In the first week of July, week 27 of the year, China’s EV market was down compared with the week before, with Xiaomi being an exception. Nio weekly insurance registrations were down 20%, Tesla was down 50%, and BYD 20%. Xiaomi registrations were up 15%.

Week 27 of 2024 (W27) 2024 is between July 1 and July 7. The week W27 2023, used for year-on-year comparison, was between July 3 and 9.

The weekly sales are published by Li Auto, and despite Li’s not explicitly saying it, they are based on insurance registration data. The numbers are rounded and present new energy vehicles (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

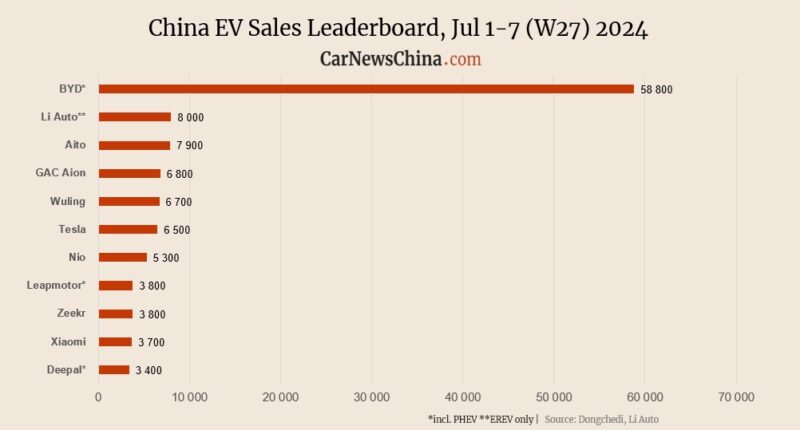

BYD secured the top position with 58,800 insurance registrations in China, down 22.43% from record-breaking 75,800 units the week before. Last month, in May, BYD sold 341,658 vehicles.

Tesla registered 6,500 vehicles, a decrease of 53,90% from 14,100 units the week before and an increase of 103,13% from 3,200 the previous year.

Li Auto registered 8,000 units this week, a decline of 38.46% from 13,000 units in the previous week. Year over year, registration increased marginally by 1.27% from 7,900 units.

Aito reported 7,900 vehicle registrations, a 36.80% drop from the previous week’s 12,500 units. Compared to last year, Aito experienced a significant increase, with sales surging 618.18% from just 1,100 vehicles.

GAC Aion’s registrations stood at 6,800 vehicles, marking a 17.07% decrease from 8,200 units the week before.

GM’s joint venture partner Wuling saw a decrease with 6,700 registrations, down 11.84% from 7,600 vehicles the previous week.

Nio registered 5,300 vehicles, down 22.06% from 6,800 units the week before. Sales have increased by 70.97% from 3,100 vehicles the previous year.

Nio delivered a record-breaking 21,209 vehicles in June, surpassing its all-time high from May last year when it delivered 20,544 vehicles.

Last month, Nio also delivered 44 EVs to the largest European automaker – Germany, down 70% year-on-year.

In June, Nio German CEO Marius Hayler stepped down after only eight months in the office and joined Polestar as a director for the Norwegian market. In 2023, Nio registered 1263 vehicles in Germany.

Nio will introduce its mass-market brand Onvo in Europe at the beginning of next year. This will be followed by an entry-level brand codenamed FireFly and its sub-30,000 EUR electric hatchback in 2025. Initially, Firefly was planned to launch in Europe, but after disappointing sales on the Old continent, Nio will launch the brand in China by the end of the year and bring it to Europe later.

Stellantis-backed Leapmotor recorded 3,800 registrations, a decrease of 20.83% from 4,800 units last week. Compared to last year, sales increased by 72.73% from 2,200 vehicles.

Geely’s Zeekr registered 3,800 vehicles this week, a decrease of 11.63% from 4,300 units. Registrations have increased by 65.22% compared to 2,300 vehicles last year.

Xiaomi had 3,700 registrations for its only car, the Xiaomi SU7, an increase of 15.63% from 3,200 units the week before.

Xiaomi delivered over 10,000 units of the SU7 sedan in June, heading to its target of 120,000 delivered vehicles in 2024, according to the company.

Deepal registered 3,400 vehicles, a decline of 30.61% from 4,900 units last week. Compared to last year, sales increased by 78.95% from 1,900 vehicles.

Volkswagen-backed Xpeng registrations declined to 1,800 vehicles, a 41.94% decrease from 3,100 units last week and a 50.00% increase from 1,200 cars a year ago.

BYD’s Denza registered 1,700 units, down 41.38% from 2,900 vehicles last week, with a 32.00% decrease from 2,500 vehicles a year earlier.