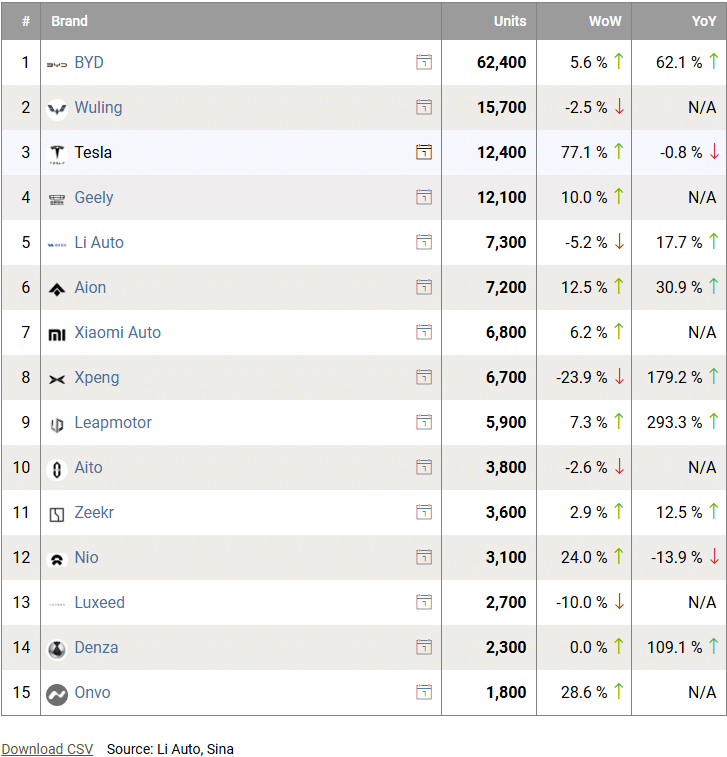

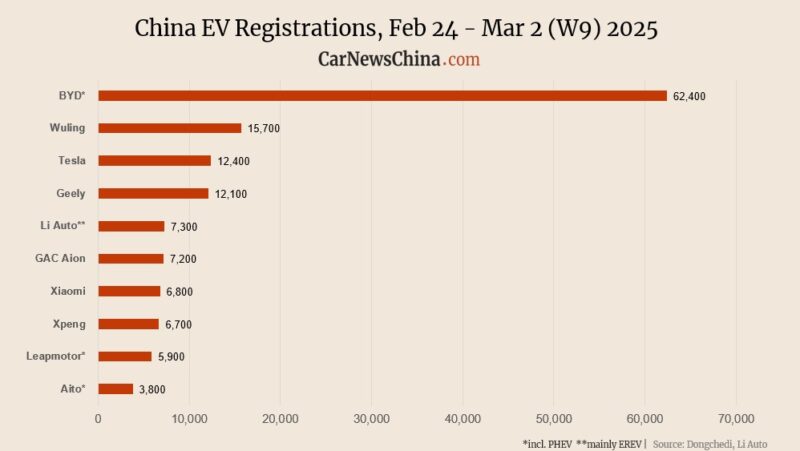

China EV registrations in Week 9: Nio 3,100, Xiaomi 6,800, Tesla 12,400, BYD 62,400

In week number 9 of the year, China EV market was mostly up, with several exceptions. BYD grew 6%, Xiaomi 6%, Nio 24% and Tesla 77%. Onvo sold 1,800 units, up 29%.

The weekly sales are published by Li Auto or Dongchedi, and despite Li’s not explicitly saying it, they are based on insurance registration data. The numbers are rounded and present new energy vehicles (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China. Onvo registrations are not published by Li Auto but come from China EV DataTracker.

Keep in mind that insurance registration and sales/deliveries are different datasets. Regulator-related automotive associations report insurance registration, while delivery data are self-reported by automakers, which might include show cars, test cars, and other instruments.

Week 9 of 2025 (W9) was between February 24 and March 2.

