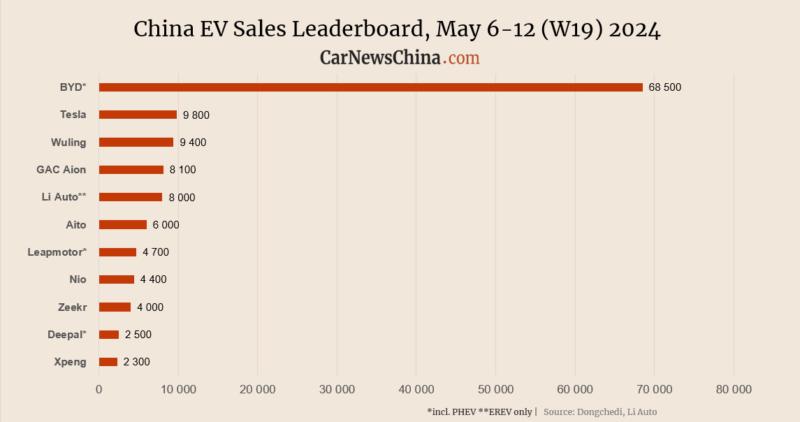

China EV registrations in W19: Xiaomi 1,100, Nio 4,400, Tesla 9,800, BYD 68,500

The 19th week of the year (May 6-12) saw the EV market strongly rise in China, except for Tesla and Xiaomi. BYD was up about 30%, Nio was up 20%, Tesla was down 10%, and Xiaomi was 15% down, marking the third week with no rise.

Li Auto publishes the weekly sales data, which resumed publishing registration data after a few weeks without any official explanation. The numbers are rounded and present new energy vehicles (NEV), the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

As usual, BYD took the first spot, registering 68,500 vehicles, up 30.23% from 52,600 vehicles the week before. In the first half of the month, between May 1 – 12, BYD registered 101,300 vehicles in China.

Tesla registered 9,800 vehicles, down 10.91% from 11,000 vehicles the week before. In the first half of the month, between May 1 – 12, Tesla registered 11,690 vehicles in China.

Tesla sales breakdown:

- Model Y: 8,500 vehicles

- Model 3: 1,300 vehicles

GM’s Chinese joint venture with SAIC, SGMW’s Wuling, registered 9,400 vehicles, up 2.17% from 9,200 vehicles the week before. In the first half of the month, between May 1 – 12, Wuling registered 0 vehicles in China.

GAC Aion registered 8,100 vehicles, up 145.45% from 3,300 vehicles the week before. In the first half of the month, between May 1 – 12, GAC Aion registered 0 vehicles in China.

With over half a million sold NEVs in 2023, GAC is the latest member of Nio’s battery swap alliance.

Li Auto registered 8,000 vehicles, up 50.94% from 5,300 vehicles the week before. In the first half of the month, between May 1 – 12, Li Auto registered 10,800 vehicles in China.

Li Auto used to sell only EREVs and, in March, launched its first all-electric vehicle – Li Mega futuristic minivan. The acceptance of Li Mega was lukewarm and Li Auto had to adjust its annual sales target from 800,000 to 560,000 – 640,000 units.

Li Auto sales breakdown:

- Li L6: 2,800 vehicles (smallest Li’s SUV)

- Li L7: 2,100 vehicles

- Li L9: 1,600 vehicles (flagship SUV)

- Li L8: 1,300 vehicles

- Li Mega: 140 vehicles (MPV)

Huawei’s brand Aito registered 6,000 vehicles, up 25.00% from 4,800 vehicles the week before. In the first half of the month, between May 1 – 12, Aito registered 8,100 vehicles in China.

Aito offers all its models, such as BEV or EREV. Aito M5 is a new model which will officially start deliveries tomorrow on April 15.

Aito sales breakdown:

- Aito M9:3,700 vehicles

- Aito M7: 1,900 vehicles

- Aito M5: 400 vehicles

Stellantis-backed Leapmotor registered 4,700 vehicles, up 104.35% from 2,300 vehicles the week before. In the first half of the month, between May 1 – 12, Leapmotor registered 5,600 vehicles in China.

Nio registered 4,400 vehicles, up 22.22% from 3,600 vehicles the week before. In the first half of the month, between May 1 – 12, Nio registered 5,600 vehicles in China. The Nio ES6 SUV and Nio ET5 + its station wagon variant ET5T accounted for 75% of all the sales. CarNewsChian previously reported that Nio should discontinue some of its low-performing models.

Nio sales breakdown:

- Nio ES6: 1,800 vehicles

- Nio ET5/ET5T: 1,500 vehicles

- Nio EC6: 700 vehicles

- The rest (ES8+ET7+EC7+ES7): 400 vehicles

Zeekr registered 4,000 vehicles, up 11.11% from 3,600 vehicles the week before. In the first half of the month, between May 1 – 12, Zeekr registered 5,600 vehicles in China.

Deepal registered 2,500 vehicles, up 8.70% from 2,300 vehicles the week before. In the first half of the month, between May 1 – 12, Deepal registered 3,700 vehicles in China.

Volkswagen-backed Xpeng registered 2,300 vehicles, up 64.29% from 1,400 vehicles the week before. In the first half of the month, between May 1 – 12, Xpeng registered 2,800 vehicles in China.

BYD’s brand Denza registered 2,200 vehicles, up 37.50% from 1,600 vehicles the week before. In the first half of the month, between May 1 – 12, Denza registered 2,800 vehicles in China.

Voyah registered 1,200 vehicles, up 20.00% from 1,000 vehicles the week before. In the first half of the month, between May 1 – 12, Voyah registered 1,500 vehicles in China.

Xiaomi registered 1,100 vehicles, down 15.38% from 1,300 vehicles the week before. In the first half of the month, between May 1 – 12, Xiaomi registered 2,000 vehicles in China.

This is Xiaomi’s third week without a rise. In week 16, mid-last month, Xiaomi registered 1,700 EVs in China; since then, it has been 1,700, 1,300, and last week’s 1,100.

Xiaomi reportedly received over 100,000 locked-in orders for its only car, the Xiaomi SU7 sedan. Lei Jun, Xiaomi’s founder, also said that the company plans to deliver 100,000 cars by the year’s end. Low registration numbers might indicate that ramping up production at its new Beijing factory is experiencing bumpers. The plant is operated by BAIC Off-road Vehicle Co., a state-owned Beijing Auto subsidiary and the Xiaomi SU7 contract manufacturer.