Germans are waiving the white flag in China as VW plans to use EV platforms from Leapmotor, SAIC, and Xpeng

Several Volkswagen Group brands announced they would buy EV platforms from Chinese automakers in recent weeks. Audi will team up with Alibaba & SAIC’s backed IM Motors and use their iO Origin electric platform, Volkswagen will launch two mid-sized EVs by 2026 with Xpeng inside and underpinned by their older Edward platform, and VW’s China-only brand Jetta is reportedly in talks with Leapmotor to use their ‘Four Leaf Clover’ EV architecture.

Leapmotor & Jetta

In Europe, Jetta is known as a family car and Passat alternative, but in China, it is a whole autonomous subbrand established in 2019 with its own lineup. Now, VW wants Jetta to enter the EV business. But as an MEB-based ID. series are not selling well in China, and they chose to underpin them with a Chinese EV drivetrain with a track record.

Two weeks ago, Leapmotor announced that they are in talks with two foreign companies to license their EV technology. One of them was rumored to be a Japanese automaker. Today, an insider revealed that the second one is Volkswagen’s Jetta. It’s a desperate move from VW, and it must be hard for folks in Wolfsburg to admit their EV tech is not good enough. However, hats off to them for such a bold move.

Xpeng & Volkwagen

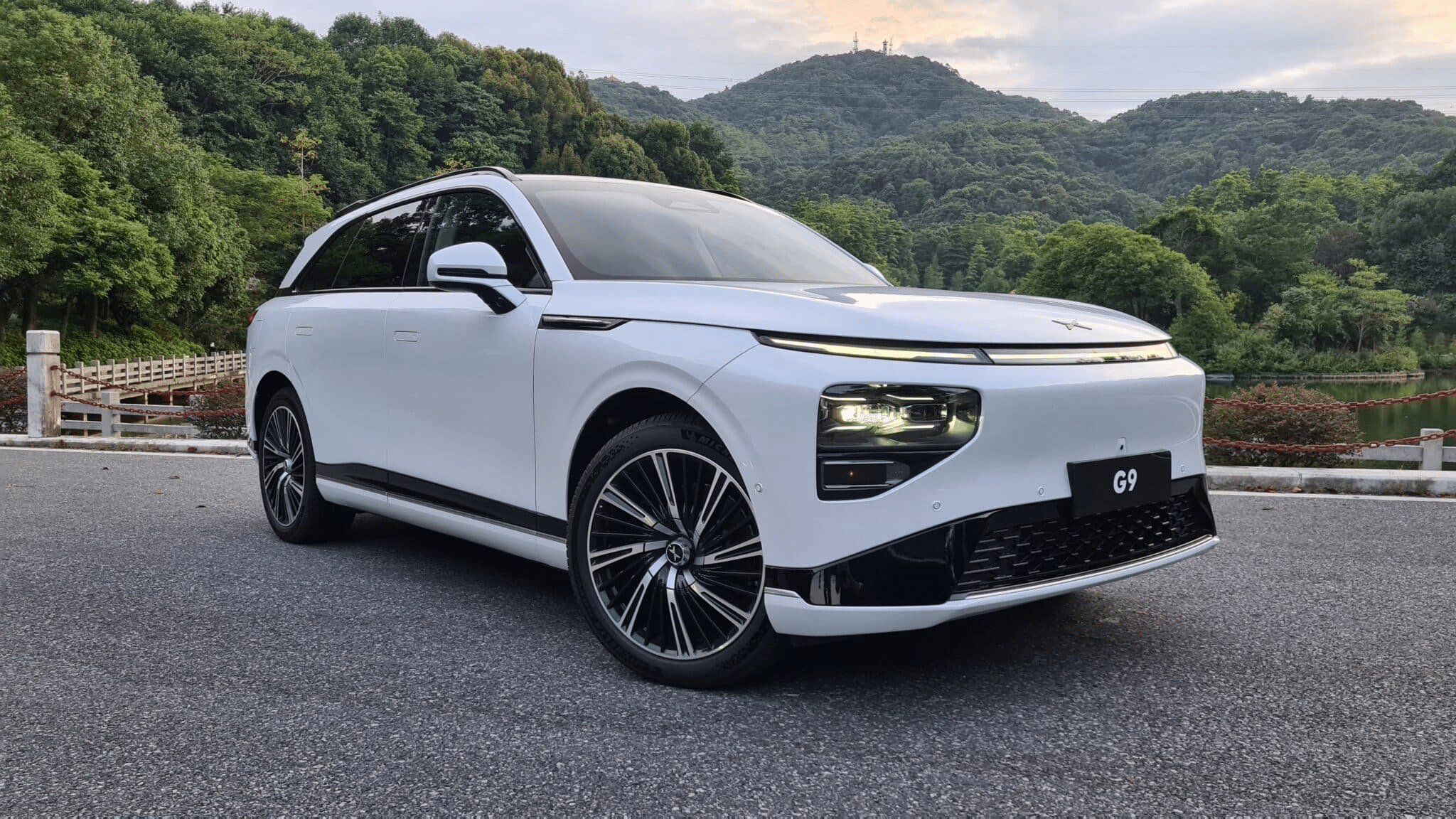

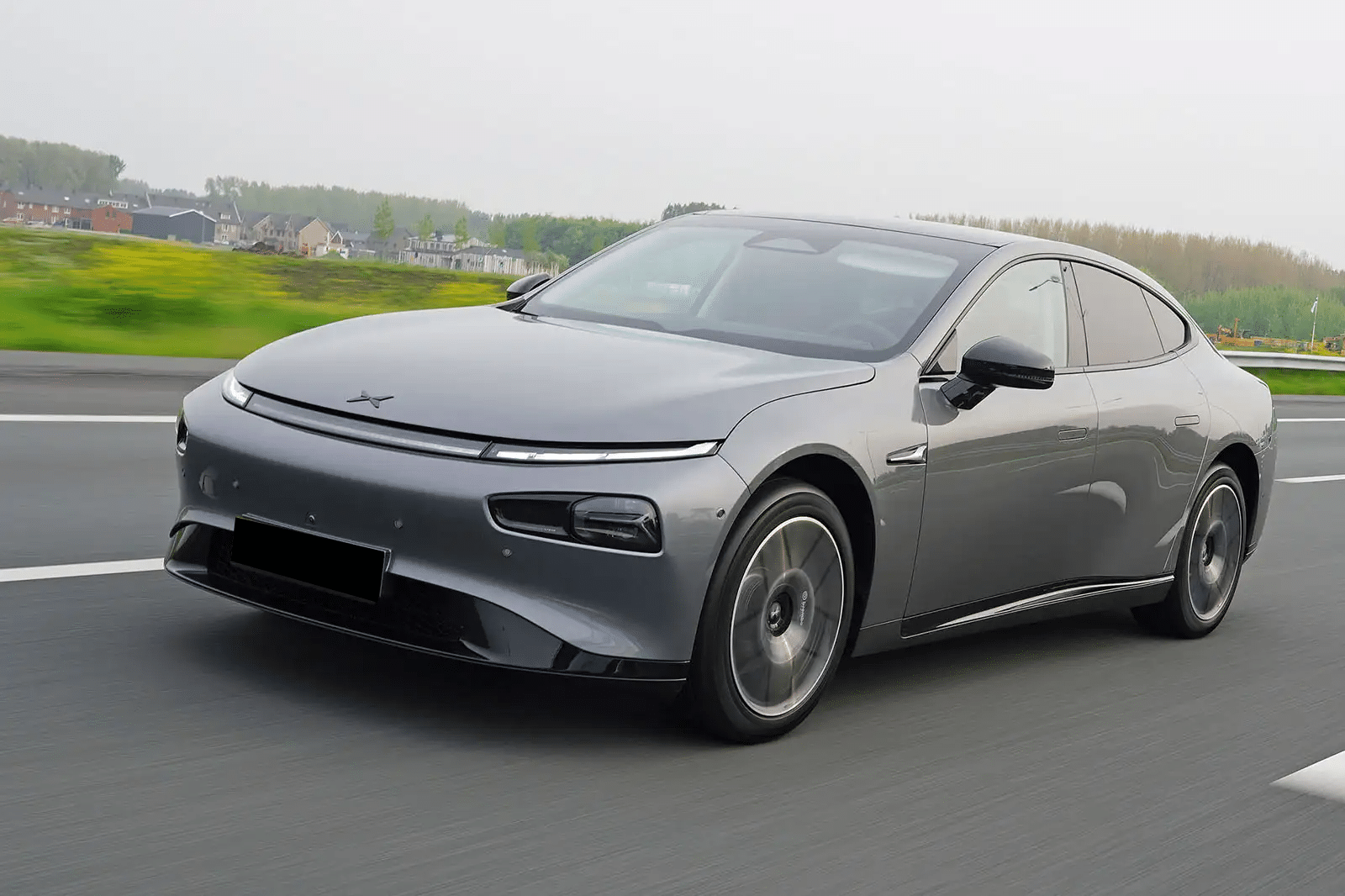

Xpeng has great EV platforms when compared with VW. The transaction has been eight months in the making and was revealed in July when VW bought 4.99% of Xpeng. On August 1, VW increased its stake in Xpeng to 6.85%. German legacy maker announced they will launch two EVs by 2026 based on Xpeng’s 800V Edward platform, which also underpins large SUV G9 and P7 sedan. Interestingly, they will not use Xpeng’s latest SEPA 2.0 platform, which underpins the G6 smaller SUV launched in June.

But the EV platform is not everything VW gets access to. Xpeng has a top-notch ADAS system called XNGP. It works pretty well on highways and recently got a permit to roll out semi-autonomous driving capabilities in Beijing; other cities will follow. Keep in mind that Tesla’s FSD is not allowed in China.

