In 2024, the Chinese automotive battery market faces changes due to overcapacity and heightened competition. CATL led in 2023, BYD rose, and second-tier firms had mixed performances. New energy vehicle growth boosted power battery capacity to 339.7 GWh from Jan to Nov 2023, a 31.1% year-on-year increase.

2023 results

Chinese manufacturers like CATL and BYD expanded their global market share, pressuring Japanese and South Korean counterparts. Global installed power battery capacity grew 44.0% year-on-year to 552.2 GWh from Jan to Oct 2023. Chinese power battery firms aim for increased global market share with cost-effective production and strong R&D.

In 2023, major power battery companies sustained strong profit margins, while second-tier manufacturers faced profitability challenges. CATL, despite price decreases and competition, experienced increased profitability with a 20.4% gross profit margin in H1 2023, a 5.3% year-on-year rise.

According to open sources, top 10 battery manufacturers in the first 11 months of 2023:

- CATL – 233.4 GWh

- BYD – 98.3 GWh

- LG – 84.8 GWh

- Panasonic – 40.3 GWh

- SK On – 30.9 GWh

- CALB – 29.1 GWh

- Samsung SDI – 28.2 GWh

- Gotion – 14.9 GWh

- Eve – 13.4 GWh

- Farasis Energy – 8.86 GWh

Hence, two Chinese companies, CATL and BYD, secure the top positions among the global top-10 battery manufacturers, with a total of six Chinese companies on the list.

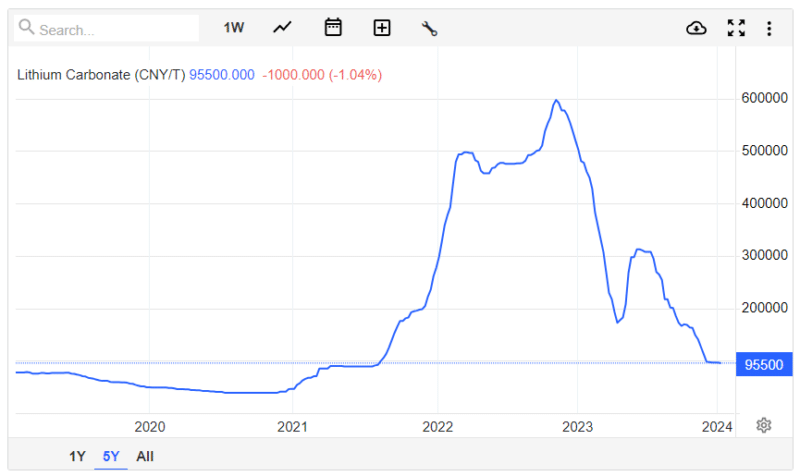

According to the research made by China Post Securities, the price of lithium in 2023 was around 130,000 yuan per ton (~18,300 USD/ton). For comparison, in 2022 lithium prices reached 590,000 yuan per ton (~83,000 USD/ton). So, the cost of lithium dropped significantly last year.

Prediction for 2024

Concerns about domestic overcapacity and increased price competition may escalate industry rivalry in 2024. Low capacity utilization rates may lead to downward pressure on battery prices and market restructuring.

Industry leaders will likely maintain positions, with second-tier companies facing challenges in differentiation. Those excelling in customer resources, cost advantages, and R&D are likely to stand out.

As demand growth slows and cost pressures increase, industry leaders’ advantages in bargaining power, cost reduction, technology, and production capacity utilization will become more pronounced, leading to variations in industry profitability.

Further decline in lithium salt prices is anticipated in 2024, facing supply-demand imbalances. High-tech lithium battery research data showed increasing market concentration, reducing demand for upstream suppliers, causing price and gross profit declines in the lithium battery materials industry.

The current overcapacity situation may lead to continued price fluctuations until a new supply-demand balance is established in 2024. While upstream lithium salt prices fell, listed lithium mining companies faced varying profit declines in 2023, reflecting the interconnected nature of the lithium battery industry.

New tech emergence

In the evolving tech landscape, sodium-ion batteries are gaining prominence. JAC‘s collaboration with HiNa battery has reached a milestone, introducing the JAC Yiwei E10X city car with a sodium-ion battery featuring:

- 25 kWh capacity

- 120 Wh/kg energy density (single cell 140 Wh/kg)

- 3C to 4C charging (10% – 80% in 20 minutes)

- 252 km range

- HiNa NaCR32140 cell

BYD is also entering the sodium-ion battery arena with plans for a 30-GWh plant. CATL is actively promoting sodium-ion technology, supplying Chery. Chinese companies are driving advancements in sodium-ion batteries, presenting a potentially cost-effective alternative in some low-priced EVs next year. Additionally, numerous automakers are investing in solid-state battery development, with Chinese companies at the forefront of these industry trends.

For now, lithium dominates the automotive battery industry, surpassing other battery technology such as sodium due to superior range, performance and cost. Sodium-ion batteries may find application in smaller vehicles, depending on improving cycle life, currently averaging 5,000 cycles compared to lithium’s 7,500 cycles for more cost-effective products.

The cost of manufacturing batteries constitutes approximately 40-50% of the total expense for an electric vehicle (EV). The decreasing cost of lithium is positive news for consumers.

Sources: Economic View, China Business News

Also Read: BYD starts construction of 30 GWh sodium-ion battery plant in China