Average EV prices in March in China: BYD’s Denza is the most expensive, Li Auto second, and Nio fourth

On April 3, Sina Finance reported comparing EV delivery data of the top 10 Chinese EV startups with their average car price. Li Auto sold over 20 thousand cars in March with an average price of $58,300, which is enough for the second position. The winner is BYD’s new subbrand Denza which sold over 10 thousand cars with an average price of $60,200.

Voyah, which sold over 3 thousand vehicles, got the third spot, with an average price of one car being $55,500. The premium carmaker Nio sold over 10 thousand cars for an average price of $54,000.

| Position | Brand | Deliveries | Average price (yuan) | Average price (USD) |

| 1 | Li Auto** | 20,823 | 401,900 | 58,300 |

| 2 | Denza | 10,398 | 415,000 | 60,200 |

| 3 | Nio | 10,378 | 371,900 | 54,000 |

| 4 | Hozon (Neta) | 10,087 | 99,000* | 14,400 |

| 5 | Shenlan (Deepal) | 8,568 | 185,000 | 26,900 |

| 6 | Xpeng | 7,002 | 240,000 | 34,900 |

| 7 | Zeekr | 6,663 | 298,000 | 43,300 |

| 8 | Leap Motor | 6,175 | 128,000* | 18,600 |

| 9 | Aito | 3,679 | 294,000* | 42,700 |

| 10 | Voyah | 3,027 | 382,000 | 55,500 |

It is worth noting that Denza currently sells only one car – a luxurious MPV D9 and their success is pretty surprising for many analytics. Denza is a high-end brand owned by BYD (90%) and Mercedes (10%).

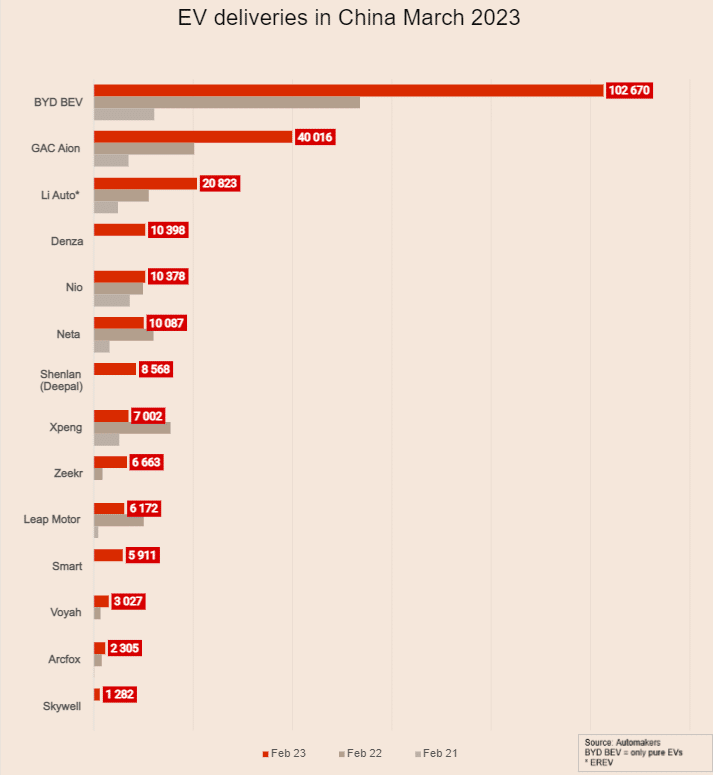

In China, EV startup automakers are called ‘new forces.’ The Weibo user 一路向北BYD, who compiled the EV average price data, didn’t include BYD (founded in 1995), which sold 102,670 pure EVs in March and, together with PHEV vehicles, sold 206,089 units in March. It is also missing the GAC Aion, which is a marque under state-owned Guangzhou Auto. GAC Aion sold 40,016 pure EVs.

The data also doesn’t include Human Horizon’s HiPhi, which sells its expensive and eccentric X and Z models. Z starts at nearly $90,000; however, HiPhi stopped releasing its delivery data some time ago.

Editor’s comment

As Nio positions itself as a premium brand competing with BBA (Chinese term for luxurious German automakers Benz, BMW, and Audi), it might seem that the fourth place with an average price of $54,000 is relatively low. The reason is that the mid-size ET5 sedan, Nio’s cheapest car, is the motor behind the deliveries, accounting for about 70% of all vehicles Nio sold in March. The car starts at 328,000 yuan ($47,600) with a 75 kWh battery. Another reason is that in China, many buyers acquire Nio cars without batteries, only with BaaS (Battery as a Service). In this case, the owner pays monthly fees to Nio, but the battery cost stays on the company’s balance sheet. ET5 without battery starts at 258,000 yuan ($37,500).

I previously thought that Nio was not participating in the price war as it was protecting the premiums of its brand. Giving discounts on a luxurious product is never a good way to go. Nio knows it very well, and it seemed that they accepted lower sales in the short term by keeping the pricing unchanged to defend the brand in the long term.

That is for sure part of the decision-making in Hefei HQ. However, Nio’s CEO William Li recently added a new reason. Yicai Global, Chinese state-owned media, quoted Li saying that Nio couldn’t participate in the price war because of insufficient margin. Nio outsources the assembling of its cars to JAC.