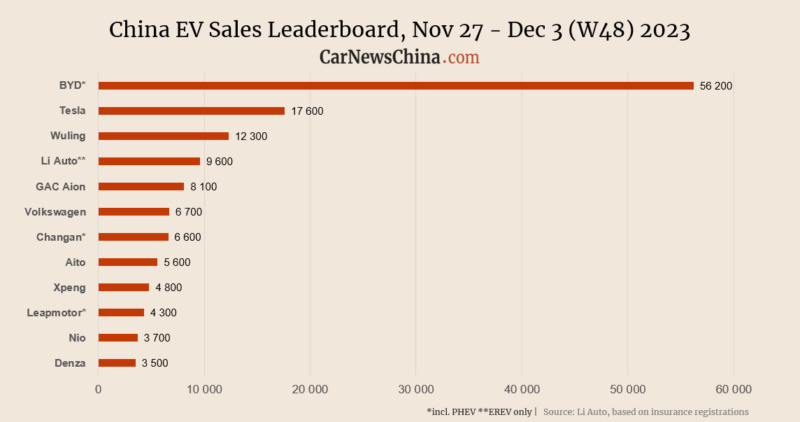

China EV sales in week 48: BYD 56,200, Tesla 17,600, Nio 3,700

In week #48 of this year, November 27 – December 3, the China EV market was mostly up as automakers started their end-of-year sales push to fulfill the annual delivery targets. BYD grew 16%, Tesla 5%, and Nio 12% compared with the previous week.

The data were published by Li Auto, and they represent weekly sales. The background data are weekly insurance registrations. The numbers are rounded and present new energy vehicles (NEV), the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

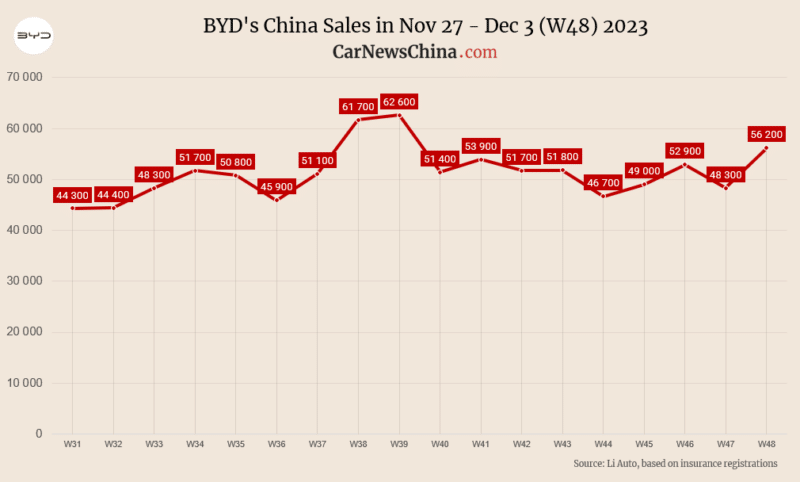

As usual, BYD got the first spot and sold 56,200, up 16.36% from 48,300 units the previous week.

BYD sells BEV and PHEV, but insurance registration doesn’t show the ratio. It is usually 50:50, with the trend leaning towards BEVs. In November, BYD sold 301,903 electric vehicles, of which 43.47% were PHEVs and 56.36% were BEVs. BYD ceased production of ICE vehicles in April last year.

Between January and November, BYD sold 2,683,374 vehicles, which means the Shenzhen-based company needs to deliver about 320,000 units in December to fulfill its 3 million target.

BYD started massive promotions and discounts for customers who buy their cars between December 1 and 31, so BYD will most likely fulfill the target easily and even overcome it.

BYD Seagull contributed with 8,400 sold units and BYD Yuan Plus (Atto 3) contributed with 6,000 units.

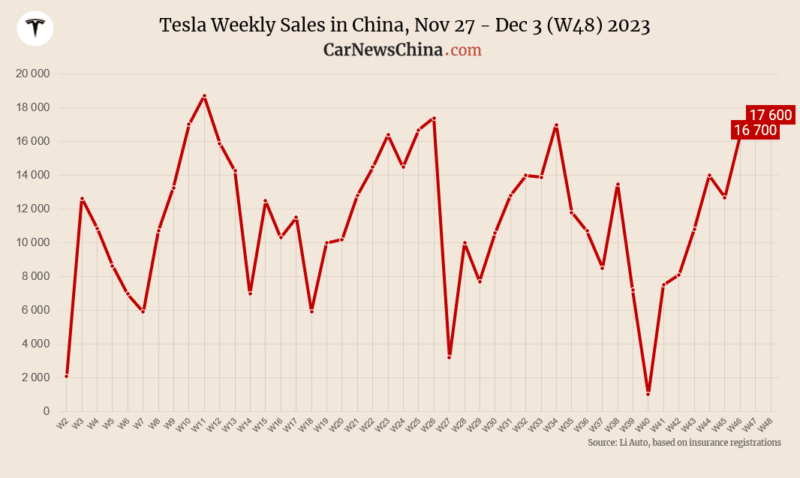

Tesla registered 17,600 EVs, up 5.39% compared with the previous week. New Model 3 sales kept declining second week in a row, while Model Y kept growing. Prepare for the Model 3 price cut soon. Tesla sold 82,432 China-made vehicles in November, up 14% from the previous month but down 18% from the same month last year.

