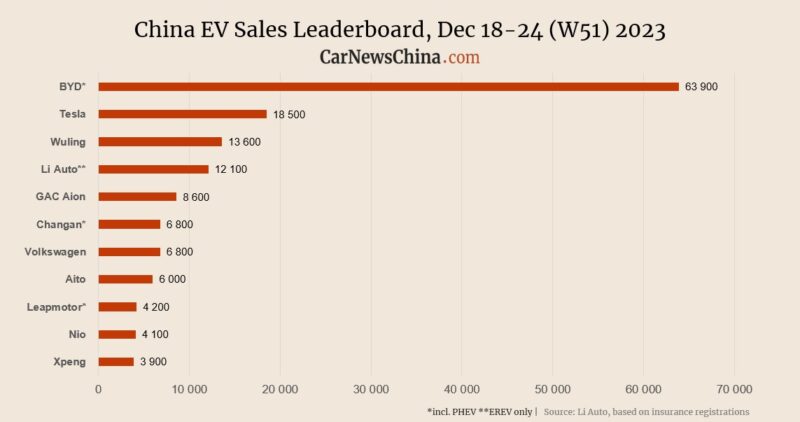

China EV sales in week 51: BYD 63,900, Tesla 18,500, Nio 4,100

Edit: The article was updated with sales breakdown to models.

In week 51 of this year, December 18-24, the market was up in a massive end-of-year sales push, except for Xpeng and Denza, which were down about 20%. BYD grew 24%, Tesla was mostly flat with 1% growth, and Nio grew 21%.

The weekly data were published by Li Auto, and they represent weekly sales. The background data are weekly insurance registrations. The numbers are rounded and present new energy vehicles (NEV), the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

BYD registered 63,900 vehicles last week, up 23.60% from 51,700 the week before. From December 1 to 24, BYD registered 180,000 cars in China.

BYD needs to sell 320,000 vehicles globally in December to fulfill its annual target of 3 million. Between January and November, BYD sold 2,683,374 cars globally. About 90% of BYD sales are in China, and 10% are overseas. The registration numbers in this article refer only to registrations in China.

To fulfill its annual target, BYD started massive promotions and discounts for customers who buy their cars between December 1 and 31.

BYD sells BEV and PHEV, but insurance registration doesn’t show the ratio. It is usually 50:50, with the trend leaning towards BEVs. In November, BYD sold 301,903 electric vehicles, of which 43.47% were PHEVs and 56.36% were BEVs. BYD ceased production of ICE vehicles in April last year.

BYD sales breakdown (key models only):

- Song Plus: 10,400 (+22% WoW)

- Qin Plus: 9,400 (+25% WoW)

- Seagull: 8,700 (+18% WoW)

- Dophin: 6,200 (+20% WoW)

- Yuan Plus (Atto 3): 6,200 (+10% WoW)

- Han: 4,100 (+19% WoW)

- Seal: 2,700(+14% WoW)

- Song L: 770 units

BYD sub-brands:

Tesla registered 18,500 EVs last week, up 1.09% from 18,300 the previous week. Between December 1 and December 24, Tesla sold 60,200 vehicles in China.

Tesla sold 82,432 China-made vehicles in November. 65,504 were sold domestically, and 16,928 were exported from the Giga Shanghai factory for overseas markets.

Tesla sales breakdown (main models only, no S and X)

- Model Y: 14,400 (flat from the week before, 0% WoW)

- Model 3: 3,800 (+26.2% WoW)

Nio registered 4,100 EVs last in China, up 20.59% from 3,400 the week before. Between December 1 and 24, Nio registered 12,000 EVs in China.

Nio’s December target is to deliver 15,000 – 17,000 EVs, and based on the insurance registration trend, they will reach the upper limit of that target or even overcome it.

In November, Nio delivered 15,959 EVs.

Nio sales breakdown:

- ES6: 1,600 (+17% WoW)

- ET5/ET5T: 1,300 (+26% WoW)

- EC6: 640 (+19%)

Li Auto was first among EV startups and registered 12,100 vehicles last week, up 7.08% from 11,300 the week before.

Li Auto sales breakdown:

- Li L7: 4,900

- Li L8: 3,800

- Li L9: 3,400

The company aims to break the 50,000 monthly deliveries record for the first time in December. Between December 1 and December 24, the company registered 36,400 vehicles.

Li Auto sells only in China, so they must register 13,600 units this week to achieve its goal.

Li Auto sells only three models, all SUVs and electric range extended vehicles (EREVs). EREV is a type of plugin hybrid, where a small ICE only works as a power generator for the battery and is not connected to the wheels.

Li Auto plans to launch its first all-electric vehicle – Li Mega MPV – by the end of December, with deliveries to start in February, according to a company statement from last month.

The week 51 wasn’t good for Xpeng. The company registered only 3,900 EVs, down 18.75% from the week before. Between December 1 and 24, Xpeng sold 12,500 EVs in China.

On December 18, Xpeng introduced temporary discounts on their best-seller and Tesla Model Y competitor, Xpeng G6. The electric SUV got a 10,000 yuan (1,400 USD) haircut if bought before month’s end. This brings the price of the G6 base model under the psychological 200k yuan level to 199,900 yuan.

Xpeng G6 was responsible for 44% of all Xpeng’s sales in November, selling 8,750 units.

Xpeng sales breakdown:

- G6: 1,500 (-15% WoW)

- G9 830 (mostly flat)

- P7i 830 (+15% WoW)

- P5: 380 (-70%)

One automaker might be in trouble despite not seeing it from the chart. Neta didn’t reach the top 10 of Li Auto’s list. That means they sold less than 1,700 EVs, the lowest reported results, belonging to Voyah. Neta is struggling to leave the 2-3k weekly delivery in 2023, and despite manufacturing budget EVs with fair enough quality, it might be one of the price war victims in 2024. Between December 1 and 24, Neta sold 5,800 EVs in China.

BYD’s brand Denza registered 2,300 vehicles last week, down 17.86% from 2,800 the week before. Denza is a former joint venture between BYD and Mercedes-Benz, which the latter exited in 2021 and kept only a 10% stake. BYD is now entirely in charge of operations. Denza sells three cars: Denza D9 MPV and N7 and N8 SUVs, which might have some cannibalization with BYD badged cars. For example, Denza N7 is a sister car of BYD Song L.

Zeekr registered 2,800 EVs last week in China, up 27.27% from 2,200 units the week before. Zeekr also sells three cars in China: the Zeekr 001 SUV fastback, the Zeekr 009 MPV, and the Zeekr X SUV. Those will be joined by the Zeekr 007 sedan, which will launch tomorrow.

Huawei’s brand Aito, which is manufactured by Seres, registered 6,000 vehicles last week, up 9.09% from 5,500 the week before. Aito is on fire recently as it introduced massive discounts on its lineup, and the Aito M5 and Aito M7 started selling well. The upcoming Aito M9 got 20k pre-orders in November and will start deliveries in February. Huawei used its deep pockets to make once struggling Aito a serious player in China’s EV race.

Aito sales breakdown

- Aito M7: 5,000 (+9% WoW)

- Aito M5: 1,000 (+11% WoW)

Volkswagen sold 6,800 EVs of its ID. series last week, up 28.30% from the week before. VW will launch the 2024 annual facelift of ID.3 on January 1, leading to discounts on current stock EVs. FAW-VW launched ID.7 Vizzion in China on December 15, which received only 300 orders in three following days, according to the report.