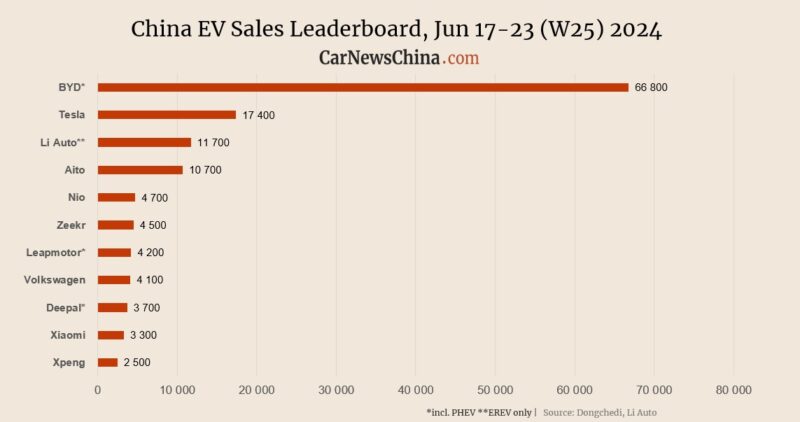

In week 25 of the year (June 17 – 23), the China EV market was firmly up, with no exceptions. Nio grew nearly 40% compared with the previous week, while Tesla sales were 50% up. BYD sales rose 17%, and Xiaomi sales rose 30%.

The weekly sales are published by Li Auto, and despite Li’s not explicitly saying it, they are clearly based on insurance registration data. The numbers are rounded and present sales of new energy vehicles (NEV), the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

BYD secured the top position, registering 66,800 vehicles, up 16.78% from 57,200 the week before. Throughout the first three weeks of the month (June 3 – 23), BYD sold 176,800 cars in China.

For BYD, this is second highest of the year.

Tesla saw significant growth, selling 17,400 vehicles, a 48.72% increase from 11,700 vehicles the previous week and up 20.00% from 14,500 in the same week last year. The week 25 (W25) of 2023 was June 19 – June 25. During the first three weeks of the month (June 3 – 23), Tesla sold 41,100 vehicles in China.

Tesla sales breakdown:

- Model Y: 11,300

- Model 3: 6,100

Notice we see the 2024 Model 3 (Highland) sales taking off again after being decimated last year by a flood of Chinese electric sedans at the 200,000 yuan level.

For Tesla, this is highest week of the year.

Li Auto registered sales of 11,700 vehicles, an increase of 11.43% from 10,500 vehicles last week and a 77.27% rise from 6,600 vehicles in the same week last year. Over the first three weeks of June, Li Auto sold 33,100 vehicles.

Li Auto Sales Breakdown:

- Li L6: 6,187

- Li L7: 2,570

- Li L9: 1,474

- Li L8: 1,329

- Li Mega: 143

Notice that Li Mega MPV sales are still way below expectations, which might be an even bigger headache for Li Auto than expected. Li Mega was launched in March and is the company’s first all-electric car, as it previously focused only on Extended Range Electric Vehicles (EREVs).

Aito reported selling 10,700 vehicles, up 15.05% from 9,300 vehicles the previous week and a significant increase of 664.29% from 1,400 vehicles in the same week last year. In the first three weeks of June, Aito sold 28,900 vehicles.

Aito Sales Breakdown:

- Aito M7: 4,651

- Aito M9: 4,129

- Aito M5: 1,886

Nio‘s sales rose to 4,700 vehicles, an increase of 38.24% from 3,400 vehicles last week and a substantial rise of 176.47% from 1,700 vehicles in the same week the previous year. Throughout the first three weeks of June, Nio registered 11,600 vehicles in China.

Nio sold 20,544 EVs in May, breaking its all-time high record from July last year when it sold 20,462 cars in a single month. In June, Nio expects to sell between 18,000 and 20,000 vehicles.

Nio Sales Breakdown:

- Nio ET5/ET5T: 1,843

- Nio ES6: 1,675

- Nio EC6: 592

- Nio ES8: 243

- Nio ET7: 207

- Nio EC7: 64

- Nio ES7: 51

Notice that the Nio ET5 sedan and its statin wagon variant ET5T became Nio’s best-selling model, surpassing the ES6 SUV.

Zeekr sold 4,500 vehicles, up 9.76% from 4,100 vehicles the previous week and a notable increase of 114.29% from 2,100 vehicles in the same week last year. During the initial three weeks of June, Zeekr sold 12,800 vehicles.

Leapmotor sold 4,200 vehicles, up 23.53% from 3,400 vehicles last week and a 23.53% increase from 3,400 vehicles in the same week the previous year. Over the first three weeks of June, Leapmotor’s sales totaled 11,400 vehicles.

Volkswagen reported 4,100 electric vehicles sold last week appeared in Li Auto-published stats for the first time since February.

Deepal sold 3,700 vehicles, an increase of 19.35% from 3,100 vehicles the previous week and a significant rise of 131.25% from 1,600 vehicles in the same week last year. In the first three weeks of June, Deepal sold 9,300 vehicles.

Xiaomi registered 3,300 units of SU7, up 32.00% from 2,500 units last week, marking its weekly record since deliveries started in early April. Throughout the first three weeks of June, Xiaomi sold 7,900 units of SU7. Xiaomi CEO and founder Lei Jun said the company aims to deliver 10,000 units in June and 120,000 vehicles in 2024. SU7 is the only model on sale, and it was launched on March 28.

For Xiaomi, this is the highest week since company started deliveries in April.

Xpeng sold 2,500 vehicles, an increase of 19.05% from 2,100 vehicles last week and a 19.05% rise from 2,100 vehicles in the same week the previous year. In the first three weeks of June, Xpeng sold 6,400 vehicles.

Xpeng Sales Breakdown:

- Xpeng G6: 1,121

- Xpeng G9: 646

- Xpeng X9: 398

- Xpeng P7: 294

- Xpeng P5: 71

- Xpeng G3: 5

Denza reported sales of 2,500 vehicles, up 25.00% from 2,000 vehicles last week and a slight increase of 4.17% from 2,400 vehicles in the same week the previous year. Over the first three weeks of June, Denza sold 6,600 vehicles.

IM sold 1,700 vehicles last week, an increase of 13.33% from the 1,500 vehicles sold the week before. Throughout the first three weeks of June, IM sold 4,700 vehicles.

Here is the list of the top 20 best-selling NEVs in China in week 25 (W25):

- Tesla Model Y: 11,300

- BYD Qin Plus: 9,800

- BYD Seagull: 8,700

- BYD Song Plus (Seal U): 8,200

- Li Auto L6: 6,200

- Tesla Model 3: 6,100

- BYD Yuan Plus (Atto 3): 6,000

- BYD Song Pro: 5,100

- BYD Qin L: 5,000

- Aito M7: 4,700

- BYD Han: 4,600

- BYD Destroyer 05: 4,600

- Aion Y: 4,400

- Aito M9: 4,100

- Aion S: 3,400

- Xiaomi SU7: 3,300

- BYD Tang: 3,200

- Zeekr 001: 3,100

- Wuling Bingo: 3,000

- Wuling Hongguang Mini EV: 2,900