Tesla sales breakdown:

- Model 3: 3,300 (-2.9% WoW)

- Model Y: 14,100 (+5.2% WoW)

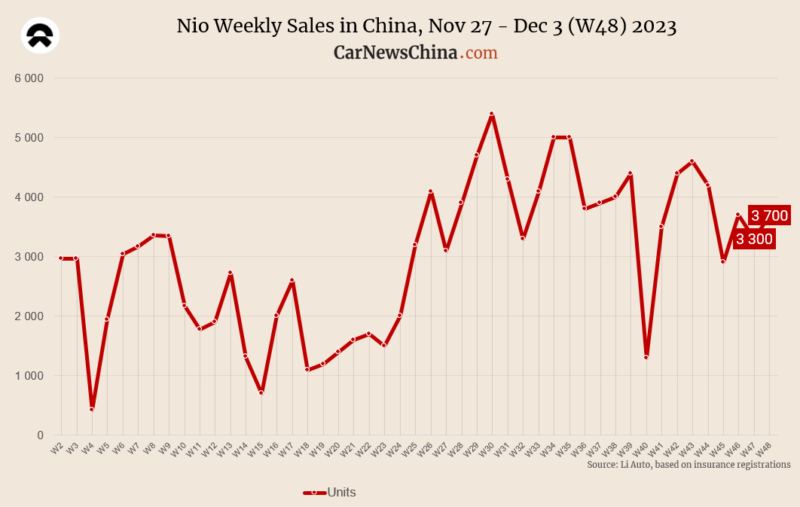

Nio registered 3,700 EVs, up 12.12% from the previous week. Nio delivered 15,959 EVs in November, almost the same as 16,074 in October. Most Nio sales are driven by only two models: the ES6 SUV and Nio ET5/ET5T sedan/station wagon.

Nio sales breakdown:

- ES6: 1,300 (up 15% WoW)

- ET5/ET5T: 1,300 (up 10% WoW)

- EC6 SUV-coupe: 700 (up 16% WoW)

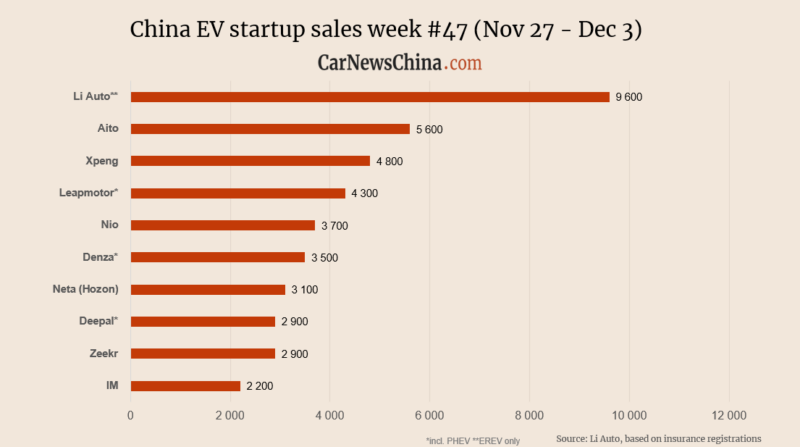

Huawei Aito is having its primetime in China as it registered a record-breaking 5,600 EVs, up 19.15% from the previous week. It secured them a second spot on the EV startups leaderboard, which Li Auto publishes. Huawei recently went all in, taking advantage of its deep pockets, massively discounted the Aito M7, and pushed it through its smartphone flagship stores to boost its flat sales. It worked. Will the upcoming M9 have the same success? We will keep an eye on it.

Li Auto remained the leader among EV startups, delivering 9,600 cars, up 2.13%. Beijing-based automaker sold a record 41,030 vehicles in November and targeted a 50,000 sales milestone in December.

Li Auto sells only range-extended electric vehicles (EREVs), which are EVs with ICE as a power generator for the battery, not connected to wheels. Later in December, Li Auto will launch its first all-electric car, Li Mega. It will be a massive MPV priced under 600,000 yuan (84,500 USD) with a futuristic design.

The third and fourth spots go to legacy-backed EV makers Xpeng and Leapmotor. Xpeng registered 4,800 EVs, up 9.09%. Xpeng delivered 20,041 units in November and 121,486 units in 2023 (January – November). Xpeng is backed by Volkswagen, which acquired 5% of the company in July and intends to use its Edward EV platform for two EVs in China.

Xpeng has had great success with its Tesla Model Y competition Xpeng G6 and 2024 Xpeng G9 large flagship SUV. Despite both cars being fair enough, the sales boost is also influenced by the renewed confidence of Chinese consumers in the company’s ability to survive among 160 other EV makers and fulfill the vehicle warranty. That is a significant side effect of the deal with VW.

Xpeng sales breakdown:

G6: 2,200 (up 9% WoW)

G9: 1,500 (up 22% WoW)

P7i sedan: 700 (down 14% WoW)

P5 sedan: 300 (down 2% WoW)

Leapmotor registered 4,300 EVs, up 4.88%. Leapmotor is backed by Stellantis, who became a strategic shareholder in October. Stellantis got exclusive rights to sell and produce Leapmotor vehicles outside China.

The only company experiencing a decline in week 48 was Changan’s EV brand Deepal, which registered 2,900 vehicles, down 9.38%.