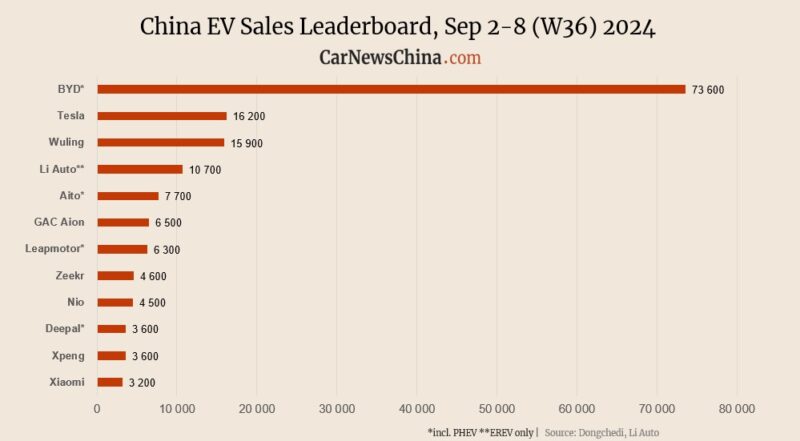

In the first week of September, week 36 of the year, the EV market was mostly down, with several exceptions. Xiaomi’s insurance registrations were up 10%, and Tesla was up 13% compared with the week before. Nio was down 25%, while BYD was down about 20%.

Week 36 of 2024 (W36) was between September 2 and 8. The week W36 2023, used for year-on-year comparison, was between September 4 and 10.

The weekly sales are published by Li Auto, and despite Li’s not explicitly saying it, they are based on insurance registration data. The numbers are rounded and present new energy vehicles (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

BYD maintained its lead in the market with 73,600 registrations, although this represents a decline of 17.12% compared to the record-breaking 88,800 registrations the previous week. However, year-over-year, BYD’s registrations have increased by 60.35% from 45,900 units.

Tesla reported 16,200 registrations, marking a 12.50% rise from the 14,400 registrations the week before and a substantial year-over-year growth of 51.40% from 10,700 units.

This is the best week since March for Tesla when it sold 17,300 EVs in week 17.

Wuling continued its upward trend, with 15,900 registrations, an 8.90% increase from 14,600 registrations in the previous week, and a remarkable 114.86% growth from 7,400 units year-over-year.

Li Auto recorded 10,700 registrations, down 5.31% from the 11,300 registrations the prior week. However, the company’s registrations have risen by 25.88% year-over-year from 8,500 units.

Aito had 7,700 registrations, reflecting a decline of 13.48% from the 8,900 registrations in the previous week. Year-over-year data is not available for comparison.

GAC Aion registered 6,500 units, down 10.96% from 7,300 units in the previous week and a decrease of 20.73% compared to 8,200 units year-over-year.

Leapmotor saw 6,300 registrations, a decrease of 10.00% from the 7,000 registrations the previous week. Year-over-year, Leapmotor’s registrations have surged by 133.33%, up from 2,700 units.

Zeekr reported steady registrations at 4,600 units, maintaining the same level as the previous week. This represents a significant year-over-year increase of 155.56% from 1,800 units.

Nio experienced a decline, with 4,500 registrations, down 25.00% from 6,000 units in the previous week, though still a year-over-year increase of 18.42% from 3,800 units.

Deepal registered 3,600 units, a 14.29% decline from the 4,200 units registered the week before, but a year-over-year increase of 24.14% from 2,900 units.

Xpeng saw a slight rise, registering 3,600 units, a 2.86% increase from the previous week’s 3,500 units and a 44.00% increase from 2,500 units year-over-year.

Xiaomi recorded 3,200 registrations, a 10.34% increase from the 2,900 registrations the week before. Year-over-year data is unavailable for comparison as Xiaomi’s only car, SU7 electric sedan, launched on March 28 with delivery start in April.

Denza reported 1,600 registrations, a 5.88% decline from the 1,700 registrations the previous week and a 36.00% decrease from 2,500 units year-over-year.