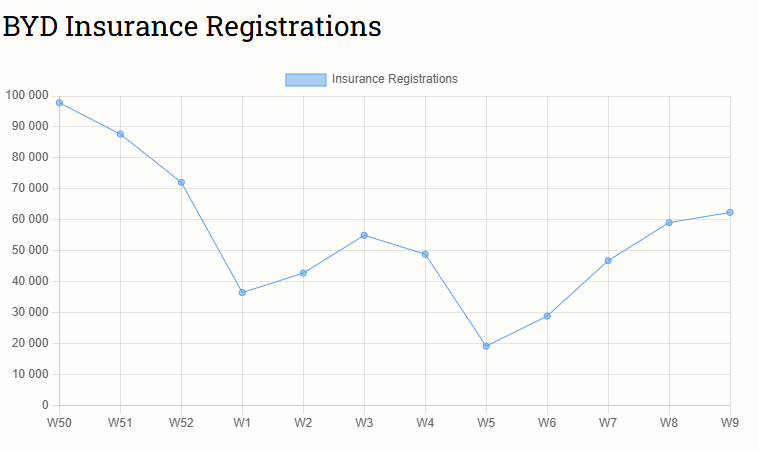

BYD secured the top position with 62,400 insurance registrations in China, up 5.6% from 59,100 units the week before.

BYD numbers show only BYD-badged cars, not other brands. Yangwang and Fang Cheng Bao didn’t make the list, but Denza maintained steady numbers with 2,300 registrations, unchanged from the prior week.

BYD Group sold 614,679 vehicles in January + February, up 90% from 322,767 units year-over-year. The reason it makes more sense to compare Jan+Feb combined is CNY, which is explained more here.

Wuling recorded 15,700 registrations, a slight decline of 2.5% from 16,100 units the previous week.

Tesla saw a strong surge with 12,400 registrations, increasing by 77.1% from 7,000 units the week prior. New Model Y ‘Juniper’ registered 6,660 units, and Model 3 registered 5,700 units.

Geely registered 12,100 vehicles, reflecting a 10.0% increase from 11,000 units the previous week.

Li Auto reported 7,300 registrations, down 5.2% from 7,700 units in the previous week.

In February+January, Li Auto delivered 56,190 vehicles, up 9.3% year-over-year.

GAC Aion recorded 7,200 registrations, marking a 12.5% increase from 6,400 units the week before.

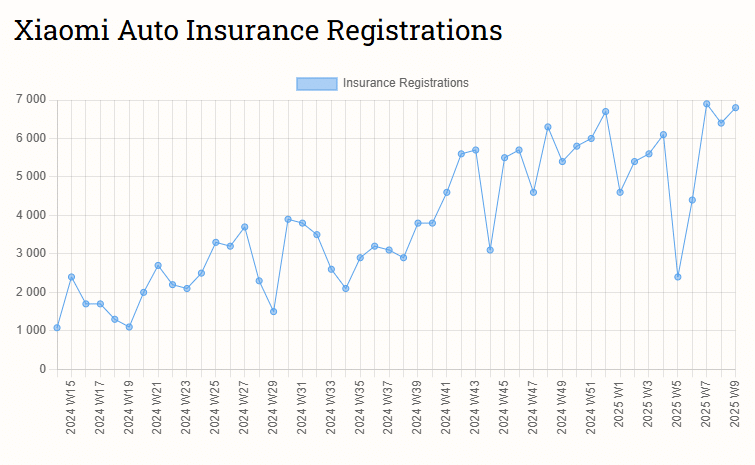

Xiaomi registered 6,800 units, up 6.3% from 6,400 units the previous week.

Xpeng recorded 6,700 registrations, a 23.9% decline from 8,800 units the prior week.

Model’s breakdown:

- Mona M03: 3,100 units

- XPeng P7+: 1,800 units

- Xpeng G6: 900 units

- Xpeng G9: 530 units

- Xpeng X9: 300 units

Xpeng delivered 60,803 vehicles in January + February, a year-on-year increase of 375%. So far, Xpeng’s monthly delivery volume has exceeded 30,000 vehicles for four consecutive months. About half of Xpeng’s sales in the last two months are done by the Mona M03 entry-level sedan.

