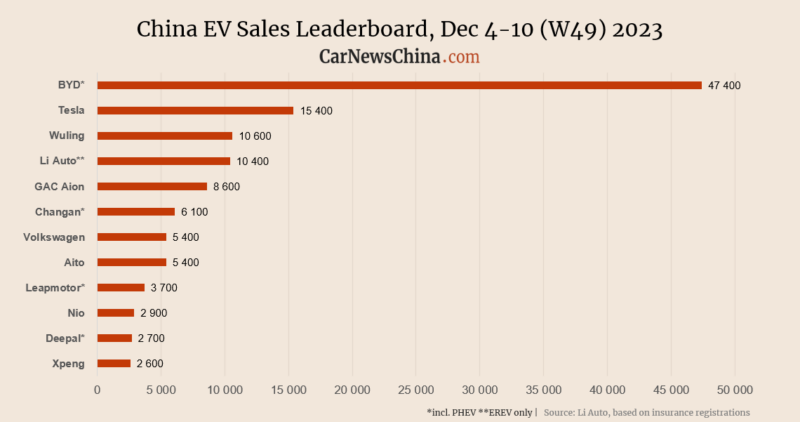

China EV sales in week 49: BYD 47,400, Tesla 15,400, Nio 2,900

In week #49 of this year, December 4 – 10, the China EV market was down despite the end-of-year sales push and time-limited December price cuts that most automakers introduced. BYD was down 17%, Tesla was down 13%, and Nio was down 22% compared with the previous week.

The weekly data were published by Li Auto, and they represent weekly sales. The background data are weekly insurance registrations. The numbers are rounded and present new energy vehicles (NEV), the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

As usual, BYD got the first spot and registered 47,400 vehicles, down 15.66% from the previous week. From December 1 to December 10, BYD sold 64,400 cars in China.

BYD sells BEV and PHEV, but insurance registration doesn’t show the ratio. It is usually 50:50, with the trend leaning towards BEVs. In November, BYD sold 301,903 electric vehicles, of which 43.47% were PHEVs and 56.36% were BEVs. BYD ceased production of ICE vehicles in April last year.

BYD started massive promotions and discounts for customers who buy their cars between December 1 and 31, so being down WoW is pretty surprising. If the trend continues in the next week, it might threaten BYD’s goal to sell 3 million vehicles in 2023.

Tesla registered 15,400 EVs, down 12.50% from the previous week. Between December 1 and 10, they registered 23,500 units in China. Tesla recently announced its Model Y Long Range is sold out until the end of the year in China. Model 3 Highland registrations continued to decrease third week in a row.

Tesla sales breakdown:

- Model Y: 12,100 (-14% WoW)

- Model 3: 3,300 (-1.5% WoW)

Tesla sold 82,432 China-made vehicles in November, up 14% from the previous month but down 18% from the same month last year.

The November export from Giga Shanghai was 16,928 units, down 61,08% from October and 55.21% from the same month last year.

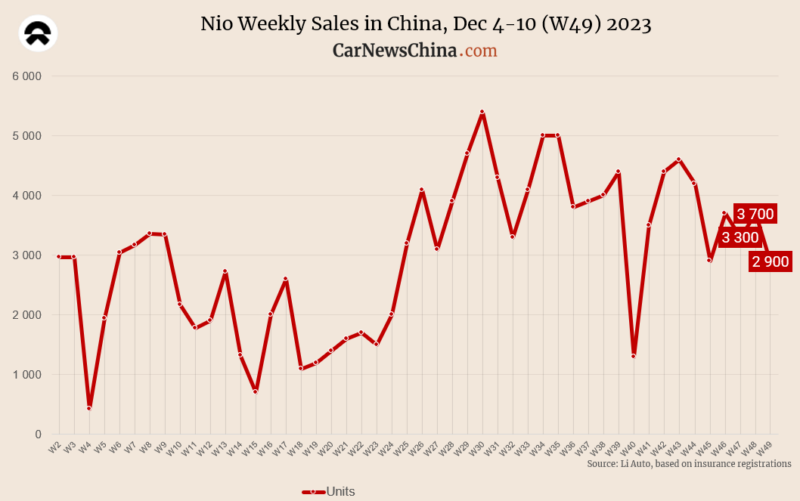

Nio registered 2,900 vehicles, down 21.62% from the previous week. Between December 1 and December 10, Nio registered 4,400 EVs in China.

Nio sales breakdown of main models:

- ES6: 1,100 (-14% WoW)

- ET5: 900 (-28% WoW)

- EC6: 530 units (-23% WoW)

Nio delivered 15,959 EVs in November, almost the same as 16,074 in October. Most Nio sales are driven by only two models: the ES6 SUV and the Nio ET5/ET5T sedan/station wagon.

Hefei-based automaker announced it doesn’t plan to launch a new Nio-badged product in 2024. During the Nio day held on December 23, the company will most likely unveil a luxurious Mercedes Maybach-like limousine with a price tag of around 1 million yuan (140k USD). However, the car will launch in 2025 and will most likely be dedicated more to brand building and showing the technological capabilities of the new NT3 platform.

In November, Nio acquired the F1 and F2 plants in Hefei from its former contract manufacturer, JAC, and obtained an independent manufacturing license. Nio paid about 1,200 USD per vehicle to JAC. Now, as the company takes care of production operations on its own, it said it will save about 10% of that cost.

Nio is also forming a battery-swapping alliance with Chinese automakers – Geely and Changan are the first members who signed the contract. The company also plans to launch a new Alps (codename) entry-level brand into a 200k – 300k yuan segment. This price segment is super crowded in China, mainly dominated by BYD, but more players will join in 2024. Xiaomi, for example, and Nio will have to put lots of effort into navigating this crowded space.

Li Auto was among only two automakers that grew in week 49. It registered 10,400 units, 8.33% up from the previous week. Between December 1 -10, they sold 13,000 vehicles.

Li Auto sells only range-extended electric vehicles (EREVs), which are EVs with ICE as a power generator for the battery, not connected to wheels. Later in December, Li Auto will launch its first all-electric car, Li Mega. It will be a massive MPV priced under 600,000 yuan (84,500 USD) with a futuristic design.

Huawei-backed Aito got the second spot among EV startups again. They registered 5,400 vehicles, down 3.57% from the previous month. Between December 1 and 10, they sold 7,200 cars in China.

Huawei recently went all in, taking advantage of its deep pockets, massively discounted the Aito M7, and pushed it through its smartphone flagship stores to boost its flat sales. It worked. With monthly sales unable to leave the 3- 4k units area, the once-struggling EV brand skyrocketed.

Aito delivered a record 18,827 cars in November, up 128% from the previous year and 48% from October.

Stellantis-backed Leapmotor was third with 3,700 registered units, down 13.95% from the previous week. Changan’s EV brand, Deepal, registered 2,700 vehicles, down 6.9%. It was followed by Volkswagen-backed Xpeng, which registered 2,600 down 45.83%, the second highest slip among all brands in week 49. The highest slip was experienced by BYD’s Denza, which registered 1,700 vehicles, down 51.43% from the previous week. Zeekr was down 34.48% and registered 1,900 EVs in China.