and Nio was up 17% compared with the previous week.

The weekly data were published by Li Auto, and they represent weekly sales. The background data are weekly insurance registrations. The numbers are rounded and present new energy vehicles (NEV), the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

As usual, BYD got the first spot and registered 51,700 vehicles, up 9.07% from the previous week. Between December 1 and 17, BYD sold 116,100 cars in China in the first half of the month.

BYD’s subbrand Fang Cheng Bao registred 969 units (+35% WoW) of their only car Bao 5 (Leopard 5) SUV. BYD’s other brand, YangWang, registered 400 units (+19% WoW) of their only car, YangWang U8 hard-core SUV.

BYD started massive promotions and discounts for customers who buy their cars between December 1 and 31, so growing weekly sales were expected.

On December 15, BYD launched Model Y competitor Song L, starting at 189,800 yuan (26,700 USD), which is 30,000 yuan (4,200 USD) lower than the presale price. As the price war rages in China, such a discount on launch is not so unusual; however, Song L’s low starting price surprised many analysts. Song L has received Song L 28,350 orders since the presale started to launch.

Meanwhile, BYD’s super sport dancing car – YangWang U9 – is warming for the official launch as many spy shots were recently published in China.

BYD sells BEV and PHEV, but insurance registration doesn’t show the ratio. It is usually 50:50, with the trend leaning towards BEVs. In November, BYD sold 301,903 electric vehicles, of which 43.47% were PHEVs and 56.36% were BEVs. BYD ceased production of ICE vehicles in April last year.

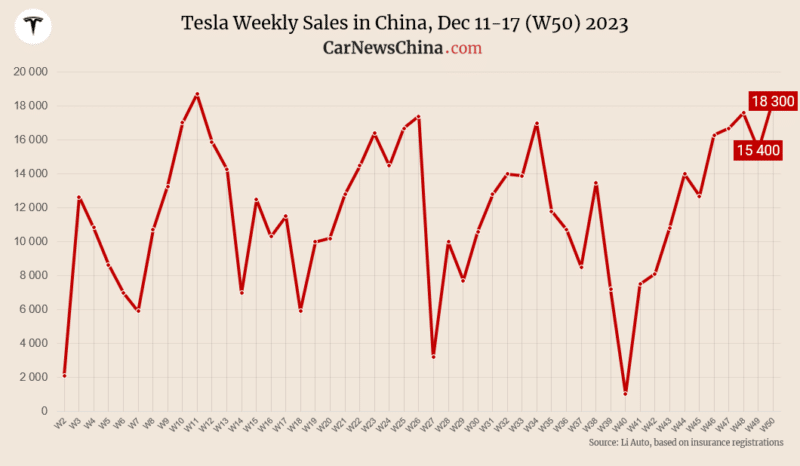

Tesla sold 18,300 EVs, up 18.83% from the previous week. In the first half of the month, between December 1 and 17, Tesla sold 41,700 vehicles in China.

Tesla Model Y registered 14,400 units, while Model 3 registered 2,900 units, down 7% from the previous week.

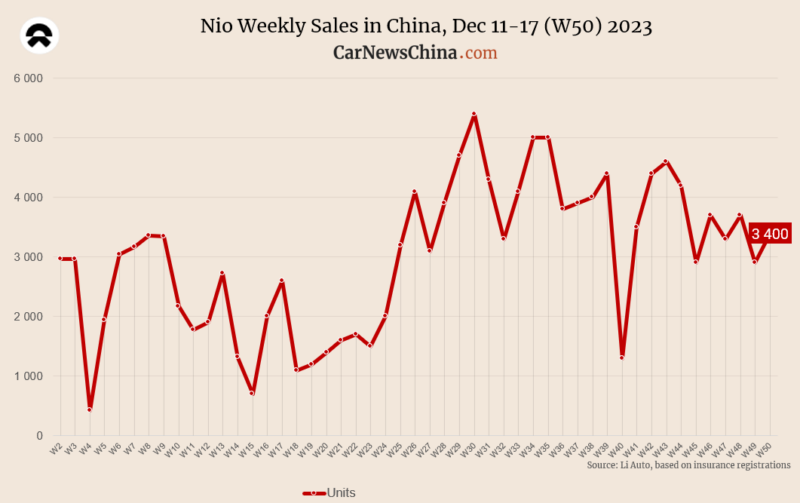

Nio registered 3,400 EVs, up 17.24% from the previous week. Interestingly, Nio didn’t introduce massive price cuts like other automakers, whose policy is to “protect the brand premiumness”.