Leapmotor reported 5,900 registrations, increasing 7.3% from 5,500 units in the previous week.

Aito registered 3,800 units, down 2.6% from 3,900 units the previous week.

Zeekr saw 3,600 registrations, growing 2.9% from 3,500 units the prior week.

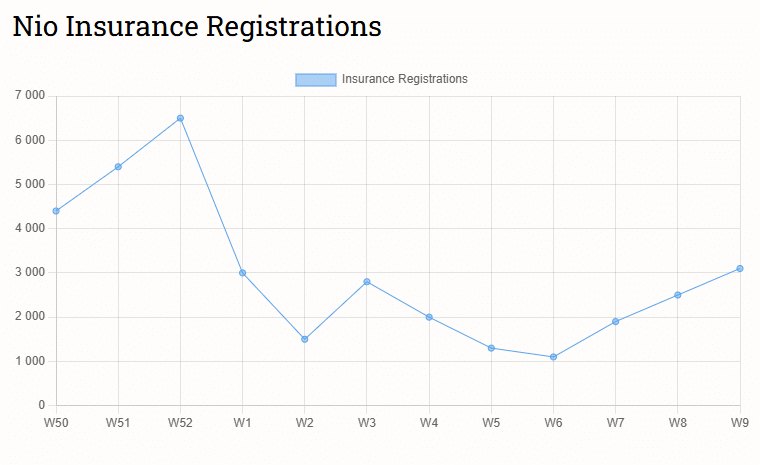

Nio recorded 3,100 registrations, marking a 24.0% increase from 2,500 units the previous week.

Model’s breakdown:

- ES6: 1,080 units

- ET5 Touring: 880 units

- EC6: 490 units

- ET5: 380 units

- ET7+ES7+ES8: less than 300 units

The company sold 17,094 Nio-branded vehicles in January + February 2025, down 6% from 18,187 in January + February 2024. The reason it makes more sense to make a year-over-year comparison with Jan+Feb combined is due to CNY and is explained more here.

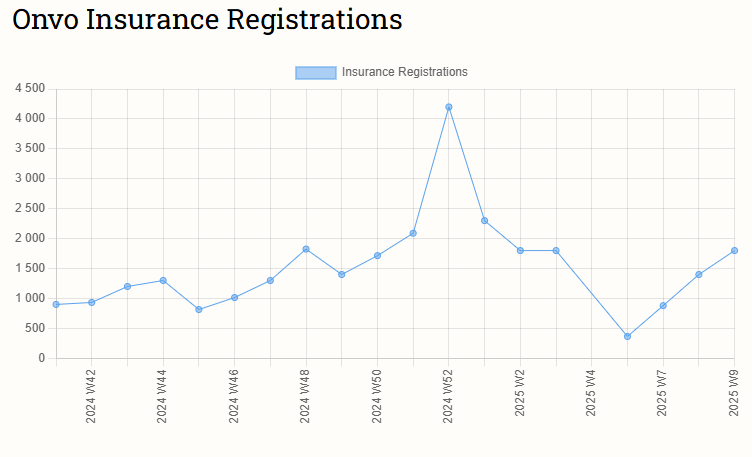

Nio’s entry-level brand Onvo registered 1,800 units, up 28.6% from 1,400 units the previous week. Together, Nio Group registered 4,900 vehicles in China in week 9.

In January + February 2025, Nio Group sold 27,055 vehicles, up 49% from 18,187 units in January + February 2024.

In February, Onvo delivered 4,049 EVs, so this month, they have to sell 5x as many vehicles to fulfill the promise CEO Alan Ai gave at Guangzhou Auto, that Onvo will deliver 20,000 units in March

Luxeed registered 2,700 vehicles, reflecting a 10.0% drop from 3,000 units in the previous week.