But VW is not the only one to benefit from the deal. Possibly hundreds of thousands of VW’s EVs using XNGP in the future is a massive bait for Xpeng. Also, VW’s endorsement gives the 9-year-old startup more credibility – both for EU expansion, which is not going very well, and a boost for their domestic sales. With over 90 EV makers in China and lots of them going bankrupt (Hengchi, Letin, Niutron, etc.) and more to come, Chinese consumers are thinking twice before purchasing a car – nobody wants to lose a warranty if the company ceases operations. Such a boost is a message – Xpeng is not going anywhere and is meant to stay. So expect the increase in sales to follow.

Finally, with all the Barbeheimer buzz, I don’t see why VW cars with Xpeng inside shouldn’t be called Xwagen.

SAIC & Audi

SAIC owns the MG brand, but I wouldn’t introduce it that way in China. Especially outside tier 1 cities, people probably wouldn’t know MG at all. But they would know SAIC for sure. The Shanghhai-based state-owned automaker sold 5.3 million vehicles in 2022, ranking the first in China for the 17th consecutive year.

Recently, they pushed hard into the EV segment, and one of their assets is called IM Motors, a joint venture with Alibaba. The subbrand sells two EVs – an L7 premium 64,000 USD sedan and an LS7 SUV. Both are based on the iO Origin (iO原点) platform, which Audi chose for their new EVs as developing their own PPE is too slow.

Despite both L7 and LS7 being fair enough EVs, they don’t sell very well, partly because of the lack of trust in SOEs and partly because of the interior. Also, the LS7 being the copycat of Aston Martin DBX isn’t helping. But what is essential is that all is in the right places under the hood and the passenger seat and it seems Audi knows.

Common traits

If you read up here, you probably notice one common trait for all three Chinese EV makers who will license their technology to Volkswagen. They have excellent in-house developed EV drivetrain, SW, or ADAS, but their sales are lower than expected. In the case of IM, low sales are obvious; in the case of Xpeng, it is much better after the launch of G6, but P5 or G9 (despite being excellent cars on paper) were a sales disaster. It’s like Xpeng is doing a great job but always missing this one last puzzle. Leapmotor is probably the best of those three, but they sell many budget cars with a small margin.

So, this is not one-sided and shouldn’t be viewed as Volkswagen being saved by the Middle Kingdom. The Chinese EV companies are also fighting for survival, and a boost from the German legacy automaker might be vital for them.

Volkswagen on downtrend

On July 27, Volkswagen cut its delivery estimate for 2023 to 9 million vehicles from 9.5 million. The reduction is mainly because of declining ICE sales in China and no EV sales to compensate for that loss. With that in mind, it is unsurprising that VW moved to licensing technology.

Editor’s comment

The 40-year-lasting era just ended this month. In October 1984, SAIC Volkswagen Corporation Ltd. was established in Shanghai – the first automotive joint venture between German and Chinese automakers. Since then, dozens of JVs have been formed as the government required every foreign automaker to team up with local producers. And the Chinese kept learning from the world’s top-notch car makers.

Now the tables have turned, and legacy automakers are preparing to sell their EVs with China tech inside. Toyota already started the trend with their BYD-inside bZ3, and as mentioned above, Germans are following as Audi prepares SAIC-inside, VW prepares Xpeng-inside and Leap Motor-inside EVs. And it’s not just Germans; Ford is building a CATL-inside battery plant in the US, while Renault partnered with Geely to develop PHEV powertrains.

This April, legacy executives received a wake-up call at Shanghai Auto Show when they saw the progress Chinese EV startups made in three years while China was closed due to covid. And only three months later, we see three new deals between German legacies and Chinese EV makers. Not talking about that the SW unit of VW Cariad fired its top executives just a month after Shanghai. Of course, the agreements were in the making for some time; for example, the VW-Xpeng deal negotiation started in December 2022. Still, I’m sure the Shanghai Auto Show speeded things up and confirmed to the VW executives the leverage is not on their side in the negotiation process.

Volkswagen realized something that readers of CNC have known for a long time. Their MEB-based EVs are not competitive in China. Every year since the launch of ID. series in China, they always missed the sales target, and despite Volkswagen being a love brand for Chinese for decades, even the hardcore fans were not buying their EVs. Solid HW is not enough anymore; you need connectivity, great software, UX, and good digital experience in general. Everything that VW lacks of.

There were dozens of surveys warning VW that Chinese customers consider their EVs dumb. The result: After several rounds of discounts, you can now buy ID.3 for about 16,500 USD in China, and VW still sold less in the first half of this year than in the same period as last year. VW CEO Oliver Blue recently said 20,000 EUR (22,000 USD) EV could be possible in the next five years. If VW just imported China-made ID.3, they could have it immediately, even considering tariffs and shipping costs. But I guess unions would go wild.

It will be interesting to watch if the VW China strategy – In China, for China with Chinese tech – will further transform into In Europe, for Europe, with Chinese tech. Volkwagen bought some time by partnering with Chinese, but if they want to stay relevant long term, now they really need to start taking EVs seriously. Instead of constant lobbying to avoid European ICE ban.