Tesla exported nearly half of its China-made vehicles from Giga Shanghai in April

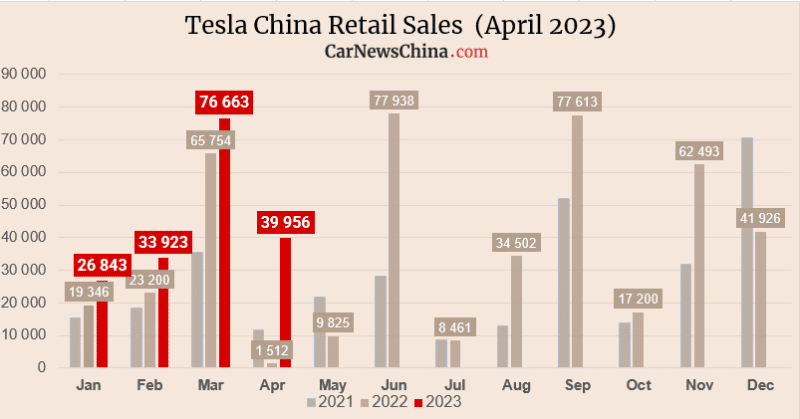

On May 9, the Chinese Passenger Car Association (CPCA) released vehicle sales data for April. It revealed that Tesla sold 39,956 vehicles on the Chinese market, and 35,886 China-made cars were exported from the Shanghai plant overseas.

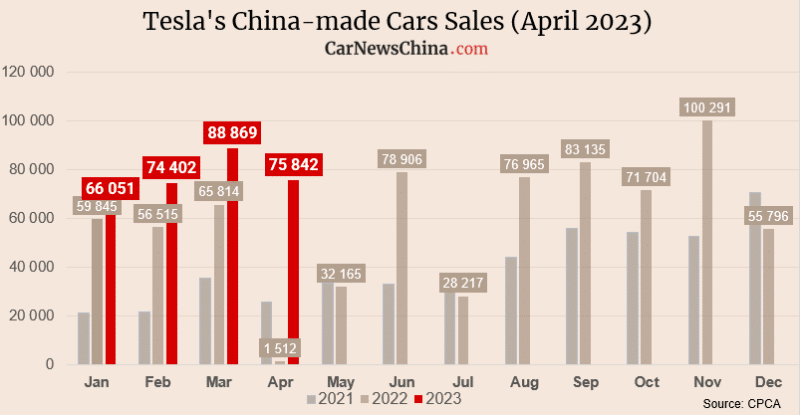

The total sales of made-in-China vehicles were 75,842 in April. Be aware – these are not production numbers of Giga Shanghai, but sales numbers of the factory. That means that 52.68% of vehicles were sold domestically, and 47.32% were exported overseas to Europe, Canada, and other regions.

In April last year, Tesla sold 1,512 vehicles domestically, which theoretically grew 2,500% year-on-year. Still, as last April was affected by covid lockdowns, it is not so relevant to compare. In April 2021, Tesla sold 11,671 vehicles domestically.

The previous month – March 2023 – Tesla sold 76,663 vehicles in China, which makes April sales 47,88% down when compared month-on-month. However, for Giga Shanghai, the first month of the quarter (January, April, July, September, and October) is usually dedicated to export, while the last month (March, June, September, and December) is committed to domestic sales.

For Tesla, this is the best first month of the quarter regarding China sales.

CPCA didn’t release the sales breakdown for particular models, but we have the breakdown of the Giga Shanghai wholesales (which includes export) – 49,059 units of Model Y and 26,783 units of Model 3. That is a 1:2 ratio; for each Model 3, two Model Ys were sold.

Tesla sold 305,164 vehicles made in China between January and April, indicating a 66% increase from the 183,686 units sold in the corresponding period of the previous year. Additionally, the total sales for 2022 reached 710,866, representing an increase of 47% compared to the last year’s figure of 2021.

Editor’s comment

In November and January, Tesla significantly cut the prices of Model Y and Model 3 in China, which was one reason for the start of the price war in China. The other part of the equation was the Chinese emissions norm 6b (something like EURO 7 in the EU), which will go into effect on July 1 and make some of the ICE vehicles inventory unsellable. That made some of the dealers panics and cut the prices for ICE vehicles.

In early May, Tesla slightly increased the prices of Model 3 and Y in China, just about 2000 yuan (289 USD). While this will not help with the margin or won’t save much money out of consumer pocket, it is an essential signal to the market – price cuts are over. Many consumers in China were still waiting for more discounts and postponing their purchases.

This is also a good message for the competition, which was feeling lots of pressure. Overall, the price hike can actually boost sales on the Chinese market, and not only for Tesla, as hesitant customers got the message that after four months of racing to the bottom, now is the time to buy.

However, the Model 3 mid-term facelift is expected to be unveiled in September in China, so the surprise older Model 3 discount is also in the game in Q3.

Image credit: Tesla China