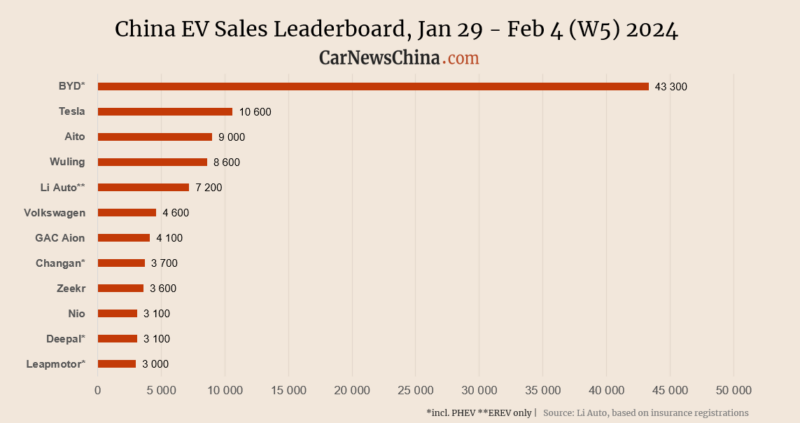

China EV registrations in W5: BYD 43,300, Tesla 10,600, Aito 9,000, Nio 3,100

The fifth week (W5) of the year, between January 29 – February 4, was the last before the Chinese New Year starts. It was mostly down, with several exceptions. BYD sold the same amount of vehicles as the week before, Tesla was 17% down, Aito 13% up and Nio 6% down.

The weekly data were published by Li Auto, and they represent weekly sales. The background data are weekly insurance registrations. The numbers are rounded and present new energy vehicles (NEV), the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

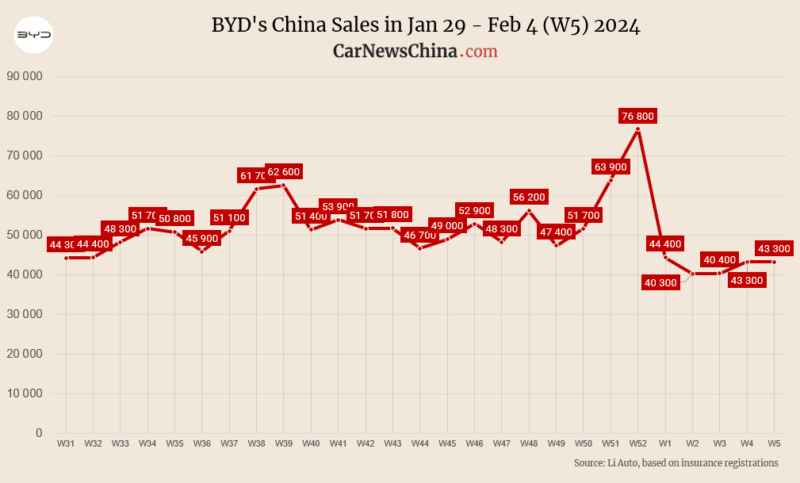

BYD won first place as usual, registering 43,300 vehicles, the same as the week before.

BYD subbrands registrations breakdown:

- Denza: 2,500, up 8.7% from the week before

- Fang Cheng Bao: 1,400 vehicles, up 27.3% from the week before

- FCB has only one vehicle on sale, Bao 5 (Leopard 5)

- YangWang: 470 vehicles, down 6% from the week before

- YangWang has only one car on sale, YangWang U8, which costs about 153,000 USD

BYD surpassed the 3 million sold vehicles milestone in 2023 and became the world’s largest BEV seller in Q4 of 2023, beating Tesla. BYD sold about 200,000 vehicles in January, down 40% from December but up 33% from the same month last year.

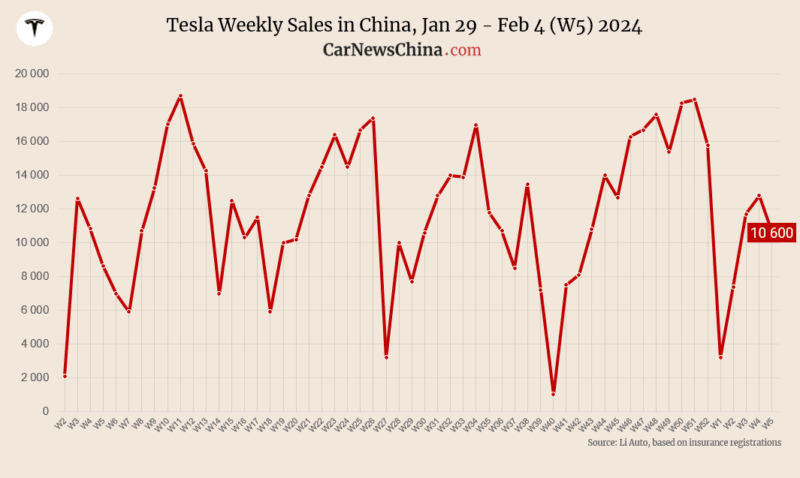

Tesla registered 10,600 EVs, down 17.19% from 12,800 the week before.

