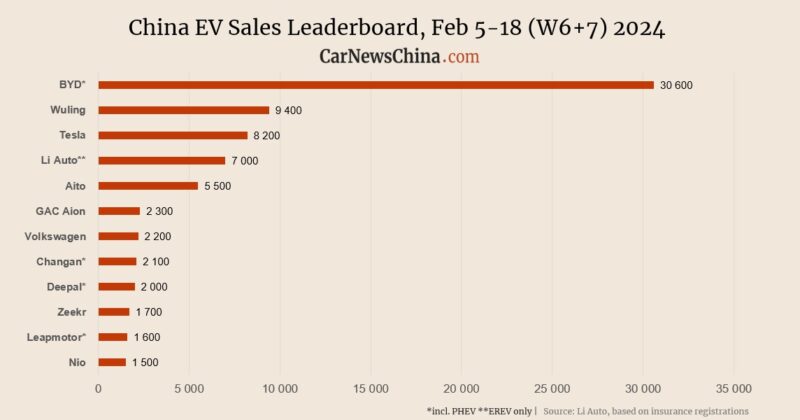

China EV registrations in W6+7: BYD 30,600, Tesla 8,200, Li Auto 7000, Nio 1,500

The insurance registration data were released combined for the past two weeks, from February 5 – 18, due to the Chinese New Year holiday. The car sales were significantly down due to celebrations. However, Li Auto sold nearly the same amount as in a pre-CNY week.

The weekly data were published by Li Auto, and they represent weekly sales. The background data are weekly insurance registrations. The numbers are rounded and present new energy vehicles (NEV), the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

In the article, we will consider the holiday weeks number 6 and 7 as one and compare it to the pre-CNY week number 5 (29 Jan – 4 Feb), only for comparison of how significant the CNY is in terms of sales.

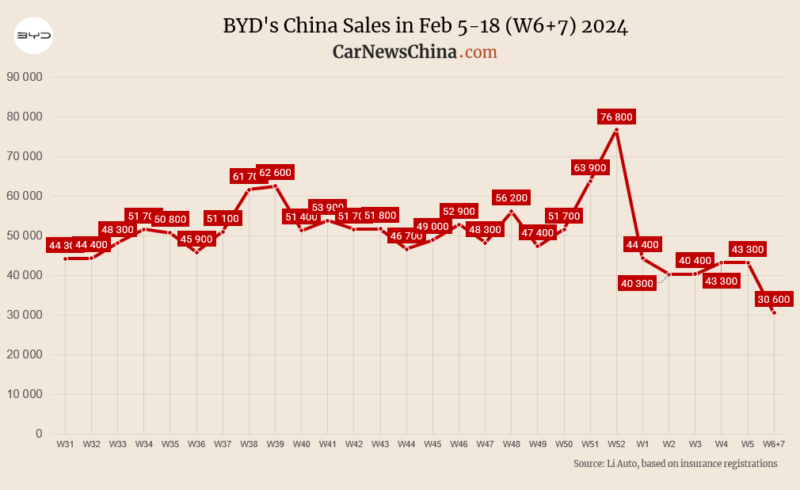

BYD registered 30,600 vehicles, down 30% from 43,300 in week 5. Between February 1 – 18, the company sold 49,400 vehicles in China.

BYD brands sales breakdown:

- YangWang: 260 units

- Fang Cheng Bao: 670 units

- Denza: 2,200 units

YangWang sells a sole car, 150k USD YangWang U8 hardcore SUV. Fang Cheng Bao also sells only one car, the Bao 5 (Leopard 5), which is positioned between the YangWang and Denza lineups.

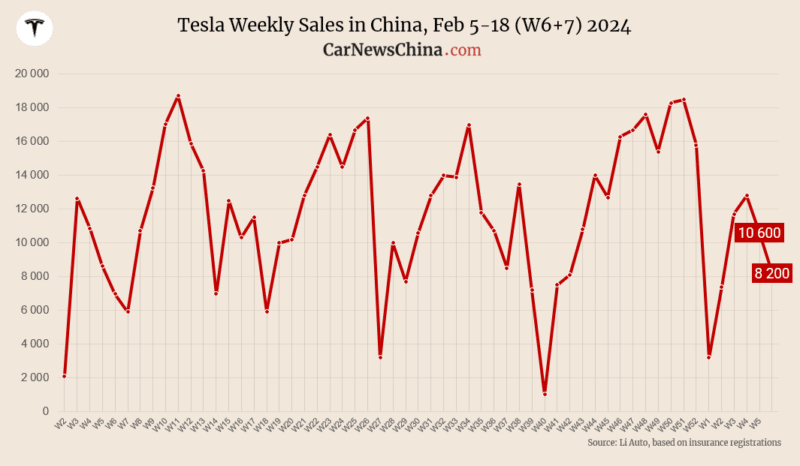

Tesla registered 8,200 EVs, down 23% from 10,600 in week 5. Between February 1 – 18, the company sold 13,500 vehicles in China.