Nio main models sales breakdown:

- ES6: 1,300 (+21% WoW)

- ET5/ET5T: 1,000 (+14% WoW)

- EC6: 540 (+2% WoW)

Nio sold 15,959 EVs in November, nearly flat from 16,074 in the previous month. According to Nio’s guidance introduced during the company’s earnings call, Nio aims to sell 15,000 – 17,000 vehicles in December.

Yesterday, Nio raised more capital and announced a 2.2 billion strategic investment from Abu Dhabi investment fund CYVN Holdings LLC, which now holds about 20% of the company. On September 25, Nio denied Bloomberg’s “market speculations” that it is in talks with Middle Eastern investors about a 3 billion USD investment and diluting the shares investors. “No reportable capital-raising activity, the report is completely false,” Nio stated. Following the denial, the stock fell 17%.

Nio raised 5.3 billion USD in 2023 so far. Following the latest 2.2 billion deal, the shares rose about 10% as it removed the near-term bankruptcy concerns, giving the company another 12-18 months of runaway to get into cash flow positivity. It also removes the overhangs and adds more investors’ confidence.

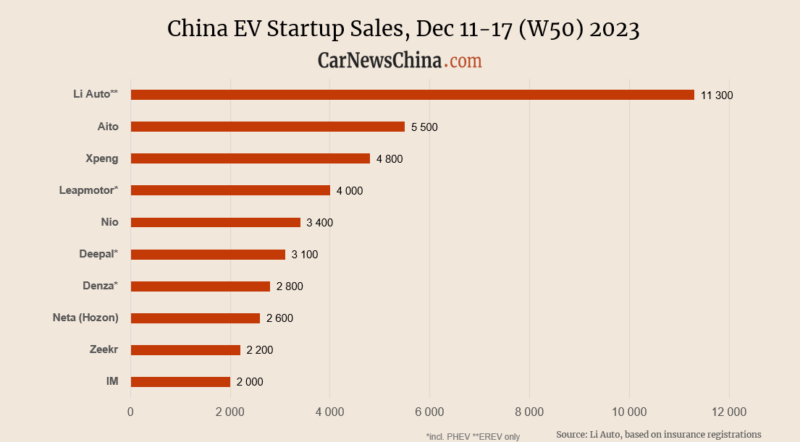

Among EV startups, Li Auto won, selling 11,300 vehicles, up 8.65% from the previous week. In the first half of the month, between December 1 and 17, Li Auto sold 24,300 cars in China.

Li Auto sales breakdown:

- L7: 4,600 (+9% WoW)

- L8: 3,400 (+11% WoW)

- L9: 3,300 (+5% WoW)

Li Auto sells only range-extended electric vehicles (EREVs), which are EVs with ICE as a power generator for the battery, not connected to wheels. By the end of the month, Li Auto will launch its first all-electric car, Li Mega. It will be a massive MPV priced under 600,000 yuan (84,500 USD) with a futuristic design and ultra-fast charging, adding 500 km of range in 12 minutes.

Huawei’s Aito got the second spot for the third consecutive week, selling 5,500 vehicles, nearly flat from the previous week when it sold 5,400. In the first half of the month, between December 1 and 17, Aito sold 12,700 vehicles in China.

From underdog selling 3-4k cars a month, Aito is establishing itself as a leading player in China’s EV race. Massive discounts and Huawei’s deep pockets are one of the reasons for Aito’s success. ADAS-focused cars and a wide range of Huawei’s flagship stores are among others.

Xpeng got the third spot, registering 4,800 EVs, up 84.62%. Between December 1 and 17, they registered 8,700 EVs. Xpeng recently introduced temporary price cuts, and its G6 SUV was discounted by 10,000 yuan (1,400 USD). The Model Y competitor starts at just under 200,000 yuan for 28,000 USD.

Xpeng sales breakdown:

- G6 1,700 (+68% WoW)

- P5: 1,300 (+800% WoW)

- G9: 1,000 (+4% WoW)

- P7i: 700 (+76% WoW)