The new generation of Tesla Model Y codenamed Juniper, is rumored to start production in the Shanghai factory in April. Meanwhile, On February 1, Tesla launched an updated Model Y with an HW4 smart driving computer.

Tesla started the Cybertruck roadshow on January 28 in China, despite not being clear if the vehicles will be available for sale in China due to the potentially problematic homologation of the large steel pickup.

In January, Tesla sold 71,447 China-made vehicles from its Shanghai plant, down 24.1% from 94,139 in December.

Sales breakdown:

- Model Y: 7,700, down 20% from the week before

- Model 3 (Highland): 2,900, down 6% from the week before

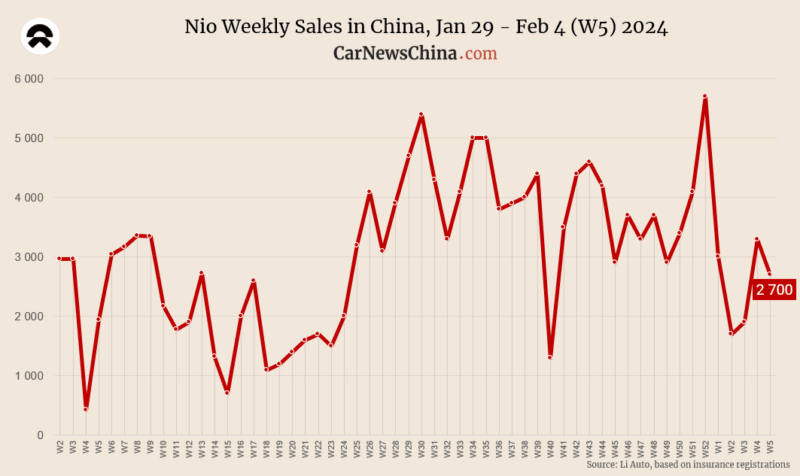

Nio registered 3,100 EVs, down 6.06% from 3,300 the week before.

Nio plans to launch its mass-market brand Alps in March or April and introduce a 2024 update of its existing lineup. Nio started to offer massive discounts of up to 5,500 USD in January for its current stock models.

Nio registration breakdown:

- Nio ES6: 1,300

- Nio ET5/ET5T: 1,000

- Nio EC6: 500

- ES8, ET7,EC7, ES7: less then 300

Aito secured the first spot among Chinese EV startups, beating even the EREV hegemon Li Auto. Huawei-backed automaker registered 9,000 vehicles, up 12.50% from 8,000 the week before.

Despite most automakers experiencing a drop in sales in January, Aito delivered a record-breaking 32,973 vehicles, up over 600% from the previous year.

Aito registration breakdown:

- Aito M7: 8,400

- Aito M5: 600

Li Auto got the second spot with 7,200 registered vehicles, down 15.29% from 8,500 the week before. Li Auto sells only EREVs (basically a BEV with an ICE generator), and on March 1, it will launch its first battery electric vehicle (BEV) called Li Mega.

Li Auto registration breakdown:

- Li Auto L7: 2,900

- Li Auto L9: 2,300

- Li Auto L8: 2,000

Zeekr sold 3,600 EVs, up 16.13% from 3,100 the week before.

Changan’s Deepal registered 3,100 vehicles, up 3.33% from 3,000 the week before. Neta and Voyah both registered 1,200 EVs, down 29.41% and 20.00% from the week before, respectively.

Volkswagen-backed Xpeng registered 2,700 EVs, up 22.73% from 2,200 the week before. Stellantis-backed Leapmotor registered 3,000 vehicles, up 11.11% from 2,700 the week before.

Xpeng registrations breakdown:

- Xpeng X9: 800 units (MPV)

- Xpeng G6: 800 units (SUV)

- Xpeng P7: 470 units (sedan)

- Xpeng G9: 460 units (large SUV)

- Xpeng P5: 100 units (sedan)