Tesla sales breakdown:

- Model Y: 6,300 units

- Model 3 (Highland): 1,900 units

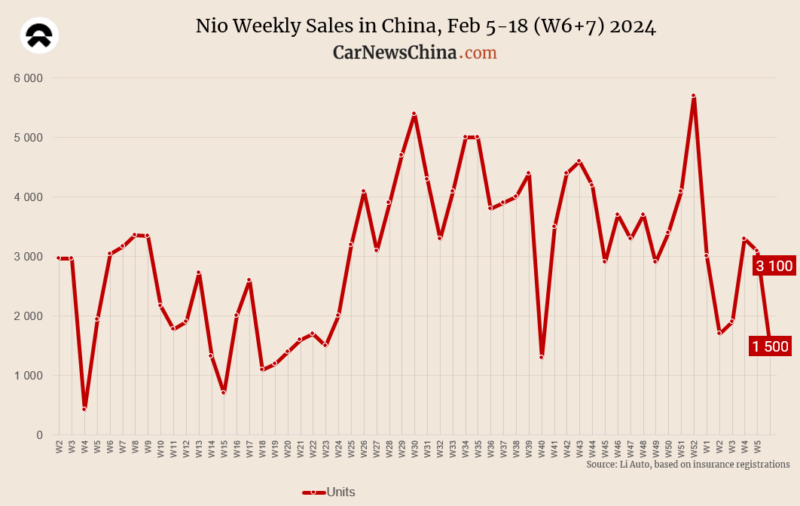

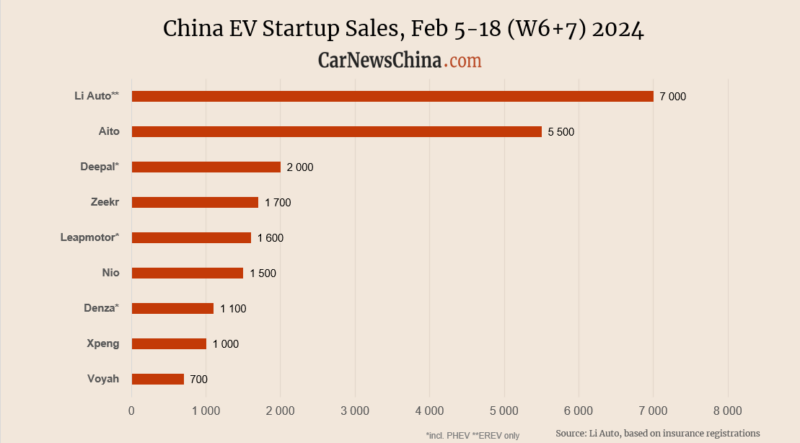

Nio registered 1,500 EVs, down over 50% from 3,100 in week 5. Between February 1 – 18, the company sold 2,800 vehicles in China.

In 2023, Nio delivered 160,038 units globally and their 2024 goal is to deliver 230,000 units.

Nio main models sales breakdown:

- Nio ET5/ET5T: 570 units

- Nio ES6: 540 units

- Nio EC6: 210 units

- The rest less then 140

Li Auto was a usual first among Chinese EV startups. The Beijing-based automaker registered 7,000 vehicles, 3% down from week 5, becoming the automaker with the best sales continuity even during holidays. Between February 1 – 18, the company sold 10,100 vehicles in China.

Li Auto delivered 376,030 vehicles in 2023 and their target for 2024 is 800,000 sold vehicles.

Li Auto breakdown:

- L7: 2,900units

- L9: 2,100 units

- L8: 2,000 units

Huawei-backed Aito was second among EV startups, registering 5,500 vehicles, down 40% from 9,000 vehicles in week 5. Between February 1 – 18, the company sold 9,800 vehicles in China.

Aito sells both all-electric cars (BEV) and Extended Range Electric Vehicles (EREV), like Li Auto.

Aito breakdown:

- Aito M7: 4,600 units

- Aito M9: 520 units

- Aito M5: 340 units

Changan’s brand, Deepal, sold 2,000 vehicles, down 35% from 3,100 on week 5. Between February 1 – 18, the company sold 3,300 vehicles in China.

Zeekr sold 1,700 vehicles, down about 50% from 3,600 on week 5. Between February 1 – 18, the company sold 3,600 vehicles in China.

Stellantis-backed Leapmotor sold 1,600 vehicles, down 45% from 3,000 in the previous period. Between February 1 – 18, the company sold 2,900 vehicles in China.

Volkswagen-backed Xpeng sold 1,000 vehicles, down 62.96% from 2,700 in the previous period. Between February 1 – 18, the company sold 1,800 vehicles in China.

Xpeng delivered 141,601 EVs in 2023, and their target for 2024 is to double that number to 280,000 units.

Xpeng breakdown:

- Xpeng G6: 300 units

- Xpeng P7: 220 units

- Xpeng X9: 200 units

- Xpeng G9: 160 units

- Xpeng P5: 50 units